Current trend

The USD/JPY pair shows ambiguous dynamics, consolidating near 154.60. The activity of the "bulls" remains quite high, but investors are in no hurry to open new long positions, expecting possible intervention from the Bank of Japan in the market situation, since officials previously criticized the speculative actions of trading participants for the groundless weakening of the national currency. The yen largely shrugged off a historic interest rate hike last month as regulators said monetary policy would remain soft. Japanese Finance Minister Shunichi Suzuki reiterated yesterday that monetary authorities were closely monitoring the situation and preparing a "comprehensive response as necessary." If they undertake currency interventions in the near future, the yen may begin a rapid upward trend.

The Japanese currency received some support yesterday from foreign trade data: in March, Exports added 7.3%, slowing slightly from 7.8% in the previous month, while Imports fell by 4.9% after rising by 0.5% in February. Against this background, the Trade Balance entered the surplus zone at the level of 366.5 billion yen after a deficit of -377.8 billion yen a month earlier. Preliminary March data from the US construction sector, presented yesterday, were weak: the Building Permits fell by 4.3% to 1.458 million, and the Housing Starts decreased by 14.7% to 1.321 million.

The focus of investors today will be the publication of a monthly economic report from the US Federal Reserve, the Beige Book, which characterizes the state of the economy in the twelve federal districts of the country and contains information on all types of industry, agriculture, corporate and consumer spending, the real estate market and other indicators at the moment. In Japan, March inflation data will be presented on Friday, with forecasts suggesting that the National Consumer Price Index will adjust from 2.8% to 2.7%.

Support and resistance

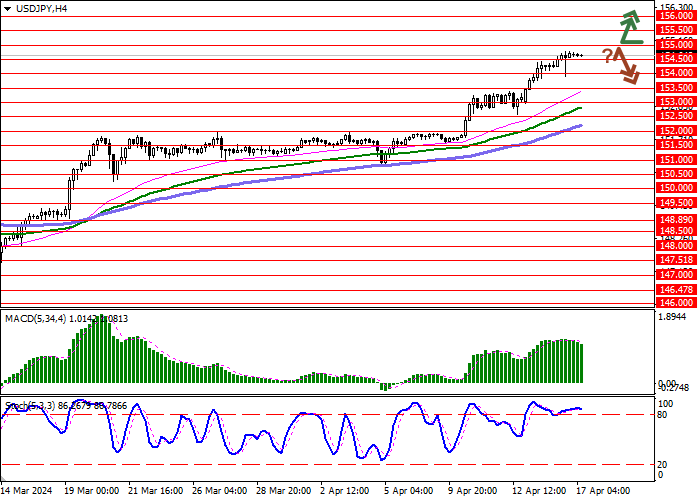

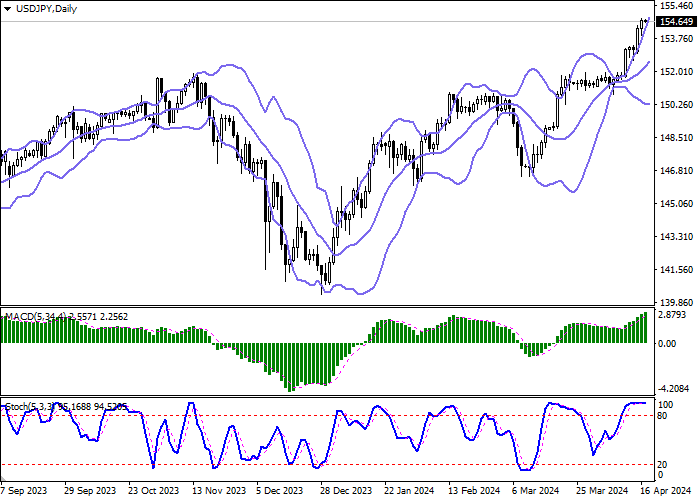

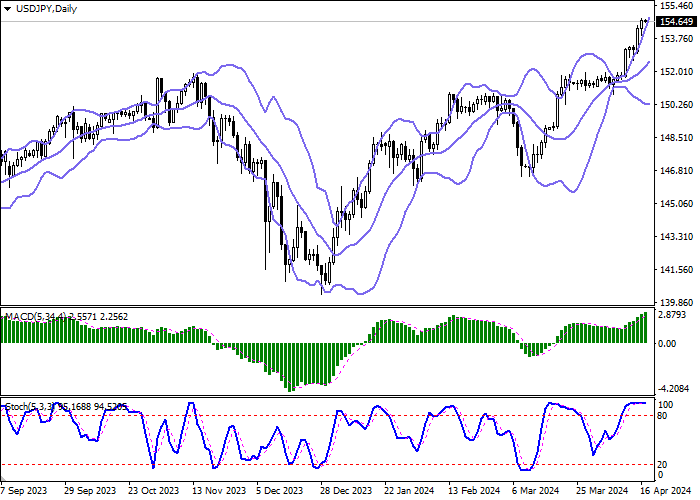

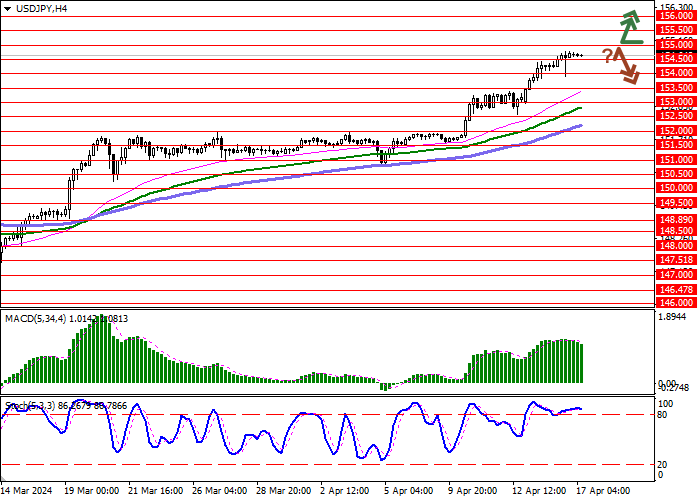

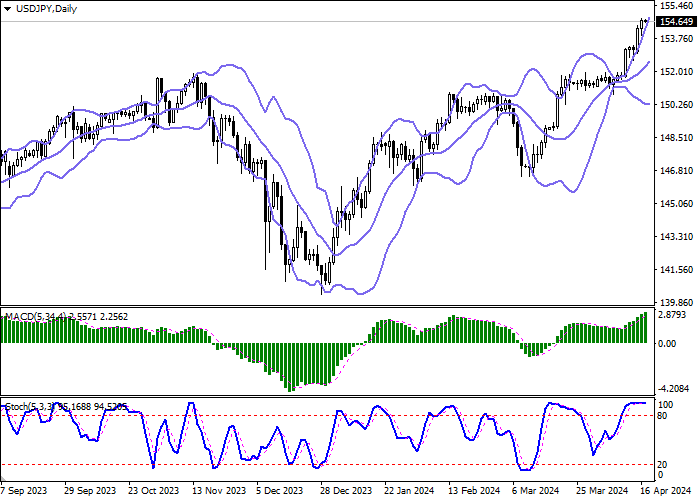

Bollinger Bands on the daily chart show a steady increase. The price range is expanding but it fails to conform to the surge of "bullish" sentiments at the moment. MACD grows, preserving a stable buy signal (located above the signal line). Stochastic, having reached its highs, reversed into a horizontal plane, indicating significant risks of overbought American currency in the ultra-short term.

Resistance levels: 155.00, 155.50, 156.00, 156.50.

Support levels: 154.50, 154.00, 153.50, 153.00.

Trading tips

Long positions can be opened after a breakout of 155.00 with the target of 156.00. Stop-loss — 154.50. Implementation time: 2-3 days.

A rebound from 155.00 as from resistance, followed by a breakdown of 154.50 may become a signal for opening of new short positions with the target at 153.50. Stop-loss — 155.00.

Hot

No comment on record. Start new comment.