Current trend

The GBP/USD pair shows a slight decline, remaining close to 1.2430 and local lows dated November 17, 2023.

The pound is under pressure today from statistics on the British labor market: the Unemployment Rate in February over the past three months rose from 4.0% to 4.2%, the Employment Change decreased by 156.0 thousand after -89.0 thousand in the previous month, and the Claimant Count Change increased in March from 4.1 thousand to 10.9 thousand, which, however, turned out to be lower than market expectations of 17.2 thousand. In turn, Average Earnings Including Bonus again increased in February by 5.6%, with preliminary estimates at 5.5%.

On Wednesday at 8:00 (GMT 2) March inflation statistics will be published in the UK: it is expected that in annual terms the Consumer Price Index will slow down from 3.4% to 3.1%, and in monthly terms it will add 0.6%. The Core CPI excluding Food and Energy could fall from 4.5% to 4.1%, confirming market confidence that the Bank of England will soon begin to reduce borrowing costs. The Retail Price Index in March is projected to fall from 4.5% to 4.2%. Previously, some representatives of the regulator warned investors against overly optimistic forecasts: last week, a member of the Bank of England board, Megan Greene, said that the transition to a "dovish" course would take some time, since the rate of price growth in the services sector remains high. Tomorrow there will be speeches by representatives of the British regulator, including its Governor Andrew Bailey, who can comment on new inflation data.

The US currency was moderately supported on Tuesday by statistics on Retail Sales in the US, published the day before: in March, the indicator slowed down from 0.9% to 0.7% against expectations of 0.3%, and Retail Sales excluding Autos accelerated from 0.6% to 1.1%, while experts assumed 0.4%.

Support and resistance

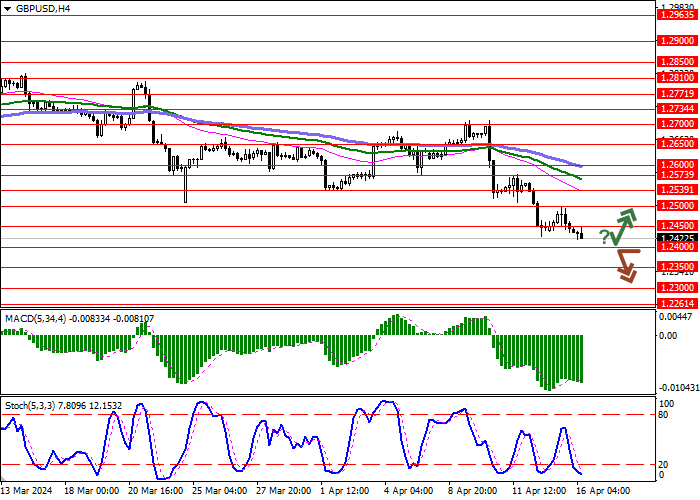

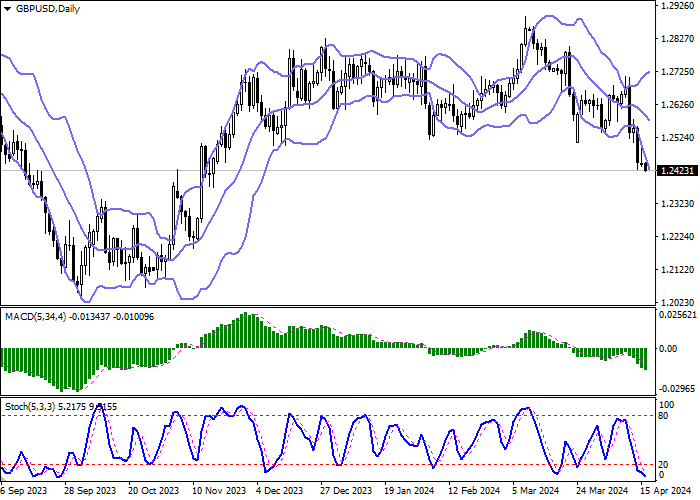

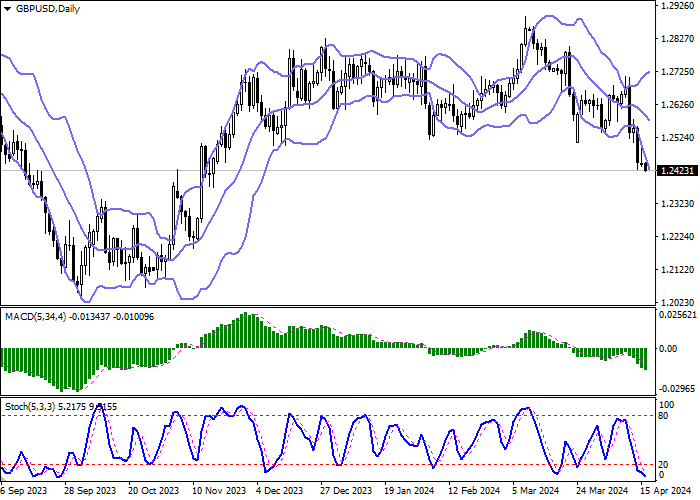

Bollinger Bands on the daily chart show a steady decline. The price range is expanding from below; however, it fails to catch the surge of the "bearish" sentiment at the moment. MACD is going down preserving a stable sell signal (located below the signal line). Stochastic retains a steady downtrend but is located in close proximity to its lows, which indicates the risks of oversold pound in the ultra-short term.

Resistance levels: 1.2450, 1.2500, 1.2539, 1.2573.

Support levels: 1.2400, 1.2350, 1.2300, 1.2261.

Trading tips

Short positions may be opened after a breakdown of 1.2400 with the target at 1.2300. Stop-loss — 1.2450. Implementation time: 2-3 days.

A rebound from 1.2400 as from support followed by a breakout of 1.2450 may become a signal for opening new long positions with the target at 1.2539. Stop-loss — 1.2400.

Hot

No comment on record. Start new comment.