Current trend

Quotes from Netflix Inc., an American entertainment company and a streaming service for movies and TV series, are correcting at 623.00.

Leading analysts are reviewing the estimates of the emitter's shares against the background of the publication of the financial report for Q1 2024 scheduled for this week: for example, Evercore ISI experts maintained the rating at "outperform" and the target price at 640.0 dollars, considering that the company's expectations for revenue growth of 13.6% and operating margin of 26.0% correspond to market estimates. Morgan Stanley analysts increased the target price of Netflix Inc. shares from 600.0 dollars to 700.0 dollars, maintaining their rating at the "overweight" level. Piper Sandler Co. also improved their expectations regarding the dynamics of shares, raising the target price from 550.0 dollars to 600.0 dollars, while maintaining the "neutral" rating.

The consensus estimate assumes Netflix Inc. revenue growth to 9.27 billion dollars from 8.83 billion dollars in the previous quarter and an increase in earnings per share (EPS) from 2.11 dollars to 4.51 dollars. Confirmation of this forecast may significantly support the growth of the emitter's shares.

Support and resistance

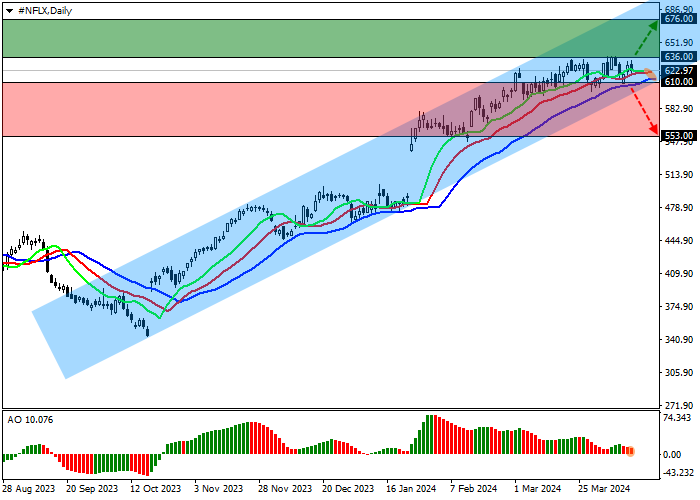

On the D1 chart, the asset is trading within a wide upward corridor with borders of 680.00–600.00, holding near the annual maximum of 636.00.

Technical indicators hold a stable buy signal, which has somewhat weakened against the background of a local correction: the fast EMAs of the Alligator indicator are above the signal line, and the AO histogram, being in the purchase zone, forms corrective bars.

Support levels: 610.00, 553.00.

Resistance levels: 636.00, 676.00.

Trading tips

If the local growth of the asset continues and the price consolidates above the resistance level of 636.00, one may open long positions with the target of 676.00 and stop-loss of 610.00. Implementation time: 7 days and more.

In the event of a reversal and continued decline of the asset, as well as price consolidation below the support level of 610.00, one can open short positions with the target of 553.00 and stop-loss of 630.00.

Hot

No comment on record. Start new comment.