Current trend

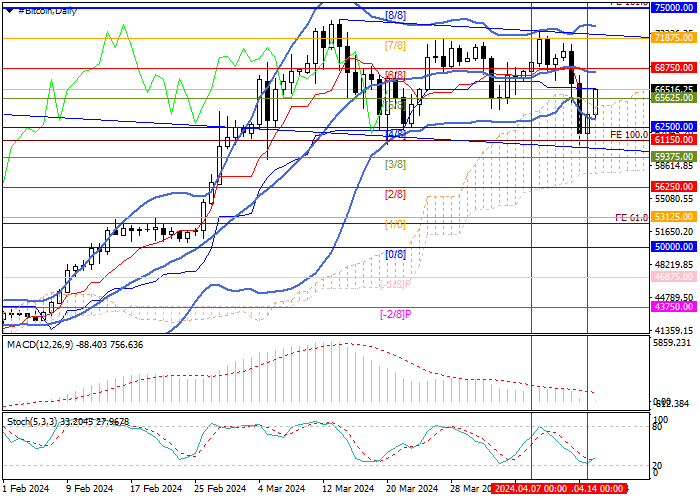

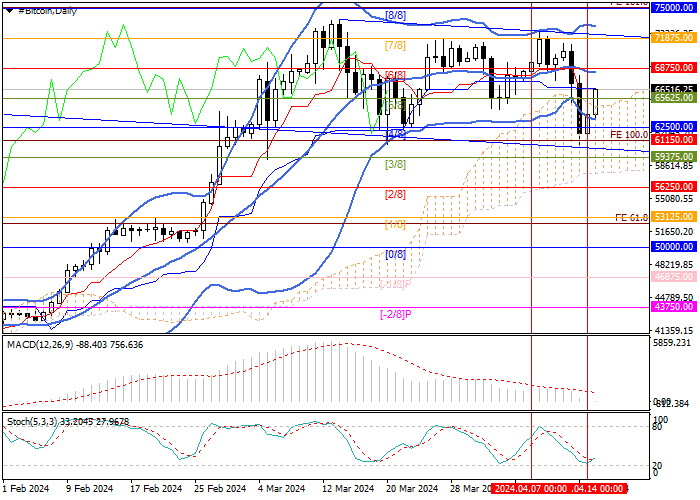

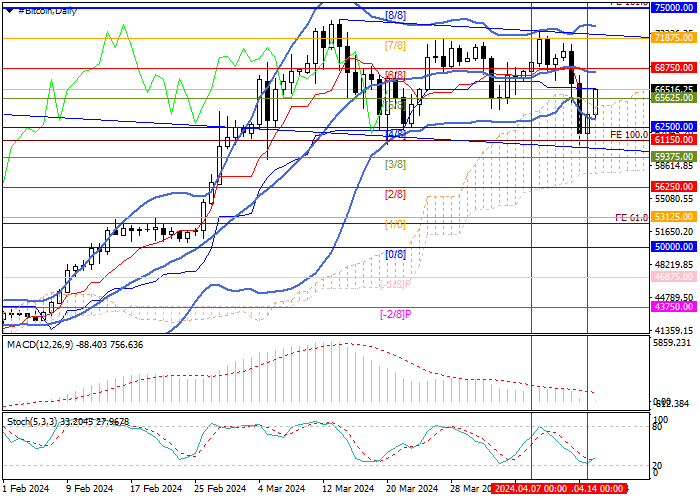

Last week, the BTC/USD pair tried to grow, rising above 72000.00 but at the end of the week, it sharply corrected downwards, losing about 14.5% in two days amid escalating geopolitical tensions in the Middle East.

Thus, over the weekend, Iran attacked Israeli territory, which caused investors to fear the start of a new major military conflict and was accompanied by a redistribution of funds in favor of shelter assets, primarily gold and the American dollar. The downward correction affected not only BTC but also the entire cryptocurrency sector, where open positions worth about 2.5B dollars were liquidated in a few days. The monetary factor also exerted additional pressure on digital assets, as the likelihood of the US Fed keeping the high interest rates for a long time increases against renewed inflationary growth.

All these events brought the price to a six-week low of 60400.00, from where a partial recovery began. Traders are returning to the market, hoping that there will be no further escalation of the Iran-Israeli conflict, according to American diplomats. In this situation, the resumption of growth in the main cryptocurrency assets, which will be supported by the expectation of halving the Bitcoin network, seems very likely soon.

Support and resistance

The trading instrument returns to 68750.00 (Murrey level [6/8] middle line of Bollinger Bands), the breakdown of which will allow it to reach the area of 71875.00 (Murrey level [7/8]) and 75000.00 (Murrey level [8/8], Fibonacci extension 161,8%). The key “bearish” level remains 62500.00 (Murrey level [4/8]), consolidation below which will cause a decline to the area of 59375.00 (Murrey level [3/8]), 56250.00 (Murrey level [2/8]).

Technical indicators do not give a single signal: Bollinger Bands are pointing downwards, Stochastic reversed upwards from the oversold zone, and the MACD histogram is preparing to enter the negative zone.

Resistance levels: 68750.00, 71875.00, 75000.00.

Support levels: 62500.00, 59375.00, 56250.00.

Trading tips

Long positions may be opened above 68750.00, with the targets at 71875.00, 75000.00, and stop loss 66300.00. Implementation time: 5–7 days.

Short positions may be opened below 62500.00, with the targets at 59375.00, 56250.00, and stop loss 64600.00.

Hot

No comment on record. Start new comment.