Current trend

The leading index of the Australian economy ASX 200 shows corrective dynamics near the 7753.0 mark. The corporate reporting season starts this week: for example, today the financial results of the mining company Rio Tinto Ltd., as well as the electricity producer Origin Energy Ltd. will be presented.

Investors evaluate macroeconomic statistics and the situation on the bond market. Last week, a report on turnover in the mining industry, which is one of the key indicators for the national economy, was published, reflecting a 9.6% drop in volumes in February, although only three of the thirteen regions experienced a decrease. The main factor for the negative dynamics was a decrease in prices for commodities, in particular for iron ore, which led to a correction in production by -13.8%.

There is an uptrend in the domestic bond market: 10-year securities are trading at a rate of 4.285%, which exceeds 4.164% recorded last week, the yield of 20-year bonds rose to 4.644% from 4.547%, and the rate on 30-year bonds grew to 4.627% from 4.506%.

The growth leaders in the index are Alumina Ltd. ( 6.50%), South32 Ltd. ( 4.41%), Nickel Mines Ltd. ( 4.65%), Rio Tinto Ltd. ( 3.76%).

Among the leaders of the decline are Appen Ltd. (-8.07%), St Gold Road Resources Ltd. (-7.28%), Star Entertainment Group Ltd. (-4.46%), Star Entertainment Group Ltd. (-4.46%).

Support and resistance

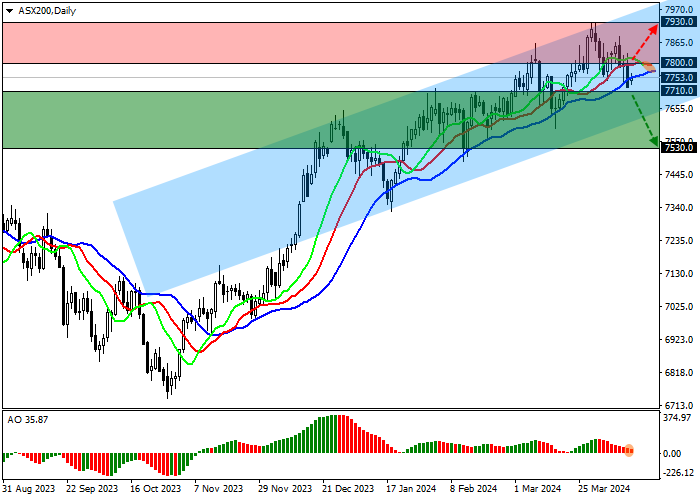

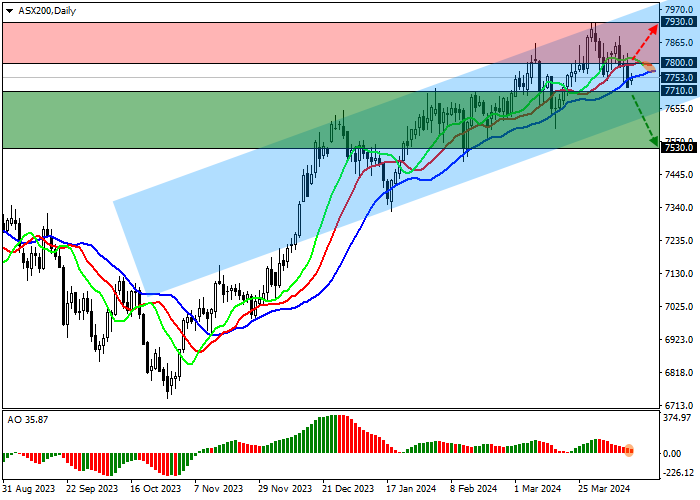

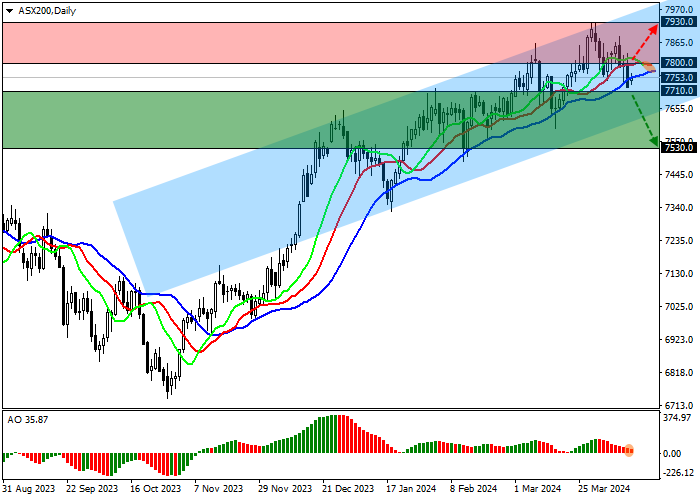

On the D1 chart, the price is trading in the 8000.0–7650.0 channel, holding within the new downward wave.

Technical indicators are ready to reverse around and issue a new sell signal: the fast EMAs of the Alligator indicator are held above the signal line, but they are rapidly approaching it, and the AO histogram forms corrective bars, while declining in the purchase zone.

Support levels: 7710.0, 7530.0.

Resistance levels: 7800.0, 7930.0.

Trading tips

In the event of a reversal and continued decline of the asset with consolidation below the 7710.0 mark, sell positions with the target of 7530.0 can be opened. Stop-loss – 7800.0. Implementation time: 7 days and more.

In case of continued growth of the asset, as well as price consolidation above the resistance level of 7800.0, buy positions with the target of 7930.0 and stop-loss of 7720.0 will be relevant.

Hot

No comment on record. Start new comment.