Current trend

After rising to 92.42 on Friday, Brent Crude Oil is correcting to 89.85 amid reports that Sunday’s Iranian attack caused limited damage to Israeli infrastructure.

Thus, after the “hawkish” rhetoric of the Iranian authorities last week, the price rose above 92.00, as traders feared that the armed conflict could extend beyond the region. Already on Sunday, Iran fired more than 300 missiles and drones toward Israel. However, the Iron Dome air defense system intercepted almost all of them. The head of the General Staff of the Iranian Armed Forces, Mohammad Bagheri, said that Operation True Promise was fully completed, and the country’s authorities do not plan to resume strikes. According to the official, Iran is committed to the principles enshrined in the Charter of the United Nations (UN) and does not seek escalation. Against this background, Brent Crude Oil began to decrease.

The situation in the Middle East remains tense, so market dynamics may remain volatile over the next few months. Let us remind you that Iran produces more than 3.0M barrels of crude oil per day, being a major producer in OPEC. The existing risks of supply disruptions, based on the sanctions policy and a possible Israeli response that could cause significant damage to the energy infrastructure, are confirmed by the fact that the reduction in prices is most likely corrective.

Support and resistance

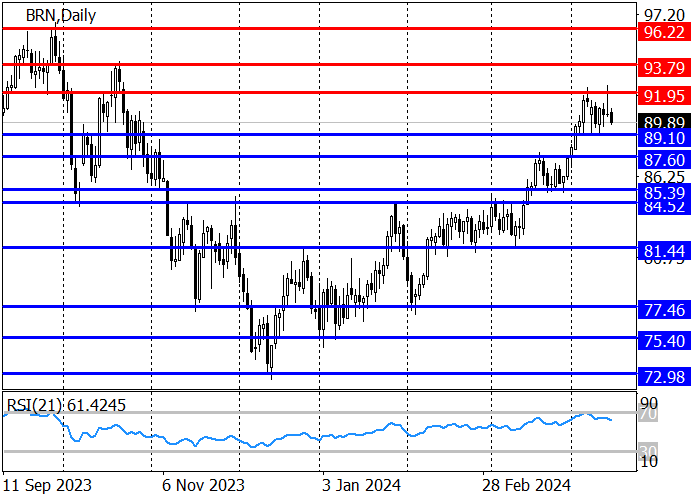

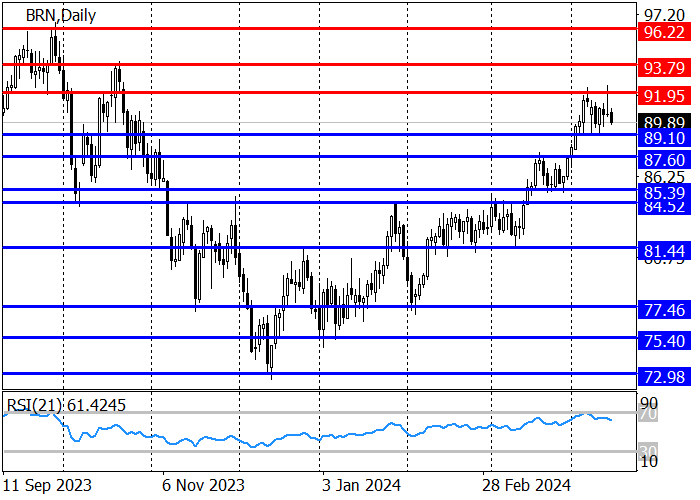

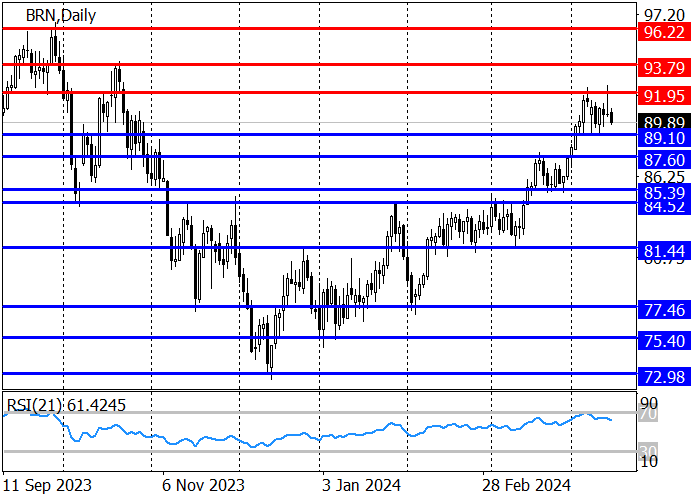

The long-term trend is upward: the price reached the resistance level of 91.95, where it began a correction to 89.10. After a breakout, the correction will continue with the target at 87.60, and if it holds, an increase to 91.95 and then 93.79 is expected.

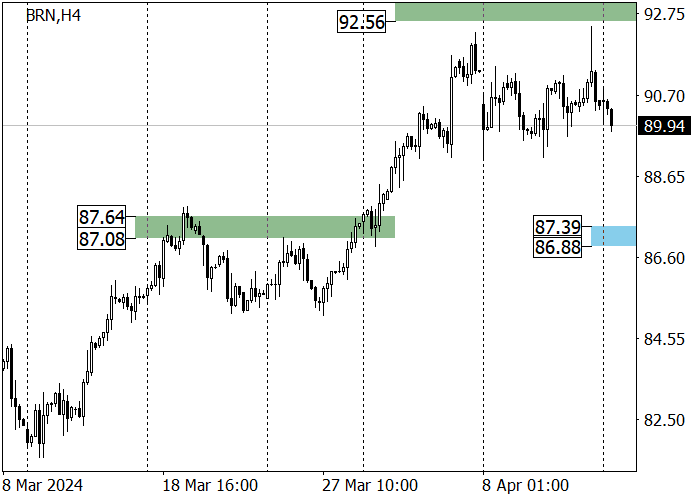

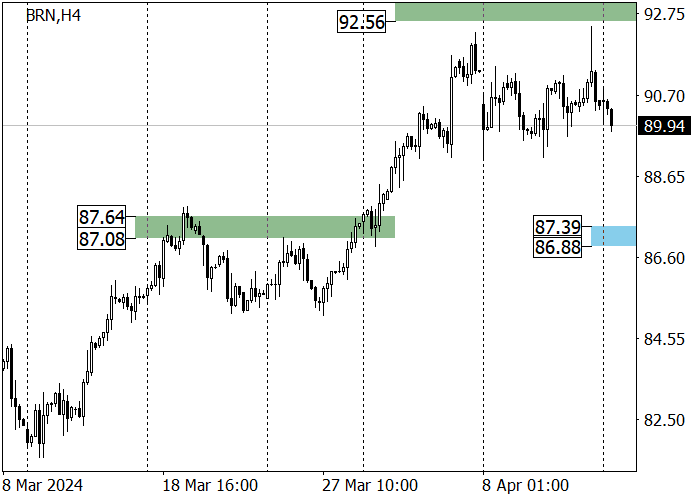

The medium-term trend is upward: the quotes rose to zone 3 (93.11–92.56) (considering errors) and reversed downwards to the trend line 87.39–86.88. After the test, long positions with the target at last week’s high of 92.37 are relevant.

Resistance levels: 91.95, 93.79, 96.22.

Support levels: 89.10, 87.60, 85.39.

Trading tips

Long positions may be opened from 89.10, with the target at 91.95 and stop loss around 88.25. Implementation time: 9–12 days.

Short positions may be opened below 88.25, with the target at 85.39 and stop loss around 85.39.

Hot

No comment on record. Start new comment.