Current trend

The NZD/USD pair is showing uncertain growth, retreating from the local lows of November 14, updated in the first hours of trading on Monday. The instrument is breaking "bearish" pressure that emerged late last week in response to growing risks that the US Federal Reserve will abandon the idea of lowering borrowing costs in June. Now analysts are increasingly counting on an interest rate adjustment in September; however, this may also be called into question given the strength of the American economy and the risks of increased inflation. Thus, last Thursday, the President of the Federal Reserve Bank (FRB) of New York, John Williams, noted that there is no clear need to ease monetary policy in the near future, and Boston Fed President Susan Collins believes that it will take more time than predicted to make sure in a sustainable weakening of inflation: in her opinion, a reduction in demand is expected throughout the year, which will slow down the growth of consumer prices and allow the Fed to move to a "dovish" course.

Macroeconomic statistics from New Zealand published last Friday put additional pressure on the instrument's position. Thus, the Manufacturing PMI in March decreased from 49.1 points to 47.1 points, and Electronic Card Retail Sales in annual terms decreased by 3.0% after an increase of 2.5% in the previous month, while in monthly terms the indicator lost 0.7% after -2.0% in February.

In turn, statistics from the United States presented on Friday reflected a noticeable decline in the Consumer Confidence Index from the University of Michigan in April from 79.4 points to 77.9 points, contrary to forecasts of 79.0 points. Today, the growth of corrective sentiment for the instrument is hampered by data on business activity from New Zealand: The Business NZ Performance of Services Index dropped from 52.6 points to 47.5 points in March.

Support and resistance

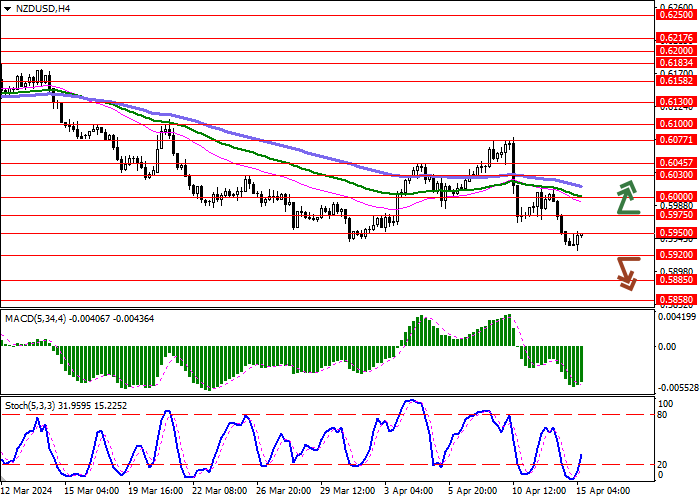

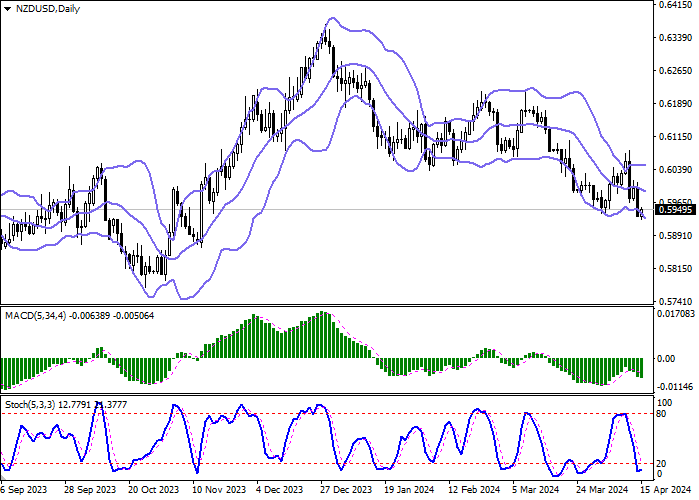

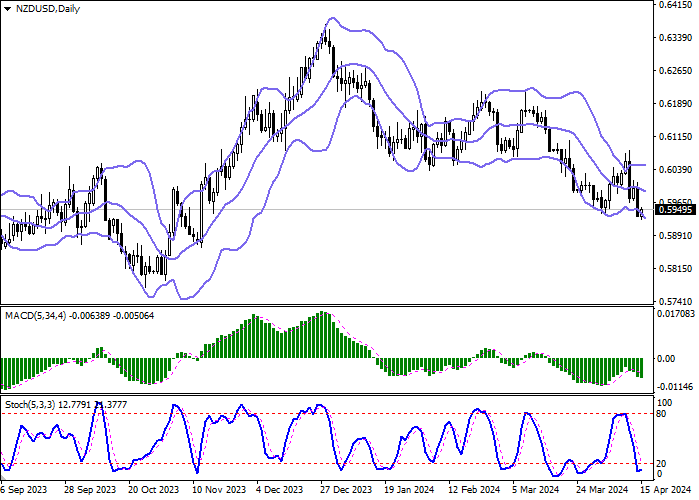

Bollinger Bands in D1 chart demonstrate a moderate decrease. The price range expands from below, making way for new local lows for the "bears". MACD is falling, keeping a relatively strong sell signal (the histogram is below the signal line). Stochastic, having reached its lows, reversed into the horizontal plane, indicating risks of oversold NZ dollar in the ultra-short term.

Resistance levels: 0.5950, 0.5975, 0.6000, 0.6030.

Support levels: 0.5920, 0.5885, 0.5858, 0.5800.

Trading tips

Long positions can be opened after a breakout of 0.5975 with the target of 0.6030. Stop-loss — 0.5950. Implementation time: 2-3 days.

The return of a "bearish" trend with the breakdown of 0.5920 may become a signal for new short positions with the target at 0.5858. Stop-loss — 0.5950.

Hot

No comment on record. Start new comment.