Current trend

The XAU/USD pair is consolidating near 2350.00. At the end of last week, quotes updated record highs, approaching the level of 2430.00, but the "bulls" failed to consolidate at this level, and many investors preferred to take profits on long positions.

The upward trend continues to be supported by geopolitical risks, as well as expectations that the world's leading central banks will soon return to lower borrowing costs. In particular, the European Central Bank (ECB) may adjust interest rates as early as June, while the US Federal Reserve looks set to ease monetary policy somewhat later. At the moment, markets are increasingly leaning towards a scenario with the first reduction of 25 basis points in September.

Macroeconomic statistics from the United States, published on Friday, April 12, put additional pressure on the dollar position. The Consumer Confidence Index from the University of Michigan dropped from 79.4 points to 77.9 points in April, while analysts expected 79.0 points. In turn, the Import Price Index added 0.4% in March, accelerating by 0.1% from the February figure, and in annual terms the value increased by 0.4% after a sharp decline of 0.8% in the previous month. Today, investors will evaluate March macroeconomic statistics on Retail Sales in the United States: it is expected that the indicator will slow down by half compared to February to 0.3%. Also, during the day, the April NY Empire State Manufacturing Index will be published: the value is predicted to increase from -20.9 points to -9.0 points.

At the same time, according to a report from the US Commodity Futures Trading Commission (CFTC), last week the number of net speculative positions in gold decreased to 202.4 thousand from 207.2 thousand positions previously. Trading participants continue to actively gain positions in the asset, and weekly fluctuations are mainly associated with local sales transactions. The balance in contracts secured by real money amounted to 208.634 thousand for the "bulls" versus 29.492 thousand for the "bears". Last week, buyers increased the number of positions by 4.156 thousand, and sellers - by 3.228 thousand, which indicates the formation of a hedging reverse position.

Support and resistance

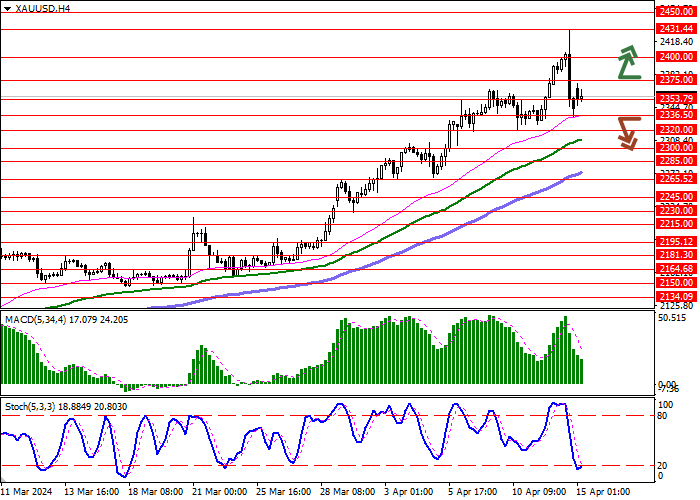

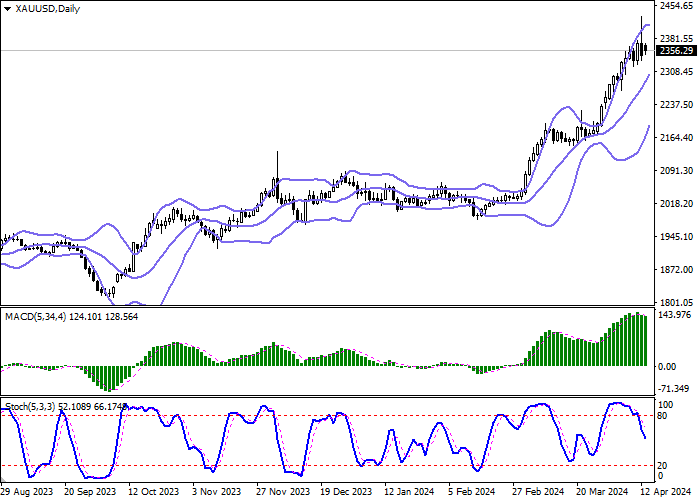

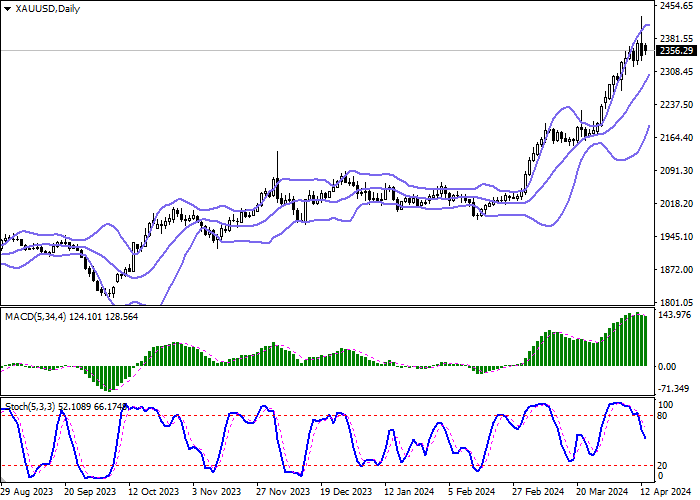

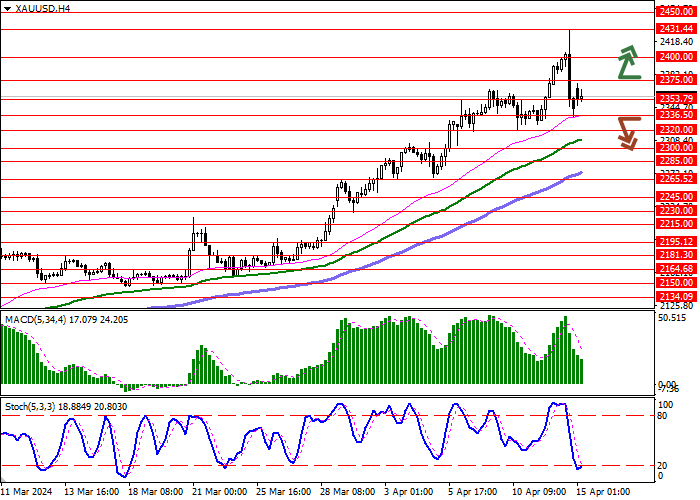

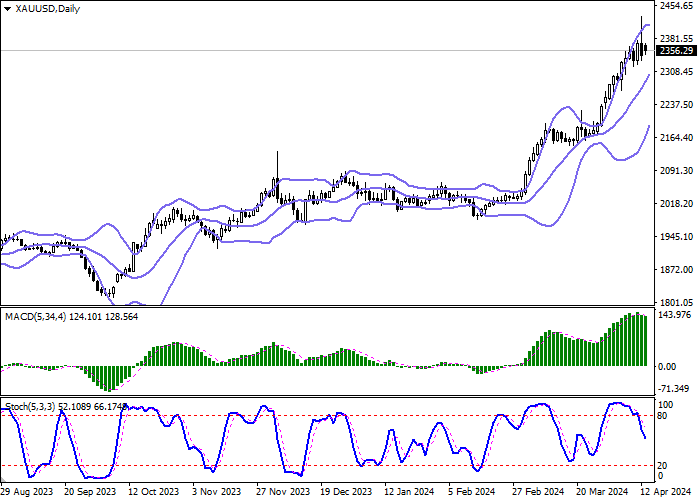

Bollinger Bands on the daily chart show a steady increase. The price range is narrowing from above, reflecting the emergence of ambiguous dynamics in the ultra-short term. MACD is reversing downwards forming a new sell signal (located below the signal line). Stochastic is showing a more active decline being located in the middle of its area.

Resistance levels: 2375.00, 2400.00, 2431.44, 2450.00.

Support levels: 2353.79, 2336.50, 2320.00, 2300.00.

Trading tips

Short positions may be opened after a breakdown of 2336.50 with the target at 2300.00. Stop-loss — 2353.79. Implementation time: 1-2 days.

The return of the "bullish" trend with the breakout of 2375.00 may become a signal for new purchases with the target of 2431.44. Stop-loss — 2350.00.

Hot

No comment on record. Start new comment.