Current trend

Shares of JPMorgan Chase & Co., one of the largest multinational financial conglomerates in the United States, are correcting at 195.00.

Management has decided to make additional investments of 20.0 million dollars in a charitable foundation working to expand housing purchase opportunities in the United States. The bank also expanded its mortgage programs: grants were increased from 5.0 thousand dollars to 7.5 thousand dollars.

JPMorgan Chase & Co. continues to search for candidates for the post of new CEO, after the current head of the bank, Jamie Dimon, announced that he could leave his post within 3 years. Yesterday, the board of directors identified a range of possible candidates, among whom are employees of the company's investment division Jennifer Piepszak and Troy Rohrbaugh.

Today, JPMorgan Chase & Co. will publish a financial report for Q1 2024: according to preliminary forecasts, the bank's revenue may reach 41.84 billion dollars, up from 39.9 billion dollars previously, and earnings per share (EPS) will increase from 3.97 dollars to 4.19 dollars. The dividends will be paid on April 30, for the first time after an annual increase to 1.15 dollars from 1.05 dollars earlier, equivalent to 2.32% of income.

Support and resistance

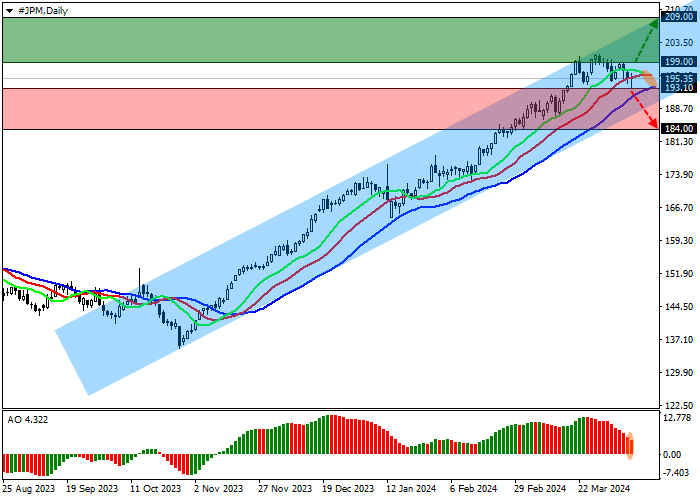

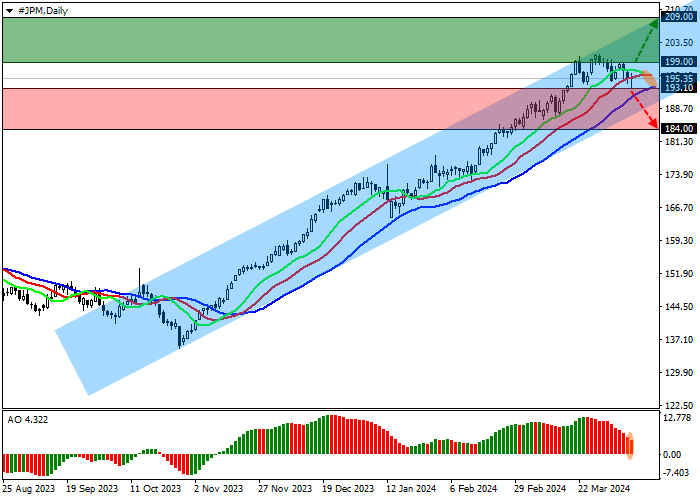

On the D1 chart, the instrument is trading within the ascending corridor with the borders of 200.00–190.00, moving away from the resistance line.

Technical indicators are holding a buy signal, which has weakened somewhat: the range of EMAs fluctuations on the Alligator indicator is still pointing upwards, and fast EMAs are above the signal line, while AO histogram has been in the buy zone for a long time, forming new correction bars.

Support levels: 193.10, 184.00.

Resistance levels: 199.00, 209.00.

Trading tips

If the asset continues to grow and the price consolidates above the maximum of 199.00, one may open long positions with the target of 209.00 and stop-loss of 195.00. Implementation time: 7 days and more.

If the asset continues to decline and the price consolidates below the minimum of 193.10, one can open short positions with the target of 184.00 and stop-loss of 197.00.

Hot

No comment on record. Start new comment.