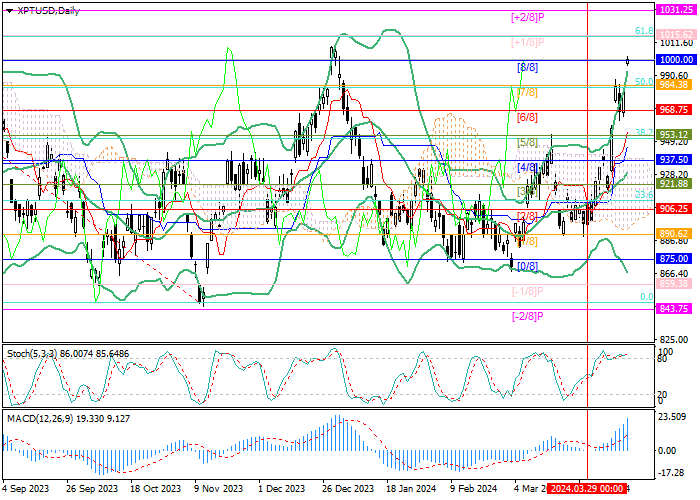

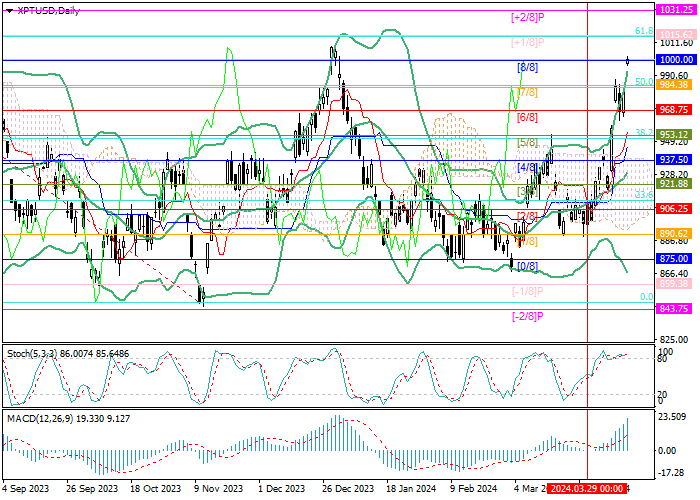

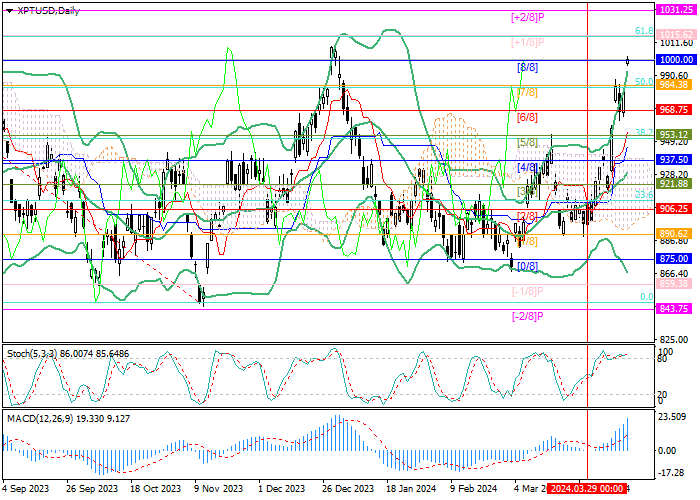

Current trend

In the middle of last year, the instrument formed a lateral range of 875.00–1000.00 (Murrey level [0/8]–[8/8]), within which it is still trading.

Currently, the quotes have again reached the upper limit of the range and, if they consolidate above it, they will be able to continue the upward movement to 1015.62 (Murrey level [ 1/8], 61.8% Fibonacci retracement), 1031.25 (Murrey level [ 2/8]), and 1062.50 (Murrey level [6/8], W1, the area of two-year highs). The key for the "bears" is the level of 968.75 (Murrey level [6/8]), the breakdown of which will ensure the development of a decline towards the targets of 937.50 (Murrey level [4/8], the central line of Bollinger Bands) and 906.25 (Murrey level [2/8], 23.6% Fibonacci retracement).

Technical indicators confirm the continuation of the uptrend: Bollinger Bands are reversing up, MACD is increasing in the positive zone. The entry of Stochastic into the overbought zone and the exit of the price chart beyond the upper Bollinger Band do not exclude a corrective pullback of quotes to the area of 968.75–953.12 (Murrey level [6/8]–[5/8], 38.2% Fibonacci retracement), but it is unlikely to lead to a change in the current trend.

Support and resistance

Resistance levels: 1000.00, 1015.62, 1031.25, 1062.50.

Support levels: 968.75, 937.50, 906.25.

Trading tips

Long positions can be opened from the 1005.00 mark or after a price reversal around 968.75 with targets of 1015.62, 1031.25, 1062.50 and stop-losses around 995.20 and 955.00, respectively. Implementation period: 5–7 days.

Hot

No comment on record. Start new comment.