Current trend

The price of North American light oil WTI Crude Oil is correcting sideways at 85.09 amid a tense geopolitical situation and a seasonal increase in global fuel demand.

Thus, experts still expect Iranian retaliatory attacks on Israeli infrastructure, and therefore, some states have recommended that citizens not visit the region soon. Meanwhile, yesterday, the Organization of the Petroleum Exporting Countries (OPEC) published its traditional monthly report, which forecasts an increase in global oil demand in 2024 to 2.25M barrels per day and a decrease to 1.85M barrels per day in 2025. In addition, the cartel expects a seasonal increase in oil demand in the second quarter: aviation kerosene demand will increase by 600.0K barrels per day, gasoline demand – by 400.0K barrels per day, and diesel fuel demand – by 200.0K barrels per day.

Demand for contracts on commodity exchanges remains stable: according to the daily report of the Chicago Mercantile Exchange (CME Group), the daily trading volume of WTI Crude Oil increased to a record value of 1.263M transactions since the beginning of March. At the same time, the options position also increased significantly, yesterday amounting to 224.7K contracts compared to the average trading volume at the end of March of 745.0K contracts, of which options accounted for only 116.0K positions. Thus, an almost doubling of trading activity may indicate increased investment demand, which, as a rule, is reflected in the quotes.

Meanwhile, investors have seriously adjusted their expectations regarding further actions of the US Federal Reserve: now most of them believe that the first interest rate cut will take place no earlier than September, there will be no more than two of them during the year, and the dollar will receive support versus alternative assets for a long time.

Support and resistance

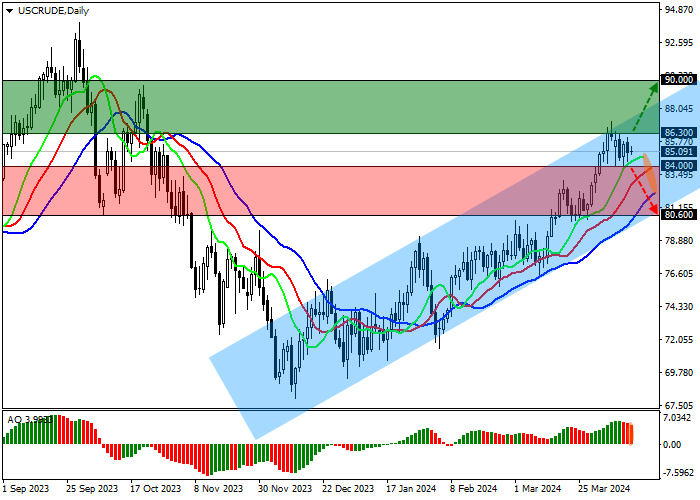

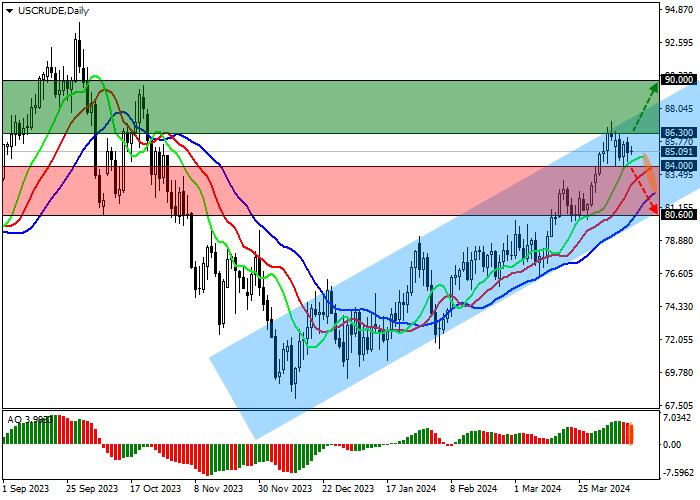

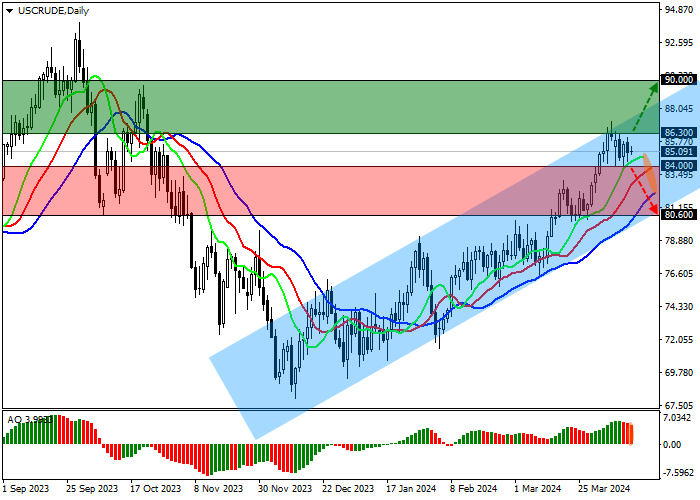

On the daily chart, the trading instrument tries to overcome the resistance line of the local ascending channel 88.00–80.50, holding around the year’s high of 85.00.

Technical indicators keep a buy signal: fast EMA on the Alligator indicator are above the signal line, and the AO histogram forms corrective bars above the transition level.

Resistance levels: 86.30, 90.00.

Support levels: 84.00, 80.60.

Trading tips

Long positions may be opened after the price rises and consolidates above 86.30, with the target at 90.00. Stop loss – 84.00. Implementation period: 7 days or more.

Short positions may be opened after the price declines and consolidates below 84.00, with the target at 80.60. Stop loss – 86.00.

Hot

No comment on record. Start new comment.