Current trend

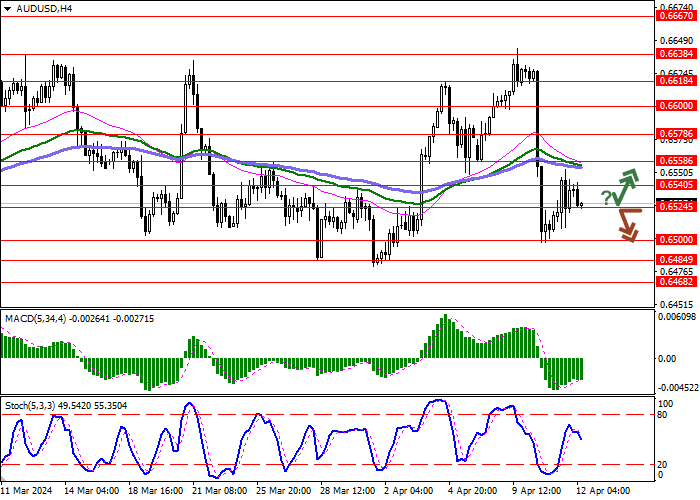

The AUD/USD pair shows an uncertain decline, leveling the results of the corrective growth the day before, which allowed quotes to retreat from the local lows of April 2. The instrument is testing 0.6525 for a breakdown, while analysts do not expect a large number of macroeconomic statistics to be published at the end of the week. However, in the US today at 17:00 (GMT 2) April data on the Consumer Confidence Index from the University of Michigan will be presented: the indicator is predicted to decline from 79.4 points to 79.0 points.

Meanwhile, investors continue to evaluate statistics on consumer inflation from China and producer inflation from the United States. The Chinese Consumer Price Index underlined the weakness of the national economy: in March the CPI in annual terms added 0.1% after rising by 0.7% in the previous month, while analysts expected 0.4%, and in monthly terms the value lost 1.0% after an increase of 1.0% in February with preliminary estimates of -0.5%. In turn, American data reflected the fact of persistent inflation, which prevents the US Federal Reserve from implementing previous plans for a possible interest rate reduction in June. The Producer Price Index in March rose from 1.6% to 2.1% against expectations of 2.2%, and the Core PPI accelerated from 2.1% to 2.4%, while experts expected 2.3%.

The Australian Consumer Inflation Expectations from Melbourne Institute in April adjusted from 4.3% to 4.6% with a forecast of 4.1%, confirming the continued significant pressure in the country's economy and increasing the likelihood of a prolonged high interest rate retention by the Reserve Bank of Australia (RBA).

Support and resistance

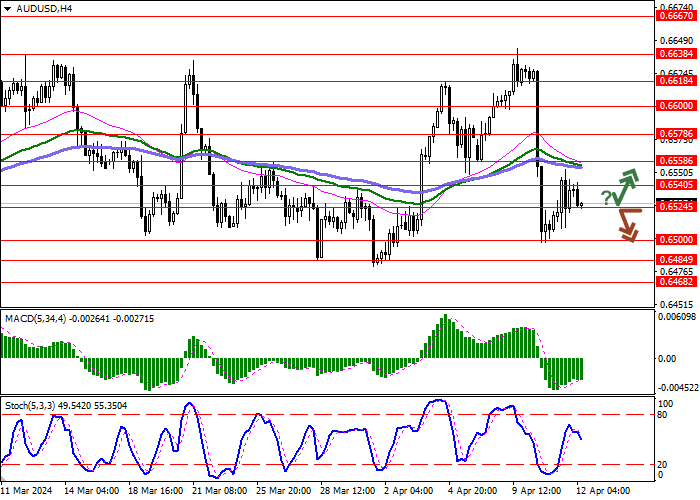

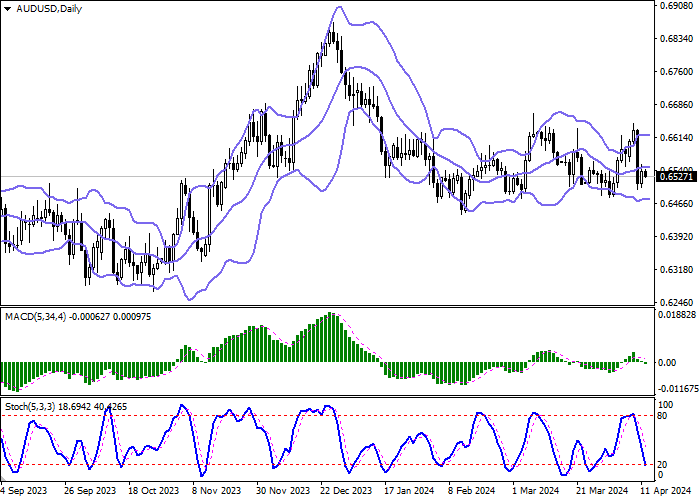

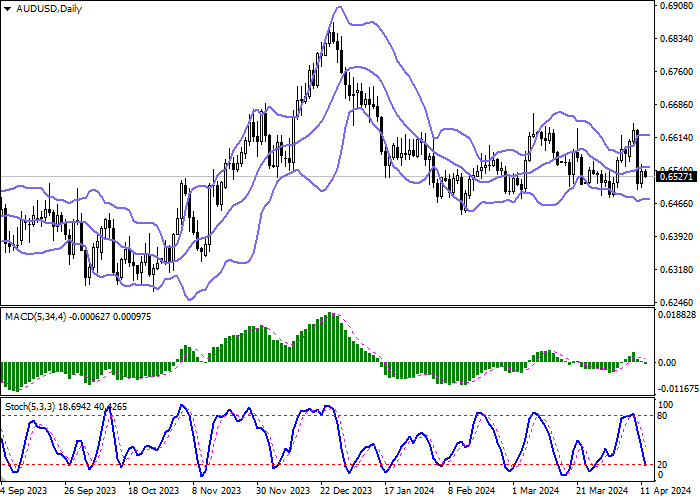

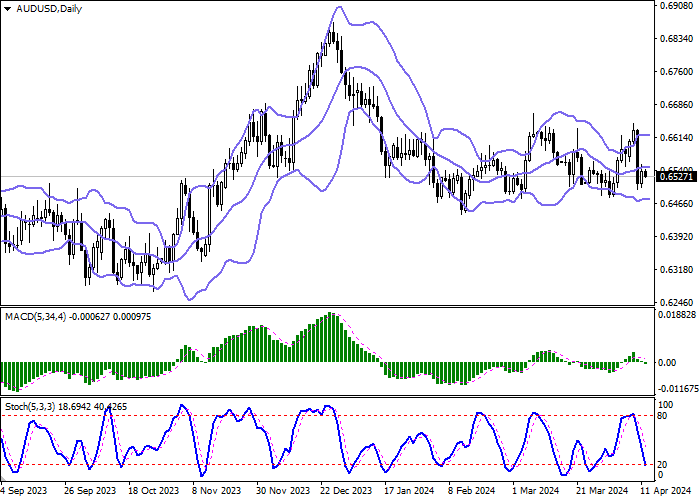

In the D1 chart, Bollinger Bands are reversing horizontally. The price range is changing slightly, but remains rather spacious for the current level of activity in the market. MACD is going down preserving a stable sell signal (located below the signal line). The indicator is trying to consolidate below the zero level. Stochastic retains its downward direction, but is quickly approaching its lows, indicating the risks of the Australian dollar being oversold in the ultra-short term.

Resistance levels: 0.6540, 0.6558, 0.6578, 0.6600.

Support levels: 0.6524, 0.6500, 0.6484, 0.6468.

Trading tips

Short positions may be opened after a breakdown of 0.6524 with the target at 0.6484. Stop-loss — 0.6540. Implementation time: 1-2 days.

A rebound from the level of 0.6524 as a support, followed by a breakout of 0.6540, may become a signal to open new long positions with the target at 0.6578. Stop-loss — 0.6524.

Hot

No comment on record. Start new comment.