Current trend

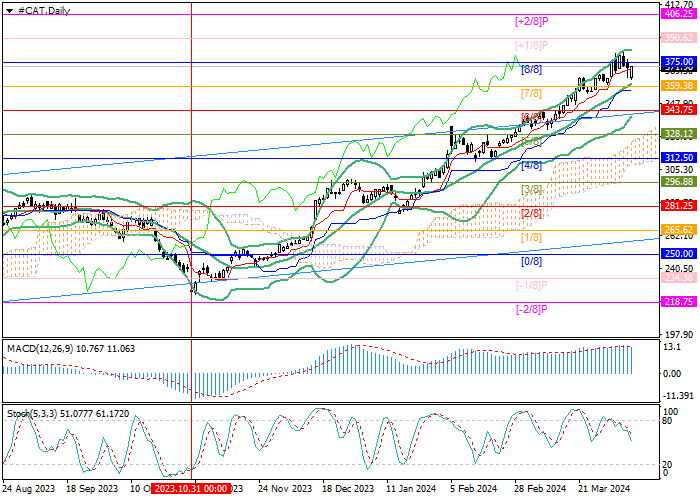

Shares of Caterpillar Inc., a manufacturer of construction and mining equipment, have been growing for the sixth month, reaching a year’s high of 375.00 last week (Murrey level [8/8]) but could not consolidate above it.

Yesterday, the quotes came under pressure after the publication of March data on American inflation: the consumer price index rose from 3.2% to 3.5%, and the core indicator remained at 3.8% instead of the expected decline to 3.7%, reducing the likelihood of the US Fed cut interest rates in June. However, most investors believe that the reduction in borrowing costs will begin in September.

The positive dynamics of the issuer’s securities were facilitated by statements by the company’s management about their intention to maintain quarterly dividends at 1.3 dollars per share, confirming the financial stability of the corporation. Over the long term, experts expect sales to increase by 1.2T dollars due to the US Infrastructure Investment Act and the transition of developed economies to renewable energy, which will require equipment made by Caterpillar Inc.

Under these conditions, continued growth of the asset in the medium term seems most likely.

Support and resistance

The trading instrument is close to 375.00 (Murrey level [8/8]), after which it is expected to grow to the area of 406.25 (Murrey level [ 2/8]) and 437.50 (Murrey level [6/8], W1). A breakdown of the key “bearish” level of 343.75 (Murrey level [2/8], lower line of Bollinger Bands) could lead to a renewed decline to the area of 312.50 (Murrey level [4/8]) and 281.25 (Murrey level [2/8]).

Technical indicators confirm the continuation of the upward trend: Bollinger bands are directed upward, and the MACD histogram is stable in the positive zone. Stochastic reversed downwards but the potential for a downward correction seems limited.

Resistance levels: 375.00, 406.25, 437.50.

Support levels: 343.75, 312.50, 281.25.

Trading tips

Long positions may be opened above 375.00, with the targets at 406.25, 437.50, and stop loss 360.00. Implementation time: 5–7 days.

Short positions may be opened below 343.75, with the targets at 312.50, 281.25, and stop loss 355.00.

Hot

No comment on record. Start new comment.