Current trend

The Dow Jones index is correcting in the local trend at 38443.0: the dynamics of the leading stock instruments still depends on the situation on the bond market, as well as macroeconomic statistics.

Investors fear that the data on the consumer price index (CPI), presented yesterday, may make serious adjustments to the plans of the US Federal Reserve to begin easing monetary policy: in March, the indicator increased by the same 0.4% MoM, contrary to forecasts of 0.3%, and rose from 3.2% to 3.5% YoY, ahead of experts' expectations of 3.4%. The base value excluding food and energy adjusted by 0.4% MoM and by 3.8% YoY, respectively, as in the previous period, above the projected slowdown to 0.3% and 3.7%. According to the Chicago Mercantile Exchange (CME Group) instrument FedWatch Tool, the probability of an interest rate cut in June is now estimated at only 60.0% compared to 81.3% of keeping it at the current level, therefore, the increased debt burden will not allow national businesses to invest in development, and stock instruments will again come under pressure.

Leading bonds accelerated growth: 10-year securities are trading at a rate of 4.543%, exceeding Monday's value at 4.365%, the yield of 20-year bonds reached 4.752% after 4.599% recorded at the beginning of the week, and the rate on 30-year securities increased to 4.628% from 4.505%.

The growth leaders in the index are Walmart Inc. ( 1.39%), Chevron Corp. ( 0.41%), Procter & Gamble Co. ( 0,37%).

Among the leaders of the decline are Home Depot Inc. (-3.00%), Intel Corp. (-2.95%), Goldman Sachs Group Inc. (-2.42%).

Support and resistance

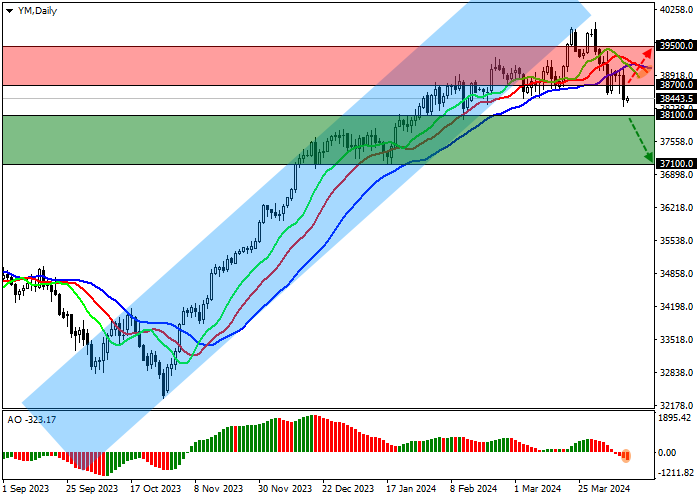

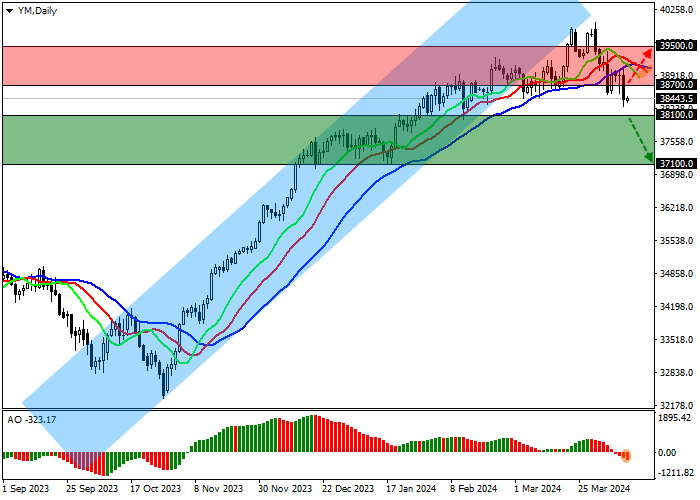

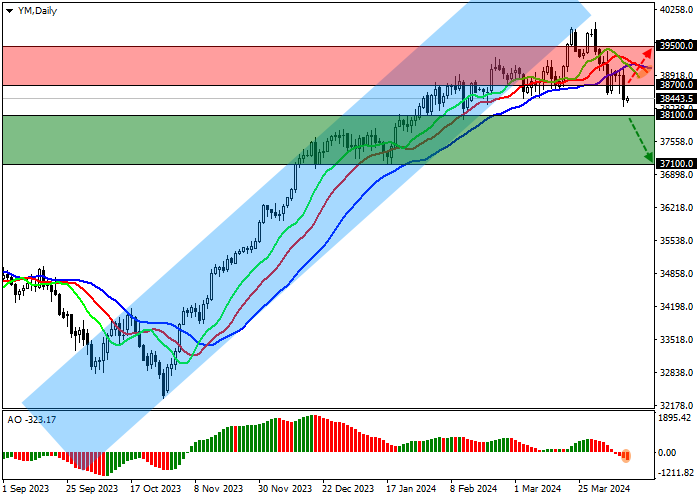

On the D1 chart, the index quotes continue their downward correction dynamics, still holding below the support line of the 40000.0–38700.0 channel.

Technical indicators have reversed, maintaining a sell signal, which is strengthening every day: the range of fluctuations of the EMAs of the Alligator indicator is expanding, and the AO histogram is forming new correction bars, being below the transition level.

Support levels: 38100.0, 37100.0.

Resistance levels: 38700.0, 39500.0.

Trading tips

In the event of a reversal and continued decline of the asset, as well as price consolidation below the support level of 38100.0, sell positions with the target of 37100.0 may be opened. Stop-loss – 38500.0. Implementation time: 7 days and more.

If the asset continues to grow, buy positions can be opened after overcoming the resistance level of 38700.0 with the target of 39500.0 and stop-loss of 38300.0.

Hot

No comment on record. Start new comment.