Current trend

Benchmark Brent Crude Oil is trading just above the 90.00 level, supported by OPEC statistics.

Thus, in March, the cartel and its allies produced 41.25M barrels per day, 40.0K barrels more than in February. Production from countries outside the organization increased by 80.0K barrels per day to 26.66M barrels per day. Just last month, OPEC participants exceeded the oil production quotas by 165.0K barrels per day, which corresponds to a 97.9% level of compliance with restrictions, while the production levels of the Russian Federation and Saudi Arabia compensated for each other: Saudi Arabia increased its figures by 10.0K barrels per day, and Russia decreased it by 9.97K barrels per day to 9.42M barrels per day.

Weekly oil inventories, according to data from the American Petroleum Institute (API), increased by 3.043M after a decrease of 2.286M earlier, and according to the Energy Information Administration of the US Department of Energy (EIA) – by 5.841M after an increase of 3.210M in the previous period.

According to the Chicago Mercantile Exchange (CME Group), investment demand for oil contracts continues to increase, peaking in the first week of April when total positions exceeded 1.2M contracts. Now, the indicators have decreased slightly, and yesterday, the futures position amounted to 871.6K contracts, and the options position – to 135.6K transactions, in total significantly exceeding the trading volumes of the end of March.

Support and resistance

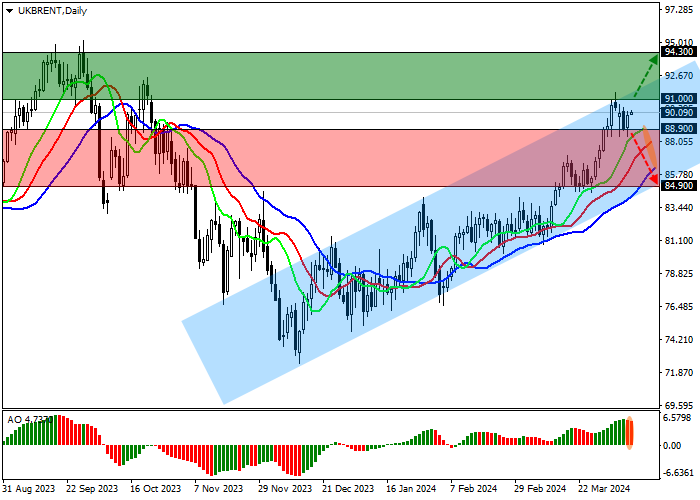

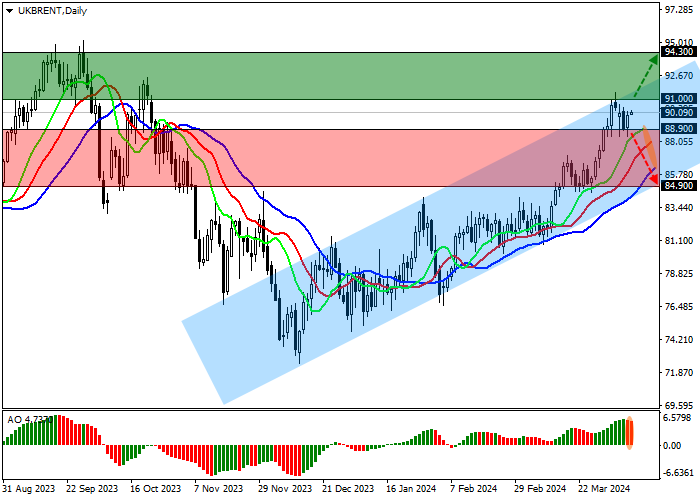

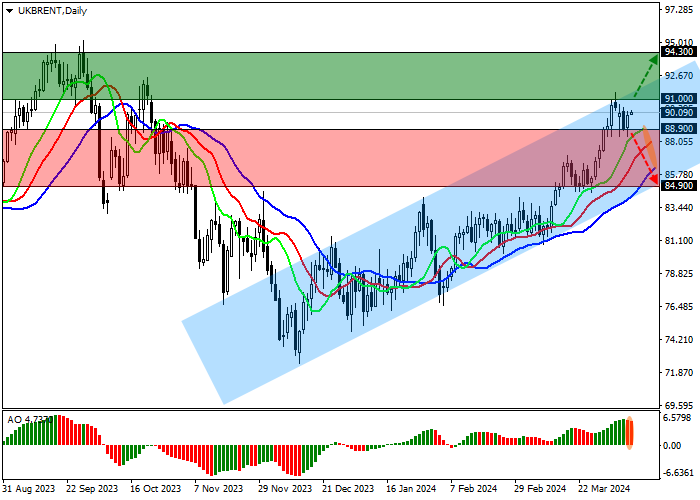

On the daily chart, the trading instrument is moving within the corrective trend, heading towards the resistance line of the ascending corridor 92.50–85.00.

Technical indicators are holding a buy signal: fast EMA of the Alligator indicator are above the signal line, and the AO histogram is forming corrective bars in the buy zone.

Resistance levels: 91.00, 94.30.

Support levels: 88.90, 84.90.

Trading tips

Long positions may be opened after the price rises and consolidates above 91.00, with the target at 94.30. Stop loss – 90.00. Implementation period: 7 days or more.

Short positions may be opened after the price declines and consolidates below 88.90, with the target at 84.90. Stop loss – 90.00.

Hot

No comment on record. Start new comment.