Current trend

The USD/JPY pair is retreating from record highs around 153.20, updated the day before. The instrument is trying to consolidate below 153.00, under pressure from technical factors and concerns about possible currency intervention by the Bank of Japan. Previously, officials noted that the decline in the national currency was mainly caused by speculative actions and did not rule out intervention in the market situation if the rapid downward dynamics of quotes continued.

The position of the American currency, in turn, received support from March inflation statistics in the United States: the Consumer Price Index in annual terms accelerated from 3.2% to 3.5%, ahead of forecasts of 3.4%, and in monthly terms - by the previous 0.4%, contrary to expectations of a decrease to 0.3%. Core CPI excluding Food and Energy added another 0.4% month-on-month and 3.8% year-on-year, while analysts expected a slowdown to 0.3% and 3.7%, respectively. The strong data will likely lead to the US Federal Reserve maintaining a wait-and-see approach regarding monetary easing in the second half of the year. However, markets are still counting on two or three interest rate cuts before the end of 2024.

Yesterday's statistics from Japan had no impact on the instrument: Bank Lending volumes in March increased from 3.0% to 3.2% with preliminary estimates at 3.1%, the Producer Price Index for corporate goods increased by 0.8%, accelerating from 0.7% in February, and the Producer Price Index rose by another 0.2%, while experts expected 0.3%. Meanwhile, the Governor of the Bank of Japan, Kazuo Ueda, speaking in Parliament, said that the regulator will not focus on changes in the yen exchange rate when determining monetary policy, denying the possibility of raising the interest rate to support the national currency.

Support and resistance

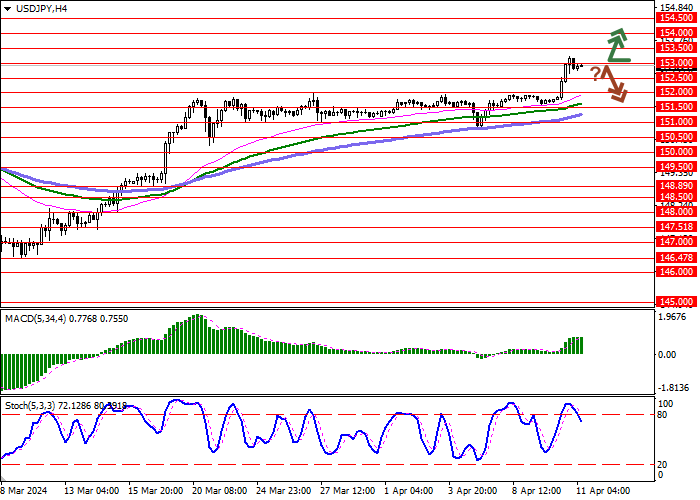

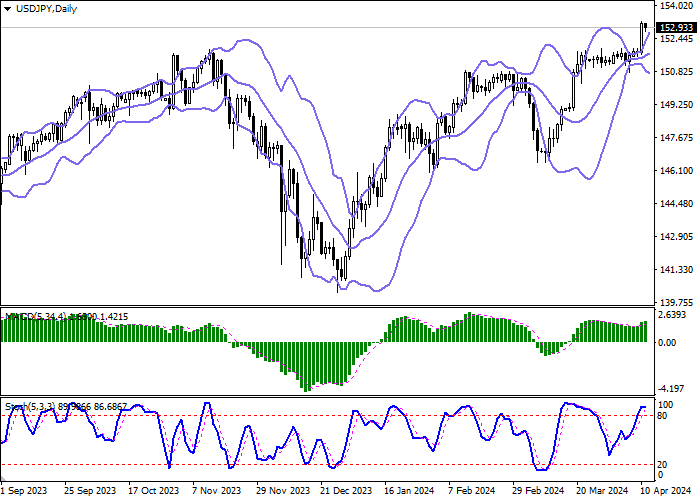

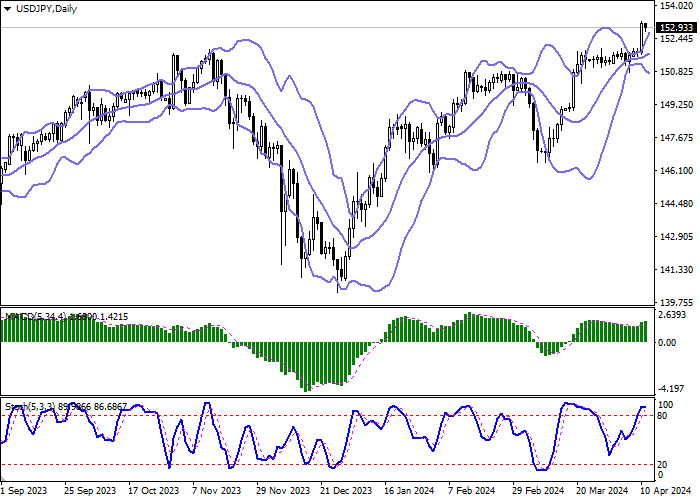

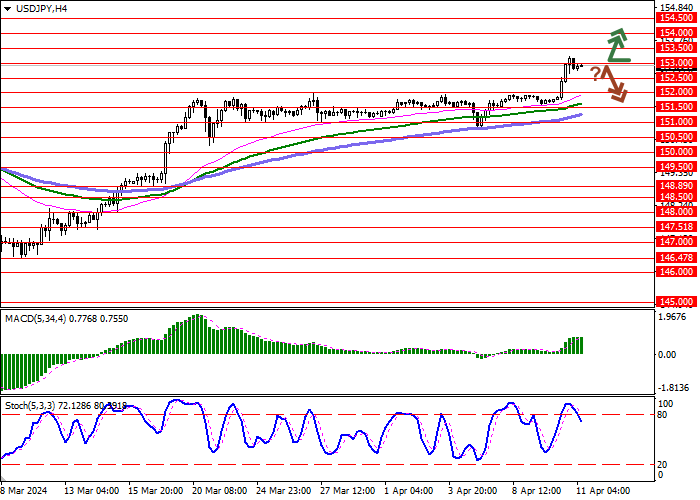

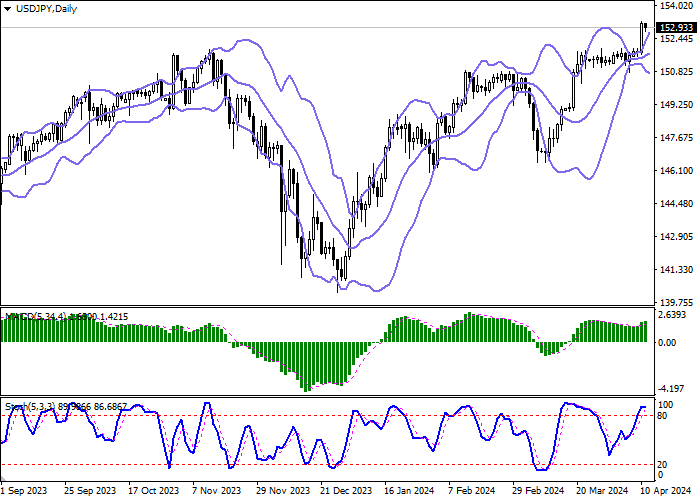

Bollinger Bands in D1 chart show moderate growth. The price range is actively expanding, but it fails to catch the surge of "bullish" sentiment at the moment. MACD indicator is growing, while preserving a rather stable buy signal (located above the signal line). Stochastic, having reached its highs, reversed into a horizontal plane, indicating overbought American currency in the ultra-short term.

Resistance levels: 153.00, 153.50, 154.00, 154.50.

Support levels: 152.50, 152.00, 151.50, 151.00.

Trading tips

Long positions can be opened after a breakout of 153.00 with the target of 154.00. Stop-loss — 152.50. Implementation time: 1-2 days.

A rebound from 153.00 as from resistance, followed by a breakdown of 152.50 may become a signal for opening of new short positions with the target at 151.50. Stop-loss — 153.00.

Hot

No comment on record. Start new comment.