Current trend

Shares of IBM Corp., a giant in the development and sale of hardware software, are trading in a corrective trend at 189.00.

Yesterday, management announced the creation of the Cloud Multizone Region in Montreal, which is scheduled to open in 2025. The company’s artificial intelligence (AI)-powered cloud infrastructure will thus complete its reach in Canada, allowing users anywhere in the country to access secure generative AI technologies. Several new fan experiences were previously announced to be added to the Masters golf app, designed to significantly expand the audience and allow users to access innovative features. Thus, the application will support the Spanish language, which was made possible thanks to the recently concluded cooperation agreement with the Spanish government in the field of AI.

Against this background, leading analysts have a positive view of the issuer’s shares: analysts at BMO Capital Markets retained their market rating for IBM Corp. shares as Market Perform, setting the target price at 210.0 dollars.

Support and resistance

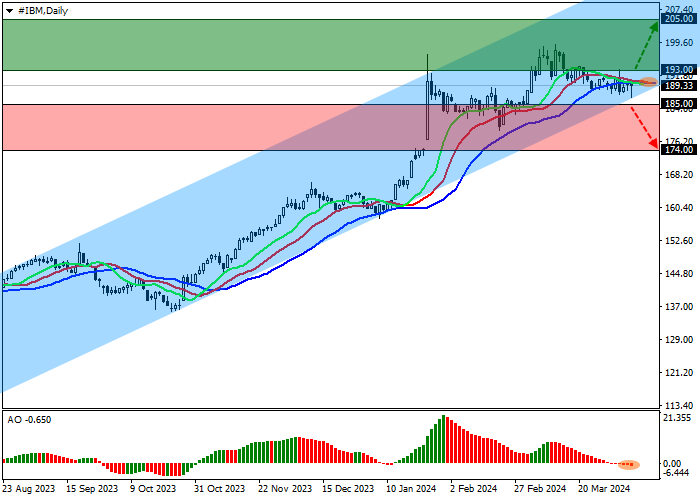

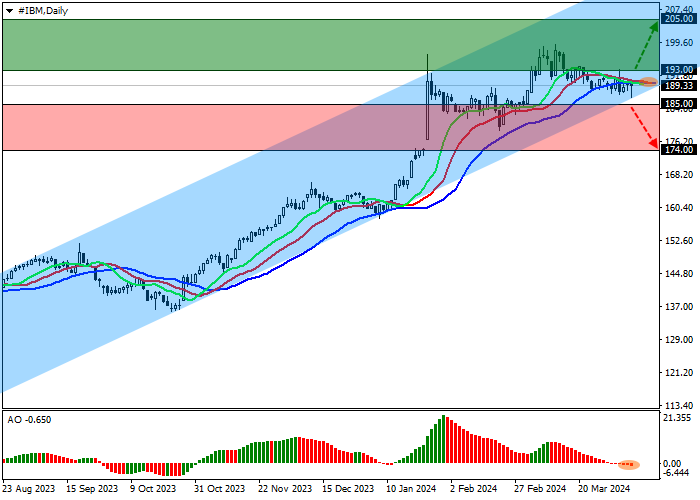

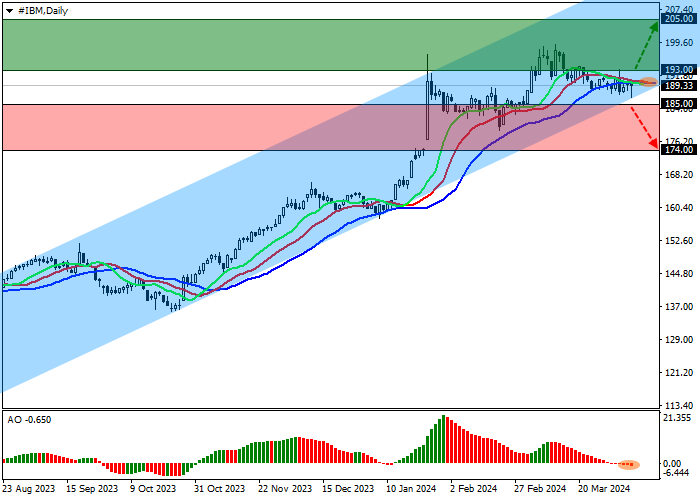

On the daily chart, the trading instrument is moving within the uptrend, correcting in the channel 210.00–187.00.

Technical indicators are in a state of uncertainty: the EMA fluctuation range of the Alligator indicator remains very narrow, and the AO histogram forms corrective bars below the transition level.

Resistance levels: 193.00, 205.00.

Support levels: 185.00, 174.00.

Trading tips

Long positions may be opened after the price rises and consolidates above 193.00, with the target at 205.00. Stop loss – 188.00. Implementation period: 7 days or more.

Short positions may be opened after the price declines and consolidates below 185.00, with the target at 174.00 and stop loss 190.00.

Hot

No comment on record. Start new comment.