Today, we present you a mid-term investment overview of the NZD/USD pair.

Today, the Reserve Bank of New Zealand (RBNZ) kept its key rate unchanged at 5.50% in response to persistently high inflation, which, according to a preliminary forecast for the first quarter, will go beyond the target range of 1.0–3.0%. According to the Monetary Policy Committee, the country's economic growth rate remains below average and is expected to remain low, so the restrictive policy on interest rates should continue to operate until inflation falls steadily below 3.0%. One can also highlight very weak retail sales, which decreased by 1.7% in Q4 2023 after an increase of 0.4% in the previous period, and compared to the same period a year earlier, the decline was 1.9%. In addition, yesterday the New Zealand Institute of Economic Research (NZEIR) published the traditional business confidence index for Q1 2024, which fell by 25.0% after a 2.0% decline earlier.

Speaking of the US currency, which, despite the local slowdown, is still stable, its global dynamics are likely to develop in a moderate upward or lateral trend in response to possible actions by the US Federal Reserve, which is more and more hinting at an interest rate cut in early summer. In turn, the Chicago Mercantile Exchange tool (FedWatch Tool) indicates a 93.7% probability of maintaining the rate at the May 1 meeting. Nevertheless, for the meeting on June 12, the situation is completely different: the CME FedWatch Tool assumes a reduction in the key rate of the US Federal Reserve to 5.00–5.25% with a probability of 50.8%, and the chances of maintaining the interest rate at 5.25–5.50% are estimated at 46.0%. The expectation of an early transition of the American regulator to a change in monetary policy will support the dollar all this time, which may strengthen its position against a basket of world currencies.

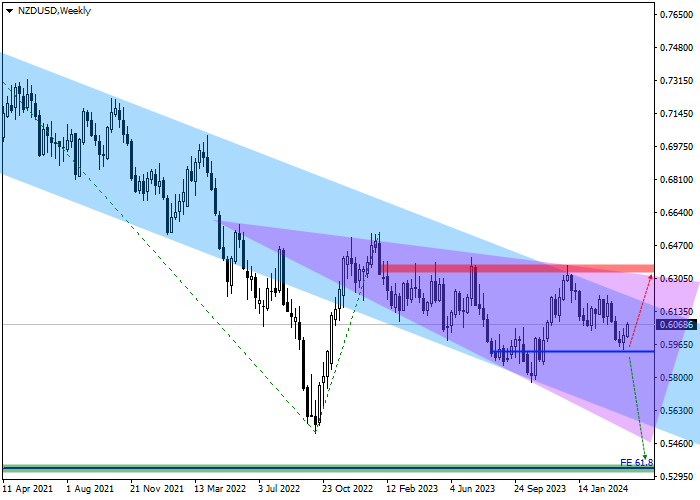

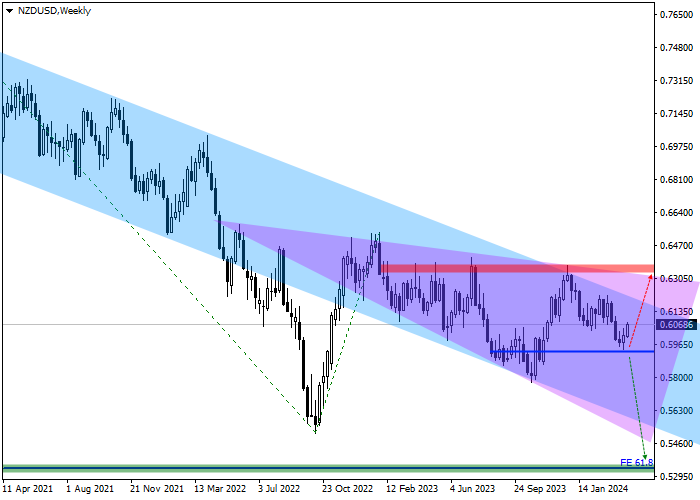

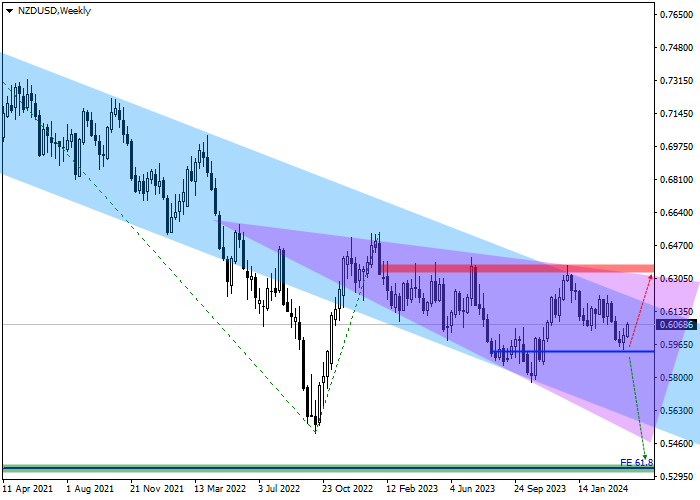

In addition to the underlying fundamental factors, the possible continuation of the decline of the NZD/USD pair is also confirmed by technical indicators: on the W1 chart, the price continues unsuccessful attempts to consolidate above the resistance line of the descending channel with the borders of 0.6260–0.5600, and at the moment there is a significant pullback of the instrument down to the level of 0.5960.

A new downward wave has already begun to gain strength, and in the global perspective, it is possible to form a full-fledged trend with the first target in the area of the initial trend level of 61.8% Fibonacci extension at 0.5330.

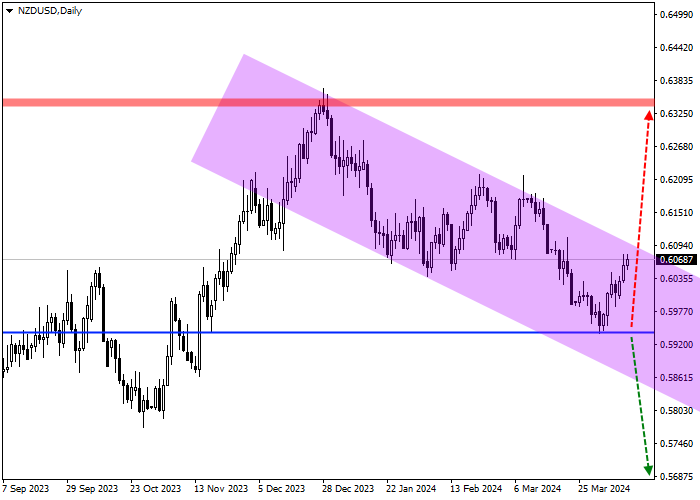

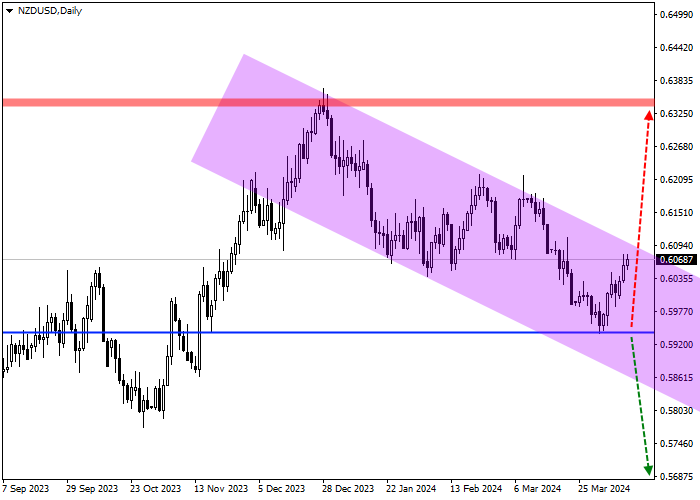

Key levels can be seen on the D1 chart.

As can be seen on the chart, the downward movement develops within the framework of a descending channel with dynamic borders of 0.6080–0.5840. At the moment, the price is once again testing the resistance line, and in case of failure, a downward reversal may occur.

There is a sell signal cancellation zone near the 0.6340 mark, which coincides with the local maximum from mid-December. If the price reaches this zone, the downward scenario will be canceled and open positions should be liquidated.

In the area of the initial trend level of 61.8% Fibonacci extension, which is located at 0.5330, there is a target zone; if the price reaches it, profit should be taken on open sell positions.

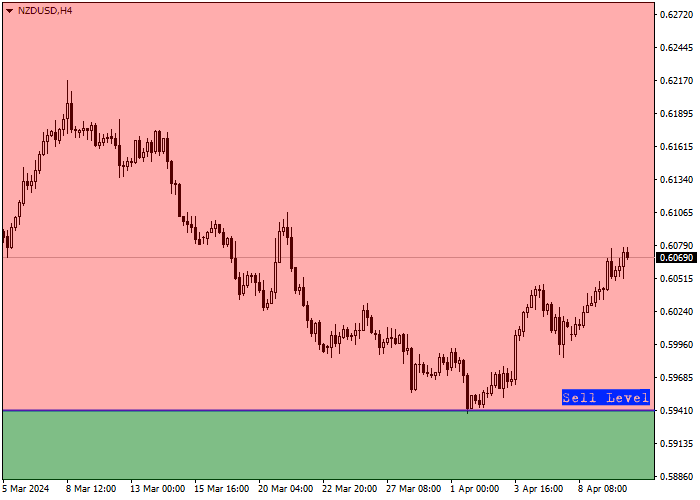

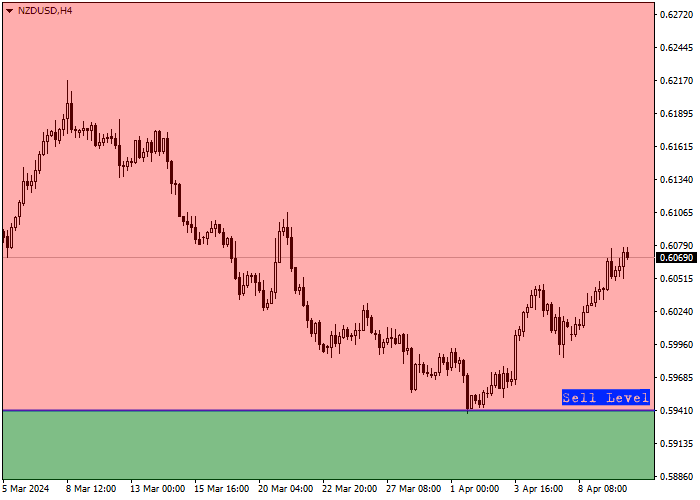

In more detail, trade entry levels can be evaluated on the H4 chart.

The entry level for sell transactions is located at 0.5940, which coincides with the minimum of April 1. Thus, a buy signal will be received after the price crosses this minimum, which may happen in the near future.

Given the average daily volatility of the trading instrument over the past month, which is 43.5 points, the price movement to the target zone of 0.5330 may take about 59 trading sessions, however, with increasing dynamics, this time may be reduced to 48 trading days.

Hot

No comment on record. Start new comment.