Current trend

This week, the SOL/USD pair continued to decline and consolidated below the 175.00 mark (Murrey level [6/8]), while, unlike most other leading digital assets, SOL quotes have not recently made significant attempts to grow.

Technical problems in the Solana network are putting pressure on the instrument, making it difficult for investors and developers to work in it: last week, the number of unsuccessful transactions reached 75.0%, which caused Helius Labs specialists providing technical support for the network to prepare a patch that should fix the situation. At the same time, the launch of new projects on the network has been suspended until at least April 15. Representatives of Helius Labs stated that the current technical problems are not structural and solutions are known, but the fight against issues will take time. Against this background, interest in the asset has seriously decreased, as has the price of SOL.

Two other factors negatively affecting the entire cryptocurrency market are the newly started outflow of funds from the bitcoin ETF, which amounted to 223.8 million dollars on Monday, as well as the uncertainty of the further policy of the US Federal Reserve. Investors fear that today's publication of March inflation data will confirm signs of increased price pressure in the national economy, which may lead to the regulator's refusal to switch to monetary easing in June and the strengthening of the US dollar to alternative assets, including digital ones.

Support and resistance

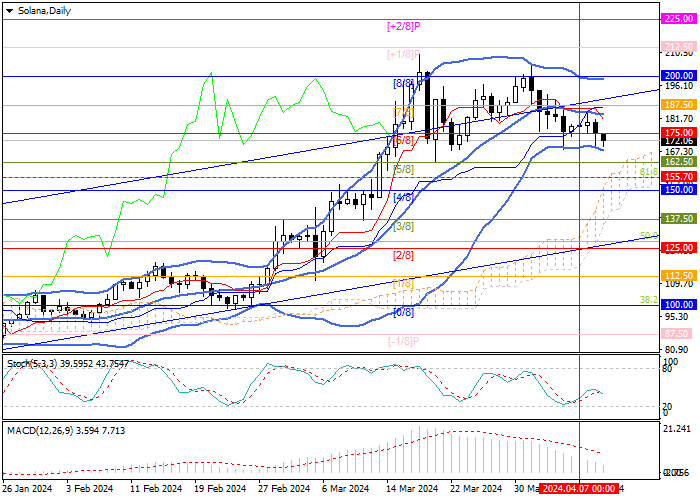

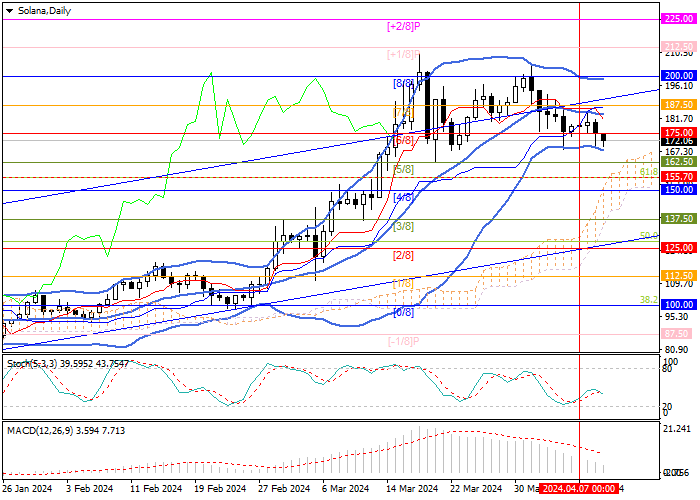

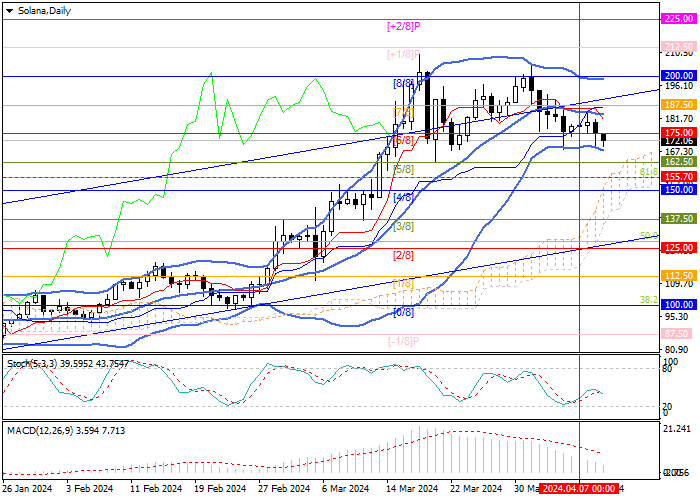

The SOL/USD pair has consolidated below 175.00 (Murrey level [6/8]), which may lead to a decline towards the targets of 155.70 (61.8% Fibonacci retracement) and 137.50 (Murrey level [3/8]). The key for the "bulls" remains the 200.00 mark (Murrey level [8/8]), the breakout of which will ensure continued growth to the levels of 225.00 (Murrey level [ 2/8]) and 250.00 (Murrey level [ 2/8], W1, the area of 4-year highs).

Technical indicators confirm the likelihood of a further decline in quotes: Bollinger Bands are reversing down, Stochastic is horizontal, and MACD is preparing to move into a negative zone and form a sell signal.

Resistance levels: 200.00, 225.00, 250.00.

Support levels: 155.70, 125.00.

Trading tips

Short positions can be opened from the 170.00 mark with targets of 155.70, 125.00 and stop-loss of 182.00. Implementation period: 5–7 days.

Long positions can be opened above the level of 200.00 with targets of 225.00, 250.00 and stop-loss of 185.00.

Hot

No comment on record. Start new comment.