Current trend

During the Asian session, prices for WTI Crude Oil are consolidating at 84.70: investors are in no hurry to open new positions in anticipation of the publication of American macroeconomic statistics on inflation today at 14:30 (GMT 2).

Preliminary estimates suggest an increase in the consumer price index in March from 3.2% to 3.4% YoY and a decrease from 0.4% to 0.3% MoM, and the core indicator excluding food products and energy resources may change from 0.4% to 0.3% MoM and from 3.8% to 3.7% YoY. At 20:00 (GMT 2), traders will pay attention to the US Fed March monetary policy meeting minutes, assessing the likelihood of an interest rate cut in June.

The asset was under pressure by renewed forecasts from the Energy Information Administration of the US Department of Energy (EIA). Thus, experts expect that OPEC oil production in 2024 will decrease by 930.0K barrels per day, which exceeds previous estimates by 190.0K barrels per day. In 2025, oil production is expected to increase by 750.0K barrels per day to 36.89M barrels per day. In general, oil production expectations for this year changed by 470.0K barrels per day, while for 2025 – by 40.0K barrels per day. Representatives of the department note that oil prices in March continued their positive trend for the third month amid geopolitical risks associated with attacks on commercial ships in the Red Sea. The asset was under pressure due to data from the American Petroleum Institute (API) on the dynamics of commercial reserves. For the week of April 5, the indicator increased by 3.034M barrels after a decrease of 2.286M barrels earlier, although analysts expected an increase of 2.415M barrels.

There is a correction in the oil market. According to the latest report from the US Commodity Futures Trading Commission (CFTC), last week, the net speculative positions in WTI Crude Oil rose from 278.0K to 300.9K. As for the dynamics, there is a rapid narrowing of the gap in positions, which may soon again bring buyers into the lead: their balance among manufacturers is 330.207K versus 331.738K among sellers. Last week, the “bulls” opened 18.146K new contracts, while the “bears” liquidated 3.783K transactions, reflecting a new stage of accumulation of long positions in the asset.

Support and resistance

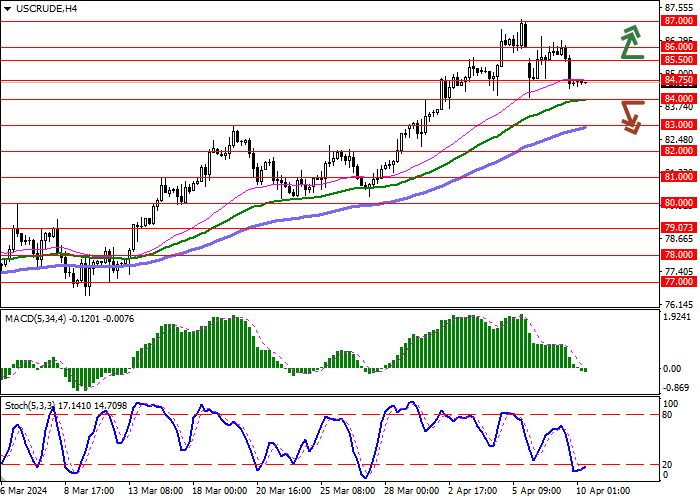

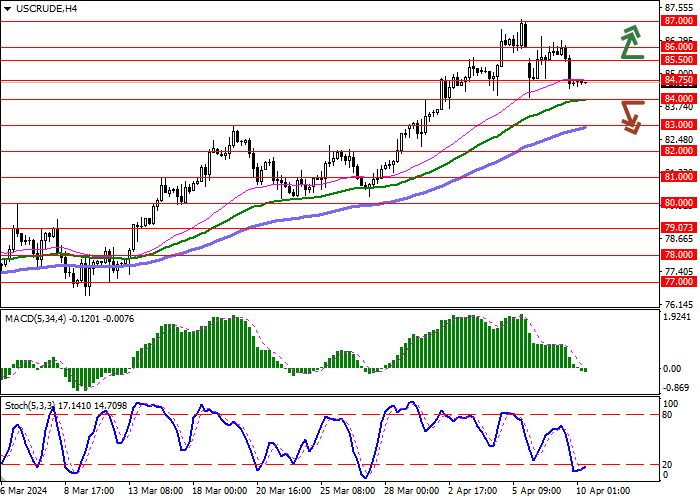

On the daily chart, Bollinger Bands are actively growing: the price range is narrowing, reflecting the emergence of ambiguous trading dynamics in the short term. The MACD indicator is declining, maintaining a sell signal: the histogram is below the signal line. Stochastic is quickly approaching its lows, indicating that the trading instrument may become oversold in the ultra-short term.

Resistance levels: 85.50, 86.00, 87.00, 88.00.

Support levels: 84.75, 84.00, 83.00, 82.00.

Trading tips

Short positions may be opened after 84.00 is broken, with the target at 82.00. Stop loss – 85.00. Implementation time: 2–3 days.

Long positions may be opened after 85.50 is broken upward, with the target at 87.00. Stop loss – 84.75.

Hot

No comment on record. Start new comment.