Current trend

The GBP/USD pair is trading with near-zero dynamics, holding near 1.2675. The day before, the instrument showed quite active growth, and also updated local highs from March 21, which was the market’s reaction to the lack of important macroeconomic statistics.

UK Retail Sales from the British Retail Consortium (BRC) increased 3.2% in March after rising 1.0% the month before, while analysts had expected 1.8%. Consortium experts note that the Easter holidays led to a significant increase in demand for food, but overall sales growth remains subdued due to bad weather and high inflation: for example, in the first quarter, spending on food increased by 6.8%, and spending on non-food products decreased by 1.9%. In turn, American statistics on Business Optimism from the National Federation of Independent Business (NFIB) turned out to be negative: in March the indicator decreased from 89.4 points to 88.5 points, with a forecast of 90.2 points.

At the same time, with the opening of the American trading session, the dollar's position began to gradually strengthen as investors revise expectations regarding the expected reduction in the cost of borrowing by the US Federal Reserve in June. Currently, the probability of such a scenario has dropped below the psychological level of 50.0%; however, many trading participants prefer to wait for the publication of March statistics on consumer and industrial inflation in the United States on Wednesday and Thursday. The Consumer Price Index is expected to increase from 3.2% to 3.4% in annual terms and decrease from 0.4% to 0.3% in monthly terms. The annualized Core CPI is likely to slow down from 3.8% to 3.7%, still well above the 2.0% target. There is a high probability that the US Federal Reserve will postpone the easing of monetary policy to a later date, which will support the American currency.

On Friday, the UK will present February data on Gross Domestic Product (GDP) and Industrial Production. According to forecasts, the national economy will slow down from 0.2% to 0.1%, while production volumes will show zero dynamics in monthly terms after -0.2% a month earlier, and in annual terms will be adjusted from 0.5% to 0.6%.

Support and resistance

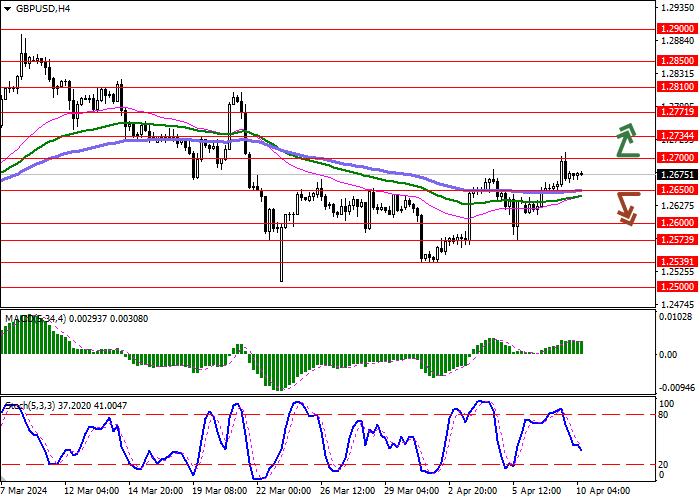

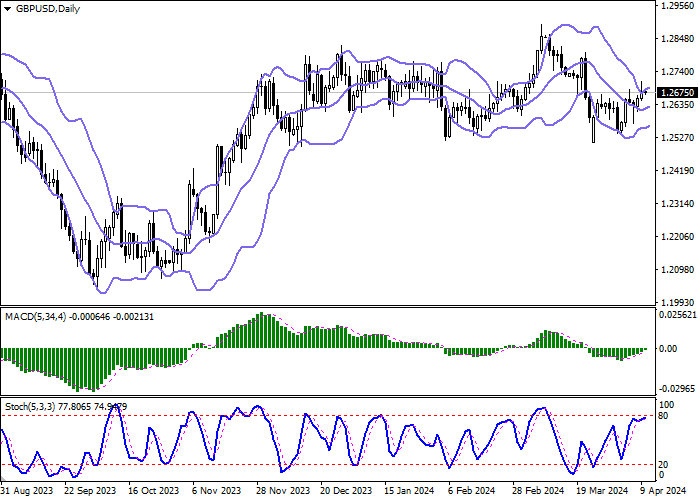

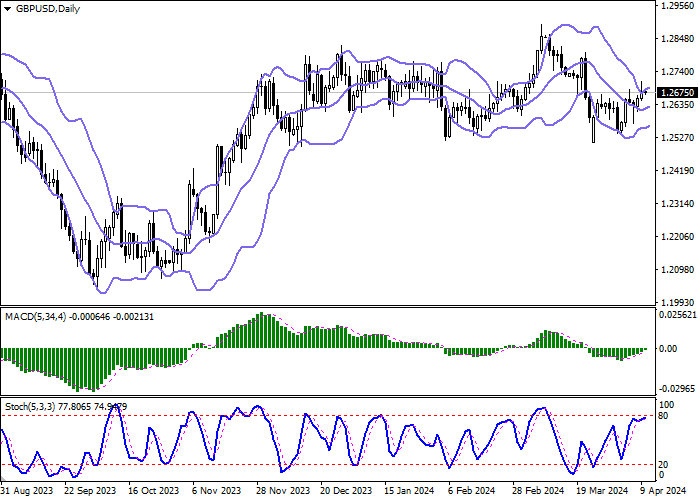

Bollinger Bands in D1 chart show moderate growth. The price range expands, freeing a path to new local highs for the "bulls". MACD indicator is growing, while preserving a rather stable buy signal (located above the signal line). The indicator is trying to consolidate above the zero level. Stochastic shows similar dynamics but is rapidly approaching its highs, which reflects risks of the overbought pound in the ultra-short term.

Resistance levels: 1.2700, 1.2734, 1.2771, 1.2810.

Support levels: 1.2650, 1.2600, 1.2573, 1.2539.

Trading tips

Long positions can be opened after a breakout of 1.2700 with the target of 1.2771. Stop-loss — 1.2660. Implementation time: 2-3 days.

The return of a "bearish" trend with the breakdown of 1.2650 may become a signal for new short positions with the target at 1.2600. Stop-loss — 1.2680.

Hot

No comment on record. Start new comment.