Current trend

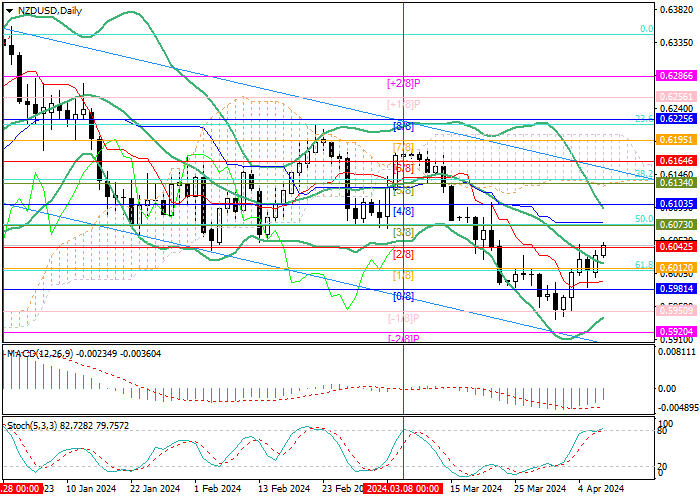

Since the beginning of April, the NZD/USD pair has been trying to correct within the medium-term downtrend: currently, growth has slowed down around 0.6042 (Murrey level [2/8]), as investors await the outcome of the Reserve Bank of New Zealand (RBNZ) meeting and the publication of March inflation data in the United States, both of which will take place on Wednesday.

It is assumed that the New Zealand regulator will keep the key rate at 5.50%, despite a significant deterioration in economic indicators and the onset of recession at the end of last year. Most likely, officials will declare that the inflation rate in the country remains too high, and confirm their intention to begin easing monetary policy only in 2025, contrary to the expectations of investors, the most optimistic of whom believe in starting lowering interest rates in August. Such a development of events may briefly ensure the upward dynamics of the instrument, but the growth will unlikely be significant.

According to forecasts, the consumer price index (CPI) in the United States may rise from 3.2% to 3.4% YoY, which will confirm the trend towards accelerating inflation and strengthen the position of supporters of the "hawkish" course within the regulator. Many officials are already very skeptical about the imminent start of monetary policy easing: for example, yesterday the US Federal Reserve Governor Michelle Bowman and the head of the Dallas Federal Reserve Bank (FRB), Lorie Logan, announced the inexpediency of lowering interest rates due to the persistence of risks of inflationary growth. Thus, the end of the corrective growth of the NZD/USD pair in the near future seems quite possible.

Support and resistance

Technically, the price is testing the 0.6042 mark (Murrey level [2/8]), the breakout of which will allow quotes to develop upward dynamics to the levels of 0.6073 (Murrey level [3/8], 50.0% Fibonacci retracement), 0.6103 (Murrey level [4/8]), however, the growth potential seems limited. The key for the "bears" is the level of 0.6012 (Murrey level [1/8], 61.8% Fibonacci retracement, the central line of Bollinger Bands), consolidation below which will act as a catalyst for the development of a downward movement in the area of 0.5950 (Murrey level [-1/8]) and 0.5920 (Murrey level [-2/8]).

Technical indicators confirm the continuation of the downtrend: Bollinger Bands are pointing downwards, MACD is decreasing, but remains in the negative zone, while Stochastic is approaching the overbought zone, which does not exclude an imminent change of direction.

Resistance levels: 0.6042, 0.6073, 0.6103.

Support levels: 0.6012, 0.5950, 0.5920.

Trading tips

Short positions should be opened below the level of 0.6012 or after the price reversal around 0.6073 with targets of 0.5950, 0.5920 and stop-losses of 0.6035 and 0.6095, respectively. Implementation period: 5–7 days.

Hot

No comment on record. Start new comment.