Current trend

Against the stabilization of the American currency and poor Canadian macroeconomic statistics, the USD/CAD pair is trading at 1.3576.

Thus, in March, the unemployment rate rose from 5.8% to 6.1%, although analysts expected an increase to 5.9% due to a change in employment of –2.2K after an increase of 40.7K compared to expectations of 25. 9K: full employment adjusted by –0.7K, and part-time employment by –1.6K. However, the share of the economically active population remained at 65.3%.

In the US, unemployment decreased from 3.9% to 3.8% due to an increase in nonfarm payrolls by 303.0K instead of 270.0K last month, and the private nonfarm payrolls increased by 232.0K instead of 207.0K a month earlier. Thus, the labor market trend index increased from 111.85 points to 112.84 points, supporting the American dollar.

Support and resistance

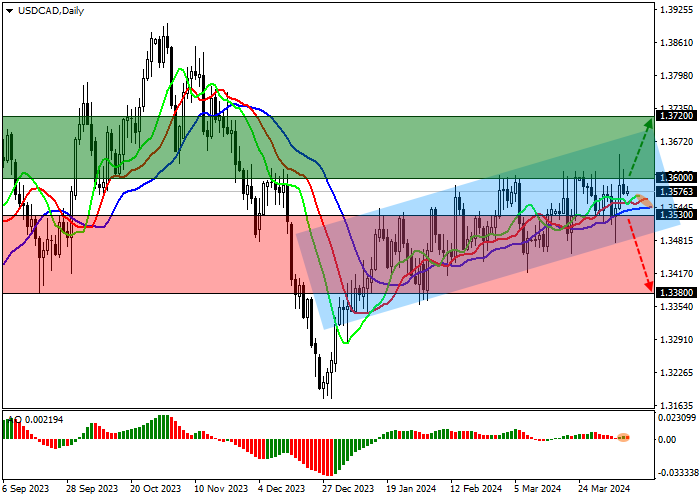

On the daily chart, the trading instrument is approaching the resistance line of the ascending corridor with dynamic boundaries of 1.3670–1.3480.

Technical indicators have been holding a stable buy signal for more than a month, slowing down against corrections: the EMA fluctuation range on the Alligator indicator is expanding upward, and the AO histogram is forming corrective bars above the transition level.

Resistance levels: 1.3600, 1.3720.

Support levels: 1.3530, 1.3380.

Trading tips

Long positions may be opened after the price rises and consolidates above 1.3600, with the target at 1.3720. Stop loss – 1.3550. Implementation period: 7 days or more.

Short positions may be opened after the price declines and consolidates below 1.3530, with the target at 1.3380. Stop loss – 1.3600.

Hot

No comment on record. Start new comment.