Current trend

The XAU/USD pair shows moderate growth, building on the strong "bullish" momentum of recent days, which leads to regular new record highs: the instrument is testing 2345.00 for a breakout, while trading participants await the emergence of new drivers.

The focus of investors' attention tomorrow will be the March inflation statistics in the US: the Consumer Price Index in annual terms is projected to accelerate from 3.2% to 3.4%, which is likely to put pressure on the US Federal Reserve to abandon its "hawkish" position and in monthly terms the indicator may slow down from 0.4% to 0.3%, while the Core CPI will adjust from 0.4% to 0.3% and from 3.8% to 3.7%, respectively. On the same day, the minutes of the March meeting of the American regulator will be published, which will make it possible to clarify the immediate prospects for its monetary policy. The main scenario for investors remains the first interest rate reduction in June, and at least three adjustments in value are expected by the end of 2024. However, the option of postponing the transition to easing monetary parameters to the end of 2024 is now being actively discussed.

Meetings of the Reserve Bank of New Zealand (RBNZ) and the Bank of Canada are also expected tomorrow, and the European Central Bank (ECB) is to hold a meeting on Thursday. In all cases, investors are confident that the parameters of the current monetary policy will remain unchanged; however, comments from the officials and their updated forecasts will be important as always.

There is a correction in the gold contract market. According to the latest report from the US Commodity Futures Trading Commission (CFTC), last week the number of net speculative positions in the precious metal increased to 207.2 thousand from 199.3 thousand positions previously. The significant growth rate of purchase contracts is increasing due to the weak activity of sellers. The balance of the "bulls" in positions secured by real money amounted to 204.477 thousand versus 26.226 thousand for the "bears". Last week, buyers opened 21.212 thousand new contracts, and sellers opened 0.719 thousand, which indicates a new stage in the entry of buyers into the asset, provoking an increase in quotes.

Support and resistance

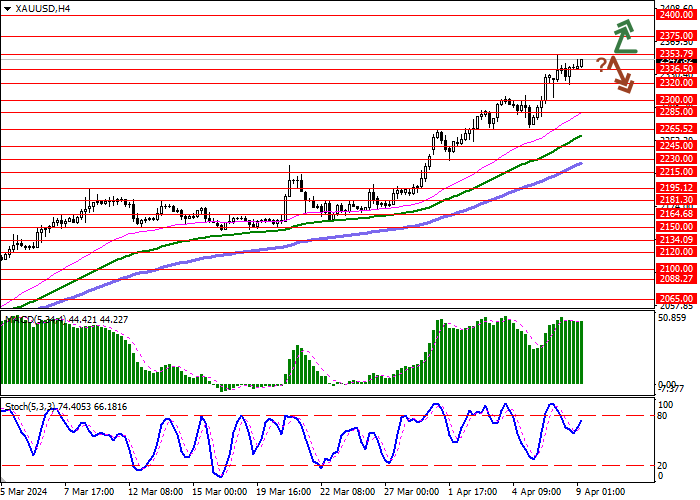

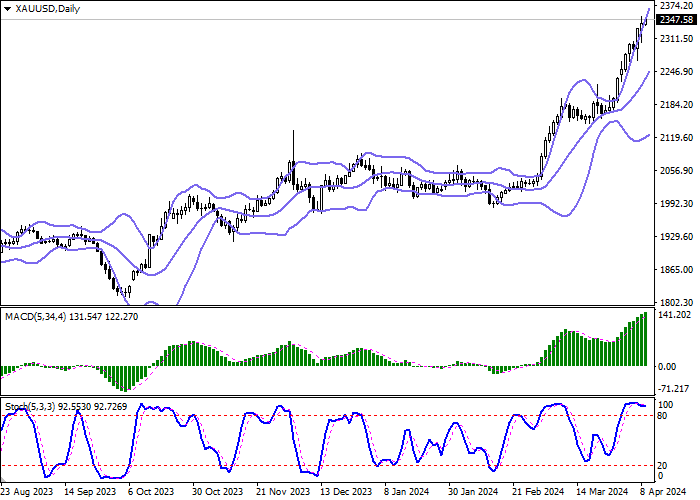

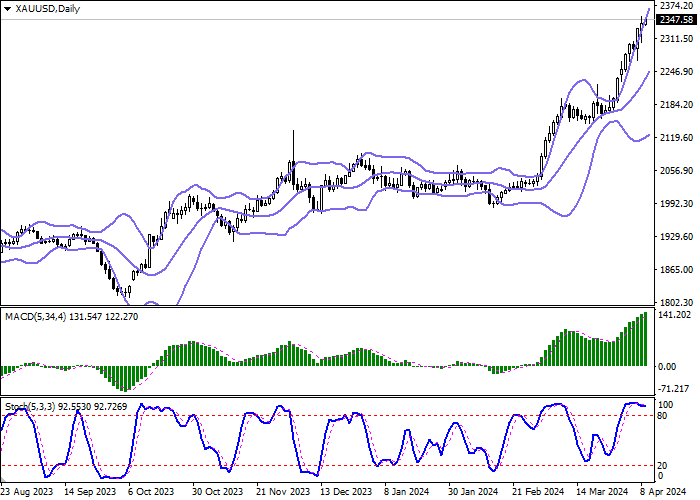

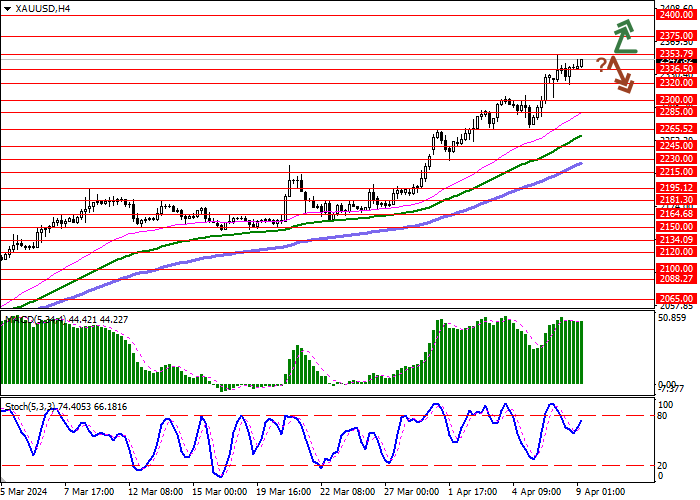

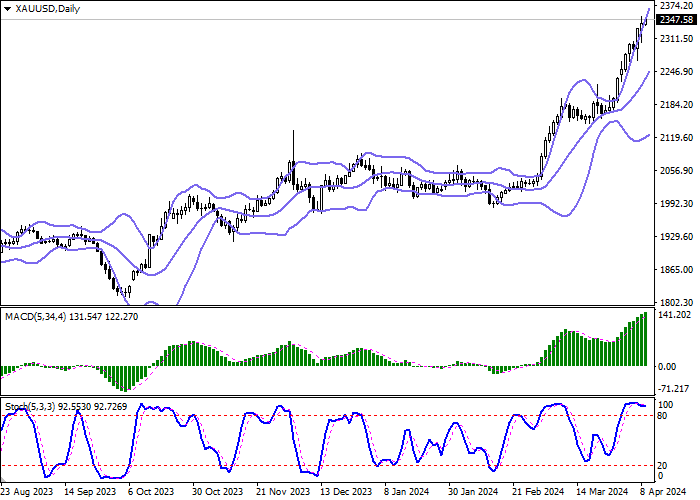

Bollinger Bands on the daily chart show a steady increase. The price range expands from above, freeing a path to new record highs for the "bulls". MACD grows, preserving a stable buy signal (located above the signal line). Stochastic, having reached its highs, reversed into a horizontal plane, indicating overbought instrument in the ultra-short term.

Resistance levels: 2353.79, 2375.00, 2400.00, 2425.00.

Support levels: 2336.50, 2320.00, 2300.00, 2285.00.

Trading tips

Long positions can be opened after a breakout of 2353.79 with the target of 2400.00. Stop-loss — 2330.00. Implementation time: 1-2 days.

A rebound from 2353.79 as from resistance, followed by a breakdown of 2336.50 may become a signal for opening of new short positions with the target at 2300.00. Stop-loss — 2353.79.

Hot

No comment on record. Start new comment.