Current trend

Shares of Microsoft Corp., a giant in the development and sale of operating systems and computer software, are trading in a corrective trend at around 425.65.

At the beginning of the month, it became known that the corporation had concluded an additional eight-year agreement with the Cloud Software Group in the field of developing and implementing a virtual application platform in Citrix desktops. As part of the deal, Cloud Software Group will allocate 1.65 billion dollars to expand Microsoft Corp.'s cloud and generative capabilities in the field of artificial intelligence (AI).

Melius Research LLC gave a positive assessment of the emitter's activities, raising the recommendation on the company's shares to "buy". Analysts believe that Microsoft Corp.'s Copilot AI productivity tool has great prospects of becoming one of the market leaders with a user audience of 200.0 million people.

On April 23, the emitter's financial report will be published: according to preliminary estimates, revenue may amount to 60.84 billion dollars, significantly exceeding last year's figure of 52.9 billion dollars, and earnings per share (EPS) will increase from 2.45 dollars to 2.81 dollars.

Support and resistance

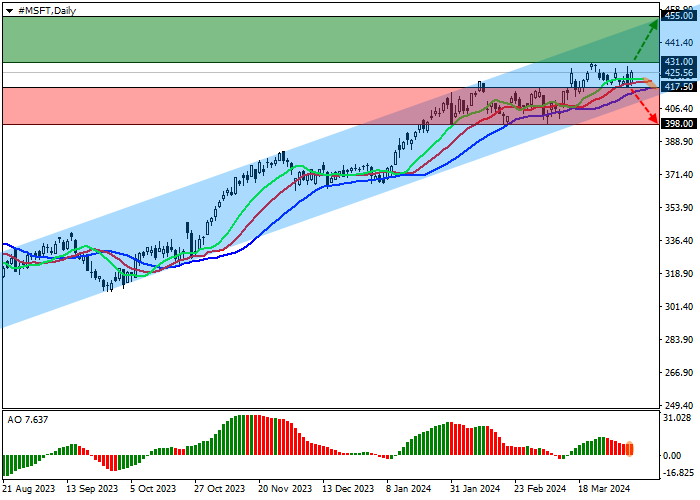

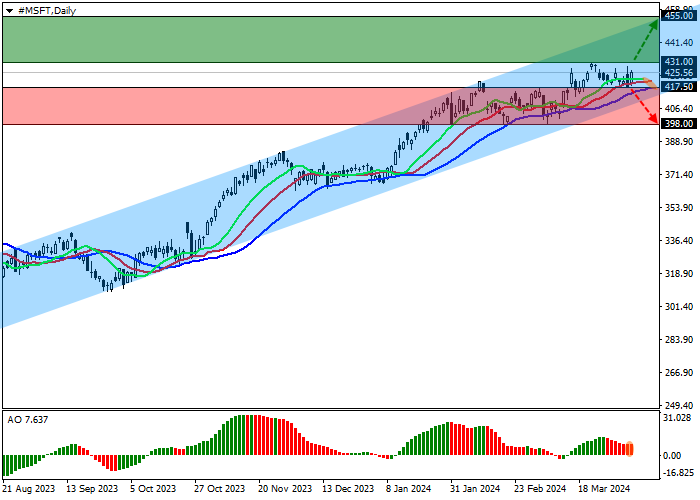

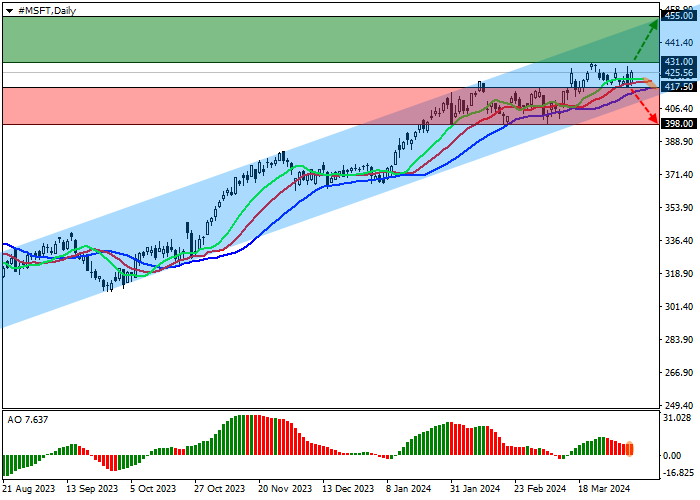

On the D1 chart, the price updates annual highs, moving in an ascending channel with borders of 455.00–410.00

Technical indicators are still showing a stable buy signal and are ready to continue strengthening it: the range of fluctuations of the EMAs of the Alligator indicator is directed upwards, and the AO histogram is forming ascending bars.

Support levels: 417.50, 398.00.

Resistance levels: 431.00, 455.00.

Trading tips

If the global growth of the asset continues and the price consolidates above the resistance level of 431.00, one may open long positions with the target of 455.00 and stop-loss of 424.00. Implementation time: 7 days and more.

In the event of a reversal and the beginning of a decline in the asset, as well as price consolidation below the support level of 417.50, one can open short positions with the target of 398.00 and stop-loss of 425.00.

Hot

No comment on record. Start new comment.