Current trend

Last week, the BTC/USD pair corrected to 64470.00 amid a decline in investor activity and partial profit-taking during the Easter holidays but then resumed growth and is now holding at 71500.00.

The anticipation of the Bitcoin halving, which is about two weeks away, supports the cryptocurrency sector and stimulates the activity of institutional investors. If last Monday there was an outflow of funds in the amount of 85.7M dollars in spot Bitcoin ETFs, then in the next four trading sessions, the volume of investments reached 593.0M dollars. Despite significant fluctuations, the interest of large players in digital assets is increasing: according to Bloomberg analysts, in March, the trading volume of Bitcoin ETFs reached 111.0B dollars, significantly higher than 42.2B dollars previously.

Most market participants hope the US Fed will begin easing monetary policy in June and assets alternative to the dollar will receive additional support. However, against American macroeconomic statistics, the officials may keep interest rates high longer than planned. Thus, in February, the consumer price index amounted to 3.2% instead of the expected 3.1%, and the labor market remained strong (in March, employment increased by 303.0K, and unemployment fell to 3.8%). This week, investors are awaiting the publication of March inflation data, and any signs of an increase could contribute to a correction in the digital sector.

Support and resistance

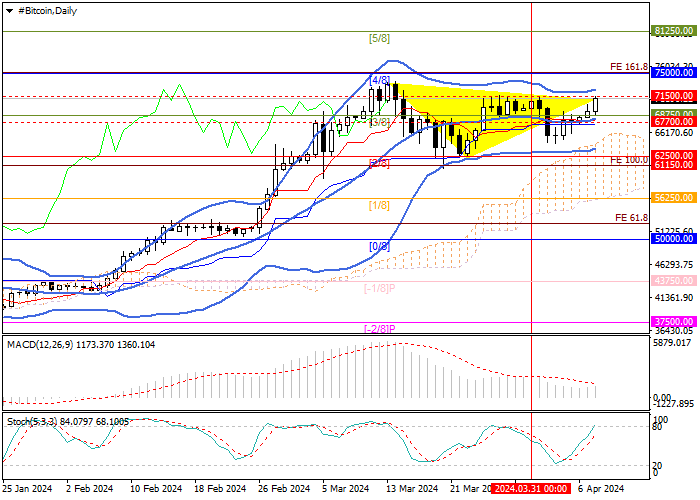

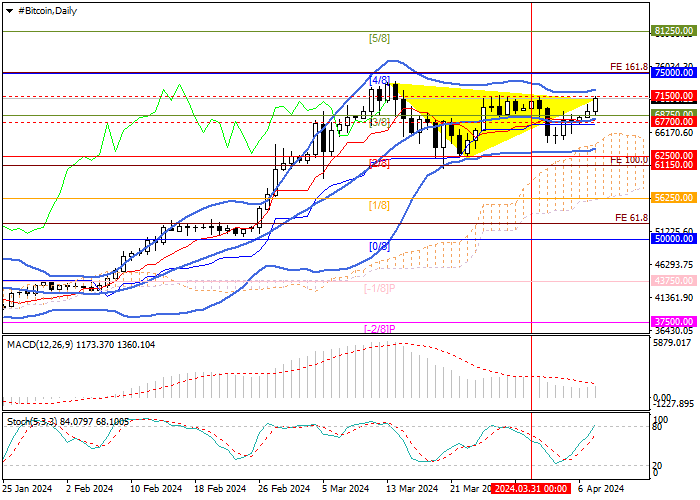

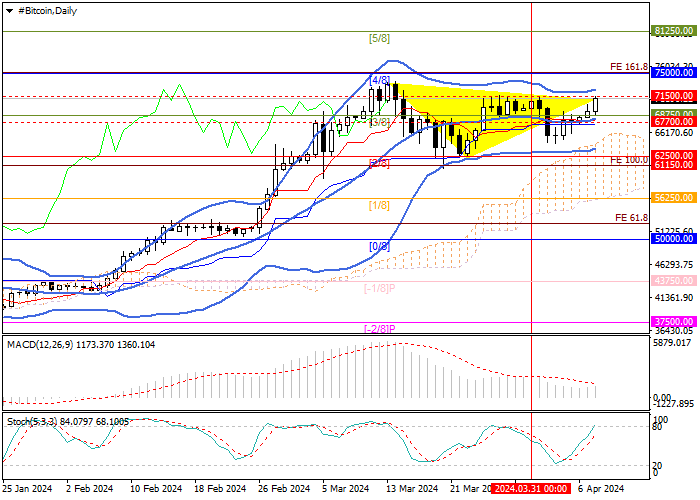

The trading instrument returned to the tested level of 71500.00, consolidation above which allows it to reach the area of 75000.00 (Murrey level [4/8], Fibonacci extension 161.8%) and 81250.00 (Murrey level [5/8]). If the key “bearish” central line of Bollinger bands 67700.00 is broken, a decline to the area of 61150.00 (Fibonacci extension 100.0%) and 56250.00 (Murrey level [1/8]) is expected.

Technical indicators allow the upward trend to continue: Bollinger Bands are horizontal, the MACD histogram is increasing in the positive zone, and Stochastic reversed upwards.

Resistance levels: 71500.00, 75000.00, 81250.00.

Support levels: 67700.00, 61150.00, 56250.00.

Trading tips

Long positions may be opened above 71500.00, with the targets at 75000.00, 81250.00 and stop loss 69000.00. Implementation time: 5–7 days.

Short positions should be opened below 67700.00, with the targets at 61150.00, 56250.00, and stop loss 72000.00.

Hot

No comment on record. Start new comment.