Current trend

One of the leading US indices, the NQ 100, is showing corrective dynamics at 18123.0 against the background of local growth in the bond market, as well as the positive dynamics of the US dollar against a basket of world currencies.

At the end of last week, March labor market data were published, which turned out to be positive. The Nonfarm Payrolls added 303.0 thousand after 270.0 thousand a month earlier, and the number of people employed in the private sector increased by 232.0 thousand from 207.0 thousand, which caused a reduction in the Unemployment Rate to 3.8% from 3.9%, as well as increasing Labor Force Participation Rate to 62.7% from 62.5%. The report is bound to have a key influence on the decisions of US Federal Reserve officials regarding adjustments to borrowing costs.

In turn, local growth is observed in the bond market: 10-year bonds are trading with a yield of 4.428%, exceeding 4.314% recorded at the end of last week, the rate on 20-year bonds remains at 4.679% after 4.567% shown on Friday and the 30-year bonds yield reaches 4.568%, up from 4.489%.

The growth leaders in the index are MongoDB ( 5.55%), Constellation Energy Corp. ( 5.44%), DexCom Inc. ( 4.19%), DoorDash Inc. ( 3.68%).

Among the leaders of the decline are Tesla Inc. (-3.63%), Intel Corp. (-2.57%), Sirius XM Holding Inc. (-1.69%).

Support and resistance

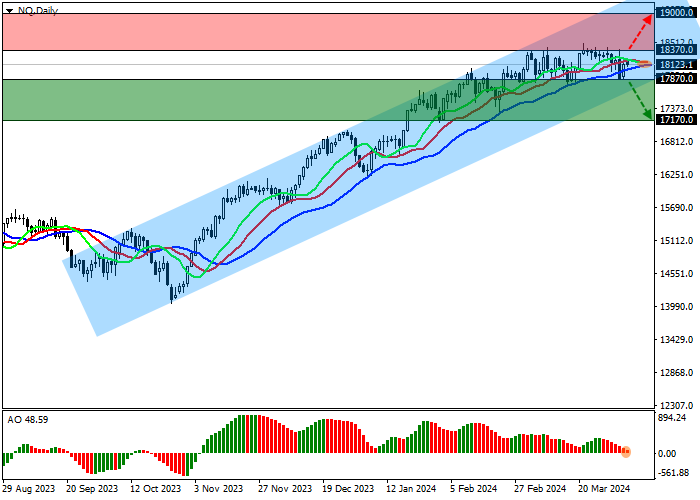

On the daily chart, the index quotes continue their upward correction, which is developing within the channel 19000.0–17500.0.

Technical indicators are holding a buy signal, which has almost changed to a downward one: fast EMAs on the Alligator indicator are above the signal line, and the AO histogram is forming new corrective bars, falling in the buy zone.

Support levels: 17870.0, 17170.0.

Resistance levels: 18370.0, 19000.0.

Trading tips

If the asset continues declining and the price consolidates below 17870.0, short positions can be opened with the target at 17170.0. Stop-loss — 18100.0. Implementation time: 7 days and more.

If the asset continues growing locally and consolidates above 18370.0, long positions with the target at 19000.0 will be relevant. Stop-loss — 18000.0.

Hot

No comment on record. Start new comment.