Current trend

During the Asian session, the USD/CAD pair is testing the level of 1.3600 for a breakout. At the end of last week, the price had already consolidated above it, renewing the November highs but retreated on Friday, despite positive American macroeconomic statistics.

Thus, in March, nonfarm payrolls increased by more than 300.0K compared to 270.0K earlier and estimates of 200.0K, the unemployment rate decreased from 3.9% to 3.8%, and the hourly wage accelerated from 0.2% to 0.3% MoM, highlighting existing inflation risks, while the value decreased from 4.3% to 4.1% YoY, coinciding with market expectations.

Meanwhile, the employment rate in Canada in the same period decreased by 2.2K after increasing by 40.7K earlier, although analysts expected an increase of 25.0K. The unemployment rate adjusted from 5.8% to 6.1% relative to forecasts of 5.9%, and average hourly wages – from 4.9% to 5.0%. However, the March Ivey PMI moved from 53.9 points to 57.5 points, above preliminary estimates of 54.2 points.

The Bank of Canada, in its report “CBDC: Banking and Anonymity,” indicated that privacy would be a key factor in consumer choice of the digital Canadian dollar if it launches. It will also attract the attention of credit institutions to take advantage of the opportunity not to reflect transactions in financial statements, which will cause difficulties for the regulator in determining the business creditworthiness. The researchers believe that at the same time, commercial banks will be inclined to reduce the anonymity of the digital dollar, as this will reduce the risk of issuing loans, so to find a balance, they will have to tighten lending standards.

On Wednesday, investors are awaiting the results of the Bank of Canada’s monetary policy meeting: analysts’ forecasts do not imply any changes in the interest rate relative to the current level of 5.0%. On the same day, the March minutes of the US Fed meeting will be published in the United States, which may clarify the likelihood of a borrowing costs reduction soon.

Support and resistance

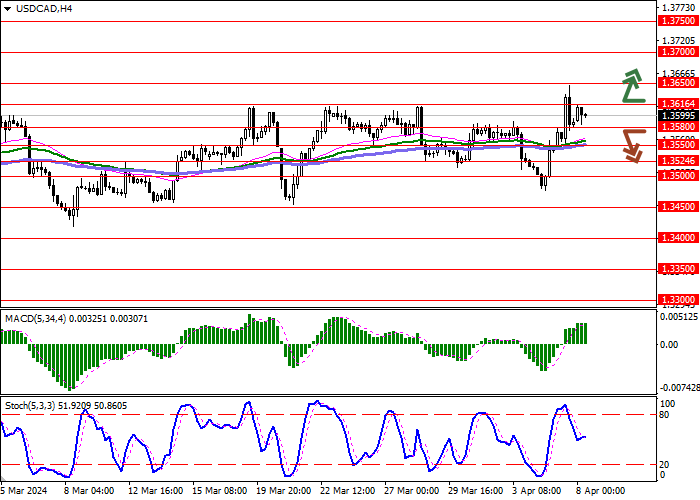

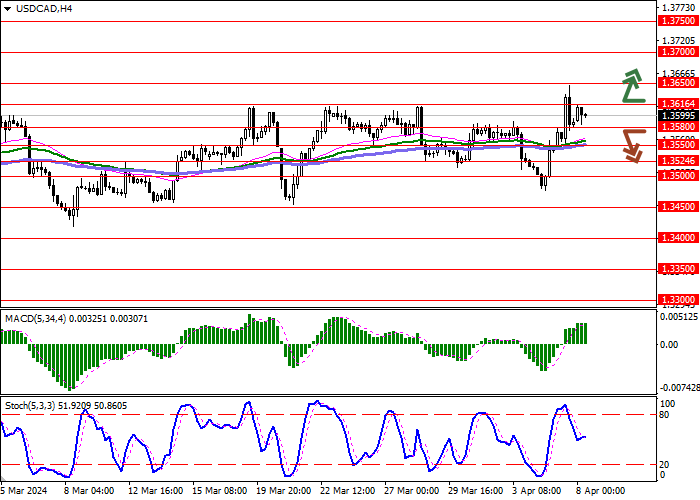

On the daily chart, Bollinger Bands are rising moderately as the price range narrows, reflecting ambiguous trading in the short term. The MACD indicator is rising, maintaining a buy signal: the histogram is above the signal line. Stochastic is directed upward but is quickly approaching its highs, indicating that the American dollar may become overbought in the ultra-short term.

Resistance levels: 1.3616, 1.3650, 1.3700, 1.3750.

Support levels: 1.3580, 1.3550, 1.3524, 1.3500.

Trading tips

Long positions may be opened after a breakout of 1.3616, with the target at 1.3700. Stop loss – 1.3580. Implementation time: 1–2 days.

Short positions may be opened after a breakdown of 1.3580, with the target at 1.3500. Stop loss – 1.3616.

Hot

No comment on record. Start new comment.