Current trend

During the Asian session, the EUR/USD pair is consolidating near 1.0830. The instrument ended Friday's trading with moderate growth, although closer to the close of the weekly session the euro switched to a downward trend, which, among other things, was due to the publication of macroeconomic statistics on the US labor market.

In March, Nonfarm Payrolls added 303.0 thousand after an increase of 270.0 thousand in the previous month, while analysts expected 200.0 thousand, and the Unemployment Rate adjusted from 3.9% up to 3.8% with neutral forecasts. Average Hourly Earnings, as expected, accelerated from 0.2% to 0.3% on a monthly basis and decreased from 4.3% to 4.1% on an annual basis. Many investors were disappointed by the report, as a strong labor market may lead the US Federal Reserve to continue to take a wait-and-see approach.

In turn, European statistics presented on Friday turned out to be worse than expected: Factory Orders in Germany rose by 0.2% in February after -11.4% in the previous month, with preliminary estimates of 0.8%, and Retail Sales in eurozone decreased by 0.5% after zero dynamics in January, while experts expected a decrease of 0.4%, while in annual terms sales dynamics improved from -0.9% to -0.7%, and also outpaced forecasts at -1.3%. Values remain low due to inflation and high European Central Bank (ECB) interest rates pressure on households.

The focus of investors today is the report on Industrial Production in Germany: in February, the indicator increased by 2.1% after 1.3% a month earlier, with expectations of 0.3%, and in annual terms, production volumes decreased by 4.9% after -5.3% in January.

Support and resistance

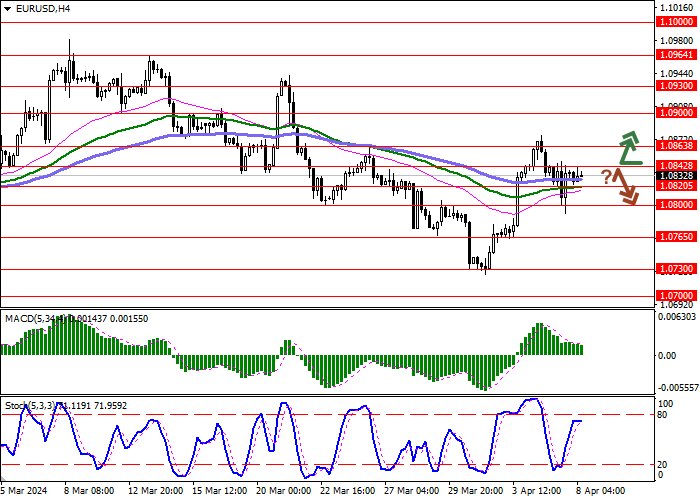

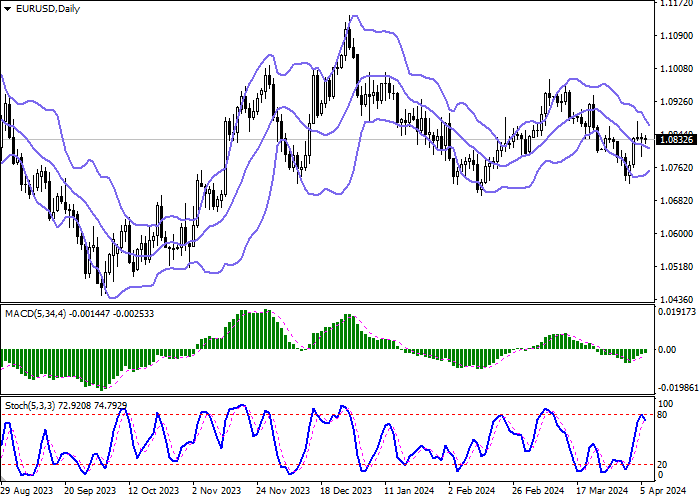

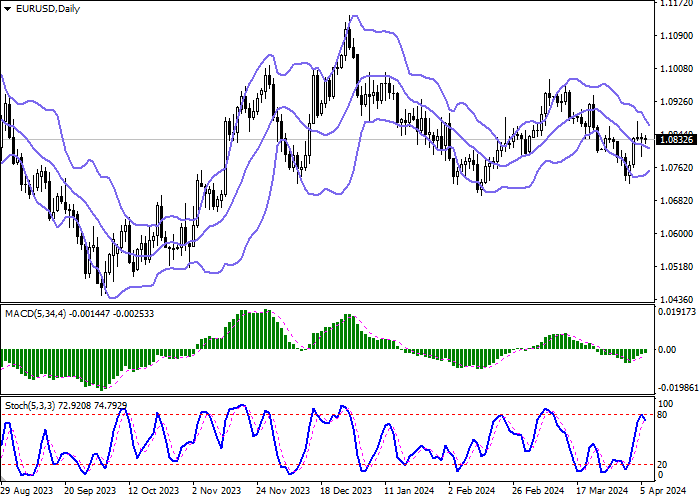

Bollinger Bands on the daily chart show a steady decline. The price range is narrowing, reflecting ambiguous dynamics of trading in the short term. MACD indicator is growing, while preserving a rather stable buy signal (located above the signal line). Stochastic, having shown a rebound from the level of 80, reversed downwards, signaling in favor of the development of "bearish" correction in the near future.

Resistance levels: 1.0842, 1.0863, 1.0900, 1.0930.

Support levels: 1.0820, 1.0800, 1.0765, 1.0730.

Trading tips

Long positions can be opened after a breakout of 1.0842 with the target of 1.0900. Stop-loss — 1.0810. Implementation time: 2-3 days.

A rebound from 1.0842 as from resistance, followed by a breakdown of 1.0820 may become a signal for opening of new short positions with the target at 1.0765. Stop-loss — 1.0855.

Hot

No comment on record. Start new comment.