Current trend

The USD/TRY pair is trading at 32.0100 as part of a long-term uptrend, but this week the quotes have adjusted downwards against the backdrop of the defeat of the ruling Justice and Development Party (AKP) in local elections, which, according to experts, was a consequence of the economic policies of the government and the Central Bank of Turkey. However, the current strengthening of the lira is seen as temporary due to two main factors – ongoing problems in the country's economy and uncertainty around the future actions of the US Federal Reserve.

March inflation data in Turkey again turned out to be weak: despite the increase in the key rate to 50.0%, the consumer prices growth rate accelerated from 67.07% to 68.50%, significantly exceeding the regulator’s forecasts. On the other hand, the US dollar may receive support amid growing concerns among market participants regarding the prolonged persistence of high interest rates, as US inflation showed signs of acceleration at the beginning of the year coupled with robust economic growth.

Today at 14:30 (GMT 2), March data on the US labor market will be presented: if employment grows significantly and unemployment remains at the same level, then the likelihood of postponing the start of monetary policy adjustment to the second half of the year will increase significantly.

Support and resistance

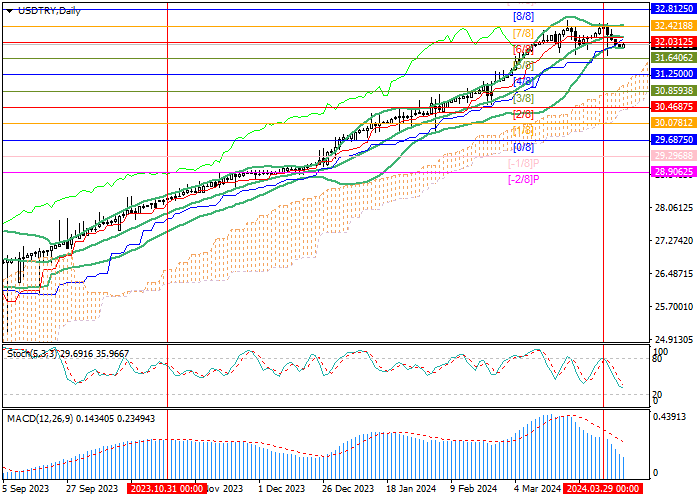

Technically, the price is trying to resume growth and is currently testing the 32.0312 mark (Murrey level [6/8]), the breakdown of which will allow quotes to develop upward dynamics to the targets of 32.8125 (Murrey level [8/8]), 33.2031 (Murrey level [ 1/ 8]). The key level for the “bears” seems to be 31.6406 (Murrey level [5/8]), after consolidation below which the decline may resume to 30.8593 (Murrey level [3/8]) and 30.4687 (Murrey level [2/8]).

Technical indicators do not give a clear signal: Bollinger Bands are directed upwards, Stochastic is pointing downwards, but is close to the oversold zone, which may lead to an early reversal upward, MACD is decreasing in the positive zone.

Resistance levels: 32.0312, 32.8125, 33.2031.

Support levels: 31.6406, 30.8593, 30.4687.

Trading tips

Long positions can be opened above 32.0312 with targets of 32.8125, 33.2031 and stop-loss of 31.7369. Implementation period: 5–7 days.

Short positions should be opened below the level of 31.6406 with targets of 30.8593, 30.4687 and stop-loss around 31.9300.

Hot

No comment on record. Start new comment.