Current trend

The leading index of the London Stock Exchange FTSE 100 shows corrective dynamics at around 7867.0, which is associated with macroeconomic statistics and the situation on the bond market.

In March, business activity in the UK services sector fell to 53.1 points from 53.8 points with a forecast of 53.4 points, and the Composite PMI fell to 52.8 points from 53.0 points with expectations of 52.9 points. In addition, the March Halifax House Price Index lost 1.0%, while analysts had expected an increase of 0.3%, and in annual terms the indicator slowed down to 0.3%. Against this background, FTSE 100 quotes are likely to continue their negative trend.

In turn, the recent decline in the domestic bond market has given way to local growth. The day before, auctions were held for the placement of 10-year Treasury bonds, the rate on which was 4.015%, exceeding 3.927% recorded last week, and the yield on 20-year bonds remained at 4.552% after 4.445%.

The growth leaders in the index are Entain Plc. ( 5.03%), Antofagasta Plc. ( 4.67%), Mondi Plc. ( 3.42%), Fresnillo Plc. ( 3.15%).

Among the leaders of the decline are Ocado Group Plc. (-5.03%), St. James’s Place Plc. (-2.39%), Admiral Group Plc. (-2.12%).

Support and resistance

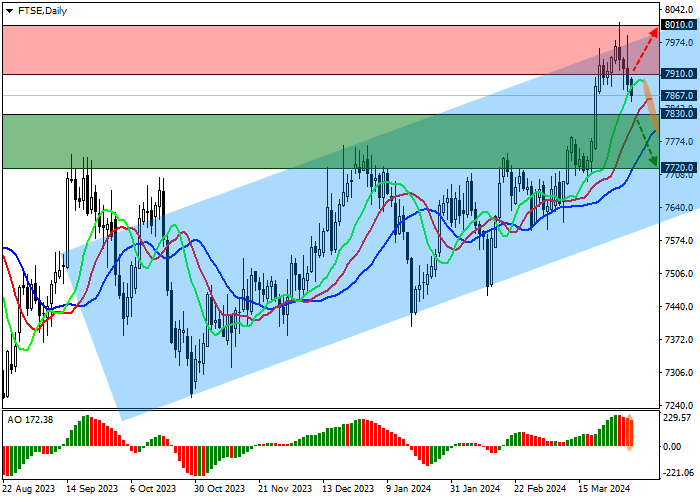

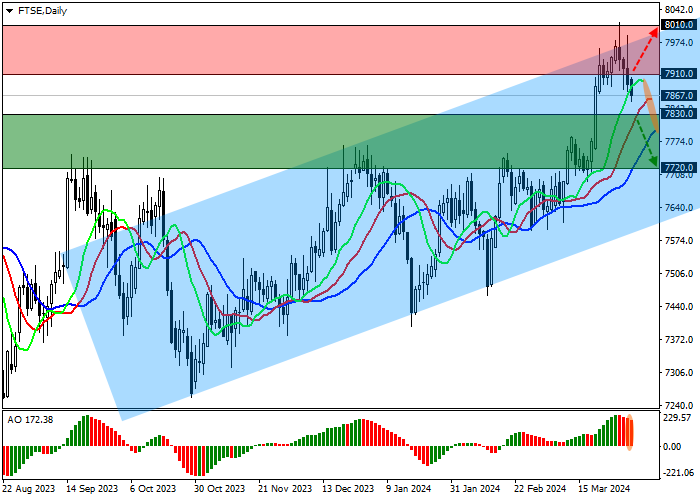

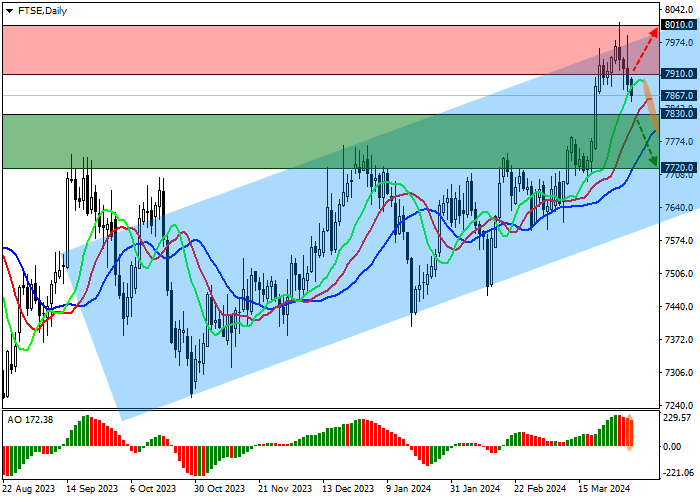

On the daily chart, the index quotes continue their local correction, turning around the resistance line of the ascending channel 8000.0–7600.0.

Technical indicators are in a buy signal state, which has begun to weaken: the EMA fluctuation range on the Alligator indicator has begun to narrow, and the AO histogram is forming new corrective bars, decreasing in the buy zone.

Support levels: 7830.0, 7720.0.

Resistance levels: 7910.0, 8010.0.

Trading tips

If the asset reverses and continues declining, and the price consolidates below 7830.0, short positions can be opened with the target at 7720.0. Stop-loss — 7900.0. Implementation time: 7 days and more.

If the index continues growing, and the price consolidates above the resistance at 7910.0, long positions with a target of 8010.0 and stop-loss of 7850.0 will be relevant.

Hot

No comment on record. Start new comment.