Current trend

Against the stabilization of the American currency, the USD/JPY pair is declining, trading at 151.22. Positive dynamics are hampered by warnings from the Japanese authorities about the possibility of currency interventions due to the excessive weakening of the national currency: experts believe that the government will begin to act if the American dollar exceeds 155.0 yen.

In addition, the yen was supported by macroeconomic statistics: in March, the service PMI increased from 52.9 points to 54.1 points, although it was behind the forecasts of 54.9 points, and the February index of household expenditures corrected from –2. 1% to 1.4%, slowing the decline in the indicator from –6.3% to –0.5% YoY. Yesterday, the Bank of Japan published a quarterly report in which it lowered its assessment of the economic condition of seven of the country’s nine regions amid falling consumption and a decline in production, especially in the automotive sector. There were also problems with exports to China due to poor electronic equipment supplies.

The American dollar is holding at 104.00 in the USDX, slightly recovered from yesterday’s losses. Initial jobless claims increased from 212.0K to 221.0K, which means overcoming a stable decline of 215.0K, reflecting the likelihood of new problems in the labor market. The average number of claims over the past four weeks increased from 211.50K to 214.25K. Today at 14:30 (GMT 2), the nonfarm payrolls report will be published, affecting the US currency at the beginning of the next week.

Support and resistance

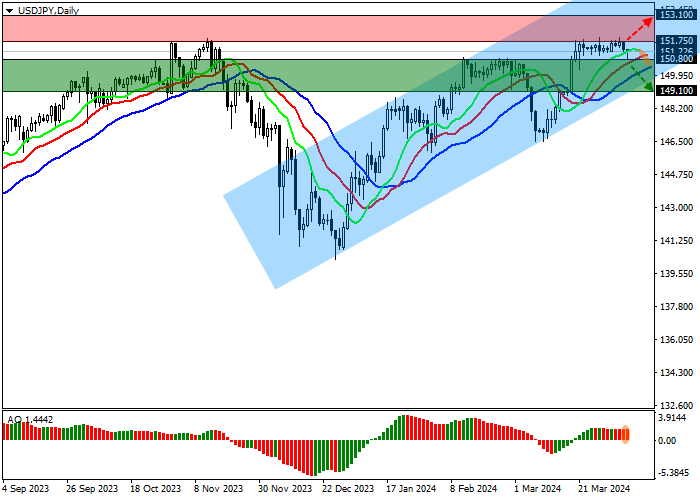

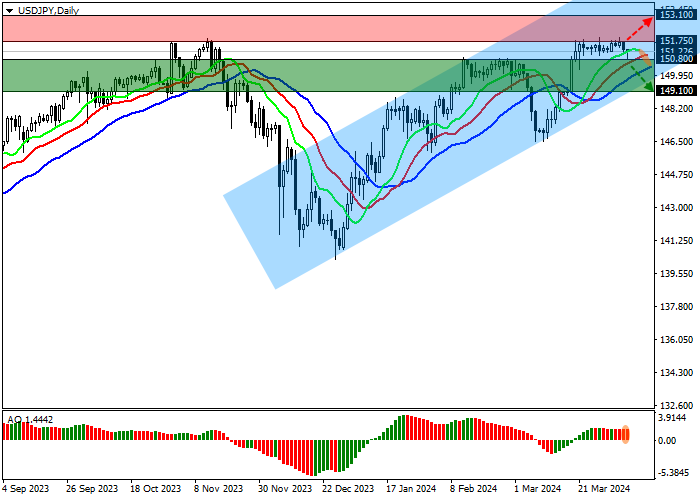

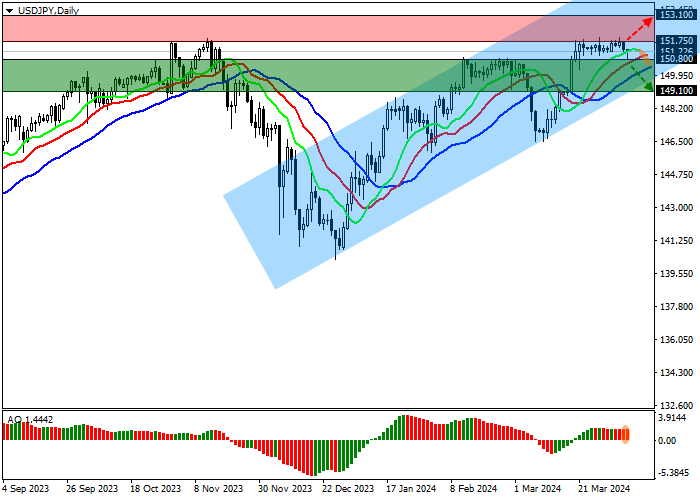

On the daily chart, the trading instrument moves within the ascending corridor of 155.00–149.00, forming a sideways correction and holding around the historical high of 151.50.

Technical indicators weaken the buy signal: fast EMAs on the Alligator indicator are above the signal line, narrowing the range of fluctuations, and the AO histogram forms corrective bars in the buy zone.

Resistance levels: 151.75, 153.10.

Support levels: 150.80, 149.10.

Trading tips

Short positions may be opened after the price declines and consolidates below 150.80, with the target at 149.10. Stop loss – 151.50. Implementation period: 7 days or more.

Long positions may be opened after the price rises and consolidates above 151.75, with the target at 153.10. Stop loss – 151.30.

Hot

No comment on record. Start new comment.