Current trend

During the Asian session, the EUR/GBP pair is growing moderately, testing the level of 0.8575 after renewing the highs of March 27 on Wednesday against macroeconomic statistics.

In March, the German consumer price index increased by the previous 0.4%, contrary to forecasts for growth to 0.6%, and slowed from 2.5% to 2.2% YoY, while the harmonized index rose by 0.6% and 2.3%, below forecasts of 2.4% and 0.7% in annual and monthly terms, respectively. EU CPI published on Wednesday showed a slowdown from 2.6% to 2.4% YoY, but the value accelerated from 0.6% to 0.8% MoM, and the core inflation rate adjusted from 3.1% to 2.9% and from 0.7% to 1.1%. In addition, the S&P Global services PMI adjusted from 51.1 points to 51.5 points while analysts did not expect any changes, and the manufacturing PMI – from 49.9 points to 50.3 points, also ahead of neutral market forecasts: companies hope that the European Central Bank (ECB) will start cutting interest rates soon.

British statistics on business activity did not live up to the calculations of experts: in March, S&P Global service PMI decreased from 53.4 points to 53.1 points, and the composite PMI – from 52.9 points to 52.8 points. Today, traders expect the publication of the construction PMI, which may increase from 49.7 points to 50.0 points.

Support and resistance

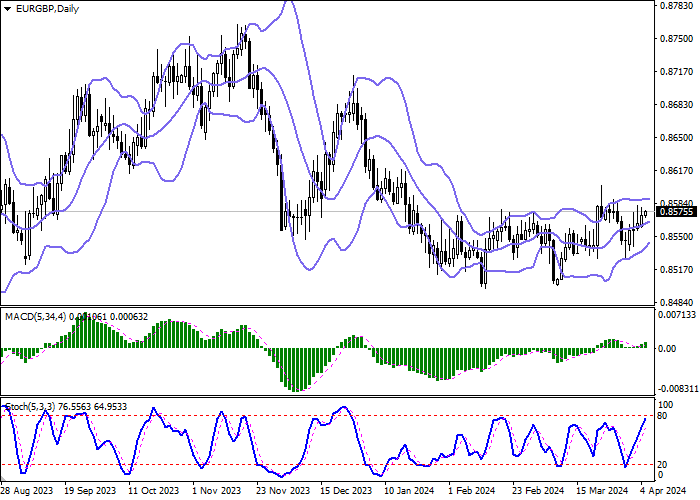

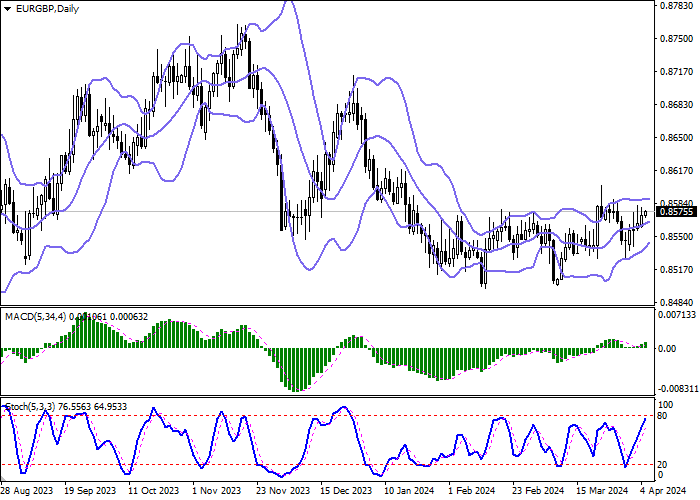

On the daily chart, Bollinger bands are growing moderately: the price range is narrowing from below, limiting the potential for the “bullish” dynamics in the short term. The MACD indicator grows, keeping a buy signal: the histogram is above the signal line. Stochastic is directed upward, approaching its highs, which indicates that the euro may become overbought in the ultra-short term.

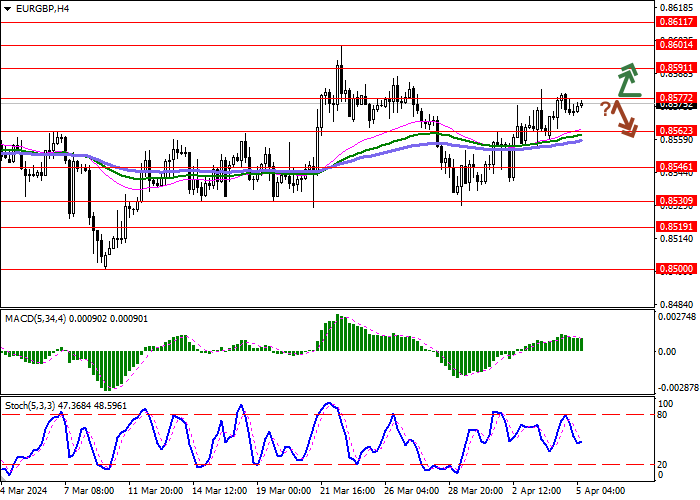

Resistance levels: 0.8577, 0.8591, 0.8601, 0.8611.

Support levels: 0.8562, 0.8546, 0.8530, 0.8519.

Trading tips

Long positions may be opened after a breakout of 0.8577, with the target at 0.8601. Stop loss – 0.8562. Implementation time: 2–3 days.

Short positions may be opened after a rebound from 0.8577 and a breakdown of 0.8562, with the target at 0.8530. Stop loss – 0.8577.

Hot

No comment on record. Start new comment.