Current trend

The USD/CHF pair shows slight growth, staying close to 0.9020 and the opening levels of this week’s trading. The US currency's positions have been under pressure since Wednesday as investors expect the US Federal Reserve's borrowing cost reduction program to be launched soon. In addition, today the March report on the American labor market will be published, which may lead to a revision of the timing of the regulator’s transition to easing monetary policy in June to a later date, especially since at the moment the probability of such a scenario barely exceeds 50.0%.

One way or another, it is assumed that the national economy in March will create about 200.0 thousand new jobs outside the agricultural sector after 275.0 thousand in the previous month, and the Average Hourly Earnings will increase from 0.1% to 0.3% in monthly terms and will decrease from 4.3% to 4.1% in annual terms. Unemployment Rate is expected to remain at the level of 3.9%.

Investors are assessing not the most optimistic data on jobless claims presented the day before: for the week ended March 29, Initial Jobless Claims increased from 212.0 thousand to 221.0 thousand, while analysts expected 214.0 thousand and Continuing Jobless Claims for the week ended March 22 fell from 1.81 million to 1.791 million. US Federal Reserve Chairman Jerome Powell acknowledged that job growth and inflation were higher than expected, but reaffirmed officials' determination to ease monetary policy this year. A member of the regulator's Board of Governors, Adriana Kugler, noted that she expects deflationary trends to continue, which will create conditions for a transition to "dovish" rhetoric. Atlanta Federal Reserve Bank (FRB) President Raphael Bostic was less optimistic, noting that interest rates should not be adjusted before the fourth quarter, but at least one reduction in the rate seems appropriate.

In turn, pressure on the franc the day before was exerted by inflation data, which confirmed the correctness of the Swiss National Bank's policy of easing monetary conditions. In March, the Consumer Price Index showed zero dynamics after growing by 0.6% in February, while analysts expected 0.3%, and in annual terms the indicator slowed down from 1.2% to 1.0% with a forecast of 1.3%.

Support and resistance

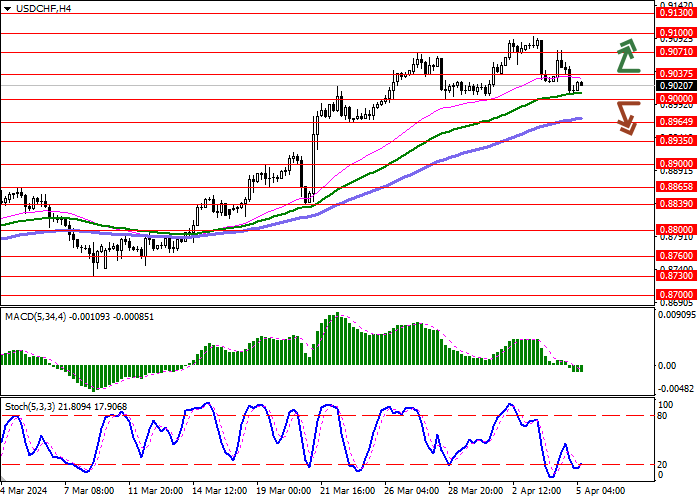

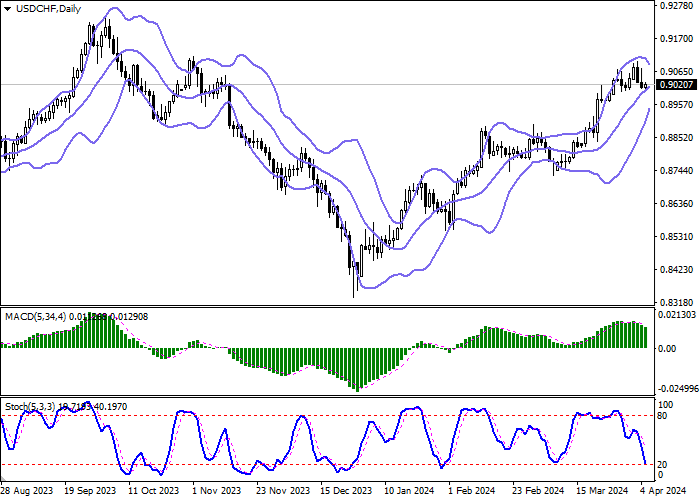

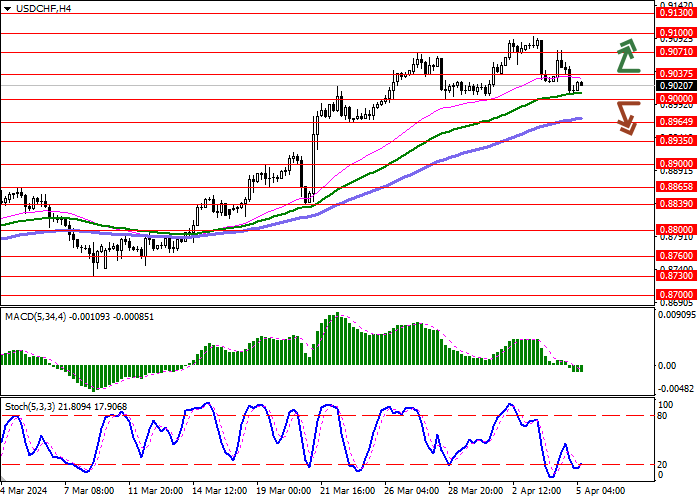

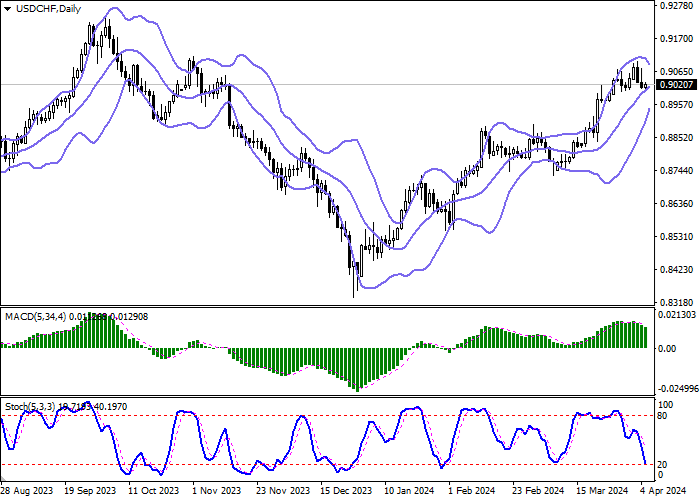

Bollinger Bands on the daily chart show a steady increase. The price range is quickly narrowing, reflecting the emergence of multidirectional trading dynamics in the short term. MACD is falling, keeping a relatively strong sell signal (the histogram is below the signal line). Stochastic shows a more confident decline but is currently rapidly approaching its lows, indicating the risks of oversold US dollar in the ultra-short term.

Resistance levels: 0.9037, 0.9071, 0.9100, 0.9130.

Support levels: 0.9000, 0.8964, 0.8935, 0.8900.

Trading tips

Short positions may be opened after a breakdown of 0.9000 with the target at 0.8935. Stop-loss — 0.9037. Implementation time: 2-3 days.

The return of the "bullish" trend with the breakout of 0.9037 may become a signal for new purchases with the target of 0.9100. Stop-loss — 0.9000.

Hot

No comment on record. Start new comment.