Current trend

Shares of Cisco Systems Inc., an American manufacturer and supplier of network equipment for large holdings and telecommunications companies, are trading at 48.00.

During the Enterprise Connect technology conference, it became known that a cooperation agreement between Cisco Systems Inc. and Ford Motor Co. was concluded. The tech giant will bring the Webex conferencing app to new Ford and Lincoln Digital Experience brands. The company also announced the new Cisco Board Pro G2, which uses artificial intelligence and touch technology to create a modern workspace anywhere. Against this background, analysts from Piper Sandler Co. renewed the financial forecast for the issuer’s securities, increasing the target price per share from 47.0 dollars to 51.0 dollars and maintaining the Neutral rating. The key point for the revision of the indicator was the early completion of the merger deal of Cisco Systems Inc. and Splunk Inc.

The quarterly financial report will be released on May 15. Analysts expect revenue of 12.29B dollars, down from 12.8B dollars previously, and earnings per share, according to preliminary estimates, to decline from 0.8700 dollars to 0.8489 dollars.

Support and resistance

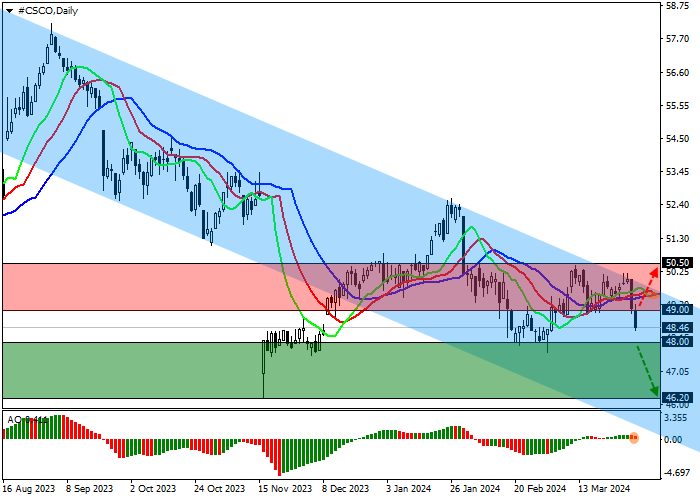

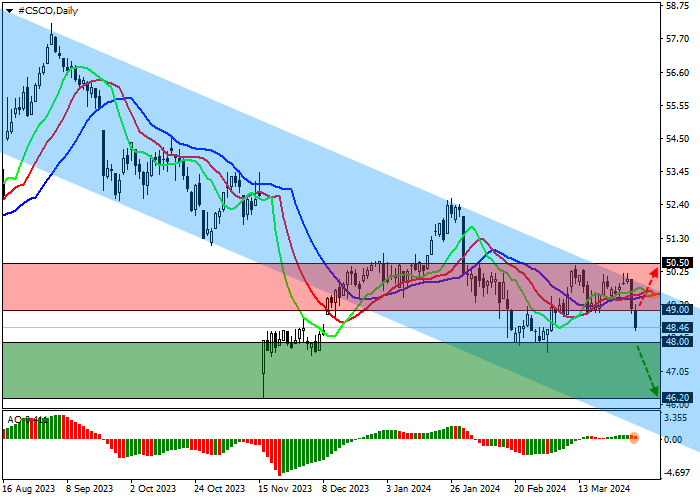

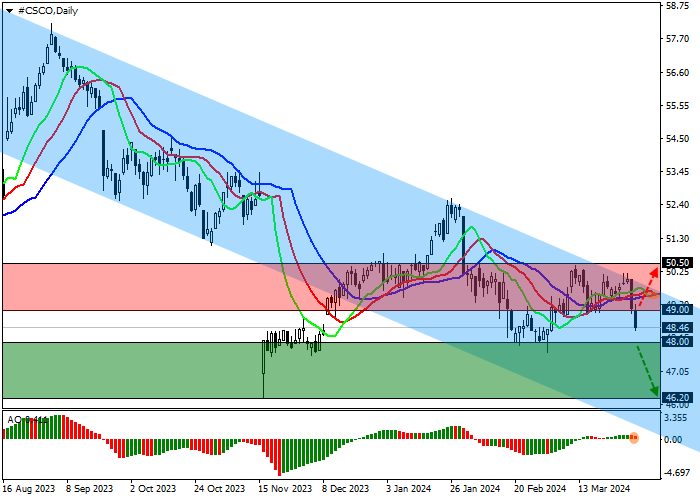

On the daily chart, the trading instrument is moving in a corrective trend, retreating from the resistance line of the downward channel 45.00–50.00.

Technical indicators are strengthening the sell signal: the EMA fluctuation range of the Alligator indicator is expanding, and the AO histogram is forming corrective bars close to the transition level.

Resistance levels: 49.00, 50.50.

Support levels: 48.00, 46.20.

Trading tips

Short positions may be opened after the price declines and consolidates below 48.00, with the target at 46.20. Stop loss – 49.00. Implementation period: 7 days or more.

Long positions may be opened after the price rises and consolidates above 49.00, with the target at 50.50. Stop loss – 48.50.

Hot

No comment on record. Start new comment.