Current trend

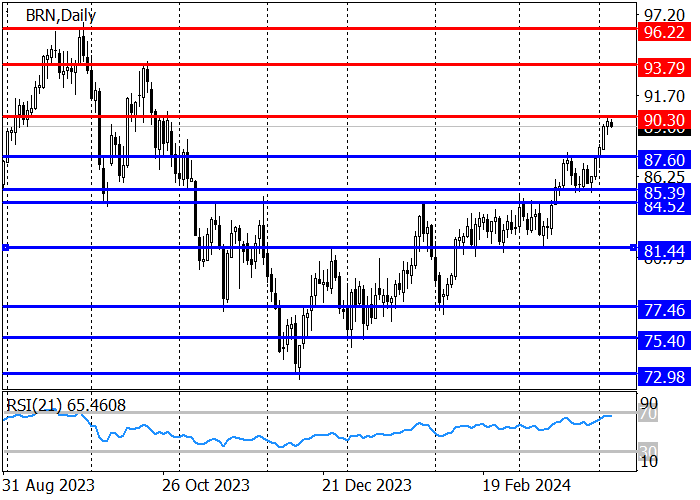

Brent Crude Oil quotes reached the level of 90.30, but today they started to correct.

Yesterday, a scheduled meeting of the OPEC Monitoring Committee (JMMC) was held, at which it was decided to leave the production reduction by 2.2 million barrels per day unchanged while noting the high degree of execution of the deal by the alliance countries. The next meeting of the Committee is scheduled for June 1. According to analysts, by maintaining restrictions, OPEC will ensure a small deficit in world oil markets during the second quarter, which may lead to an increase in prices to 100.0 dollars per barrel. The US Department of Energy yesterday announced the suspension of purchases of "black gold" in order to replenish the strategic reserve due to the high cost of commodities. Against this background, the quotes may start a downward correction.

On the D1 chart, a long-term uptrend can be noted, within which the price reached the resistance level of 90.30, which was not broken through, therefore, a downward correction may develop from it with the target at the support level of 87.60. After reaching 87.60, purchases can be considered again with the target of 90.30. If the level of 90.30 is broken out and the price is consolidated above it, the next growth target will be the October maximum around 93.80. The RSI (21) indicator is approaching the overbought zone, but has not yet entered it, which suggests some potential for growth in quotes.

The medium–term trend remains upward: target zone 2 (87.64-87.08) was broken this week. The next growth target is target zone 3 (93.11–92.56), and the key trend support is shifting to the range of 85.44–84.95, the achievement of which, as part of the correction, will allow one to consider new long positions with the first target at a weekly maximum of 90.33.

Resistance levels: 90.30, 93.80.

Support levels: 87.60, 85.39.

Trading tips

Short positions can be opened from the level of 90.30 with the target of 87.60 and stop-loss of 91.20. Implementation period: 9–12 days.

Long positions can be opened above the 91.20 mark with the target of 93.80 and stop-loss of 90.30.

Hot

No comment on record. Start new comment.