Current trend

The XAG/USD pair is showing moderate declines, retreating from June 2021 record highs updated at the opening of Thursday's afternoon session. The instrument is testing 27.00 for a breakdown, while trading participants are awaiting the publication of the March report on the US labor market at the end of the week, which may clarify the prospects for a reduction in the cost of borrowing by the US Federal Reserve.

Investors are also focusing on the results of the speech of the Chair of the American regulator Jerome Powell the day before. As expected, the official repeated previous points about the need for a more careful assessment of incoming data to ensure that inflation is steadily falling towards the target level of 2.0%. At the same time, the Chairman noted that the Fed will not rush in this matter, since the national economy continues to demonstrate stability. Either way, the main scenario at the moment is for the first interest rate cut of 25 basis points in June. The probability of such an outcome is slightly more than 50.0%, so some analysts are openly discussing the possibility of postponing the deadline for changing the regulator’s rhetoric to the end of the year.

A more confident growth of the instrument the day before was hampered by macroeconomic statistics from the United States from the Automatic Data Processing (ADP) company on the level of employment in the private sector: the March report reflected an increase in the indicator by 184.0 thousand after an increase of 155.0 thousand in the previous month with a forecast of 148. 0 thousand.

On Friday, the US will present March data from the Department of Labor. It is estimated that the national economy created about 200.0 thousand new jobs outside the agricultural sector, after 275.0 thousand in the previous month. The Unemployment Rate is expected to remain steady at 3.9%, while Average Hourly Earnings could accelerate from 0.1% to 0.3% month-on-month and slow down from 4.3% to 4.1% year-on-year.

A correction continues in the market of silver contracts. According to the report of the US Commodity Futures Trading Commission (CFTC), last week the number of net speculative positions in precious metal decreased to 50.8 thousand from 52.4 thousand a week earlier. The "bulls" maintain an advantage even against the backdrop of an increase in short positions: according to the report on positions secured by real money, their balance is 53.782 thousand versus 23.600 thousand for the "bears". Last week, buyers opened 99 new contracts, and sellers opened 7.773 thousand, which indicates the appearance of sales volume on the market, which is beginning to form a position.

Support and resistance

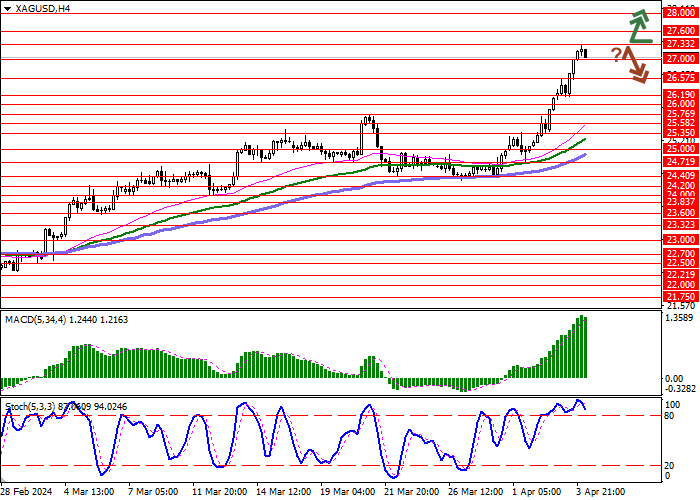

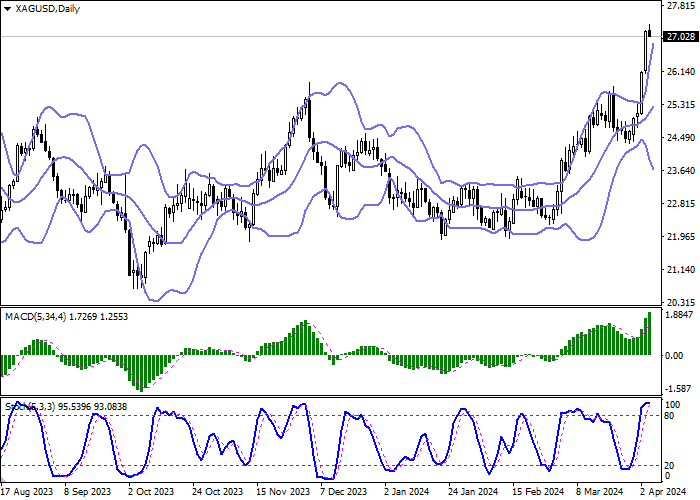

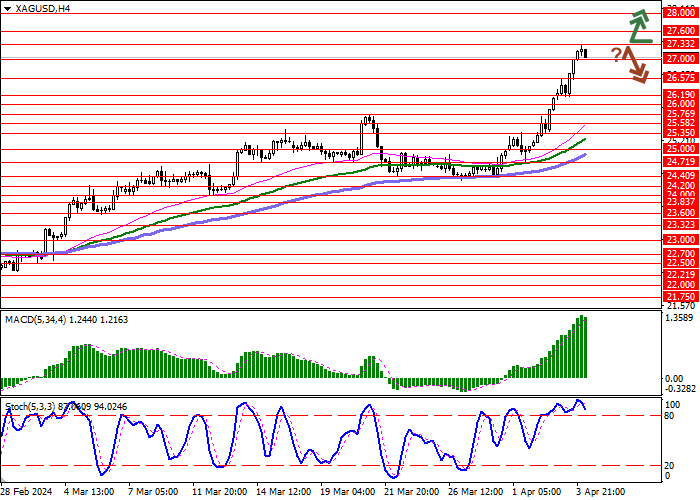

Bollinger Bands on the daily chart show a steady increase. The price range is expanding but it fails to conform to the surge of "bullish" sentiments at the moment. MACD grows, preserving a stable buy signal (located above the signal line). Stochastic, having reached its highs, reversed into a horizontal plane, indicating overbought instrument in the ultra-short term.

Resistance levels: 27.33, 27.60, 28.00, 28.29.

Support levels: 27.00, 26.57, 26.19, 26.00.

![XAG/USD: THE BULLS MAINTAIN AN ADVANTAGE EVEN AGAINST THE BACKGROUND OF AN INCREASE IN SHORT POSITIONS]()

Trading tips

Long positions can be opened after a breakout of 27.33 with the target of 28.00. Stop-loss — 27.00. Implementation time: 1-2 days.

A rebound from 27.33 as from resistance, followed by a breakdown of 27.00 may become a signal for opening of new short positions with the target at 26.30. Stop-loss — 27.33.

Hot

No comment on record. Start new comment.