Current trend

The AUD/USD pair is showing quite active growth, developing the upward corrective dynamics formed on Tuesday: the instrument is testing 0.6585 for a breakout, updating the local highs from March 21.

Quotes are supported by a moderate weakening of the US currency ahead of the publication of the final report on the US labor market at the end of the week. At the same time, data from Automatic Data Processing (ADP) on employment in the private sector presented the day before turned out to be positive: the indicator added 184.0 thousand after an increase of 155.0 thousand in the previous month, while analysts expected 148.0 thousand. Today, investors will evaluate statistics on the dynamics of jobless claims in the United States: Initial Jobless Claims for the week ended March 29 are likely to increase from 210.0 thousand to 214.0 thousand.

Today, the Australian currency is strengthening against the backdrop of macroeconomic statistics from Australia: the Commonwealth Bank Services PMI rose from 53.5 points to 54.4 points in March, and the Composite PMI rose from 52.4 points to 53.3 points. Meanwhile, Building Permits dynamics in February turned out to be ambiguous: in annual terms it accelerated from 4.8% to 5.2%, and in monthly terms it showed a decrease of 1.9% after -2.5% with a forecast of 3.3%.

Reserve Bank of Australia (RBA) Assistant Governor Chris Kent said the authorities would pursue a new way of ensuring financial institutions have sufficient liquidity, particularly through open market repos priced close to the target interest rate in so-called full allocation auctions. The regulator has been proactive in supporting banks with cash during the coronavirus pandemic, but financial institutions' reserves are dwindling as emergency loans are repaid. The new system will reduce the risk of unjustified volatility in the market.

Support and resistance

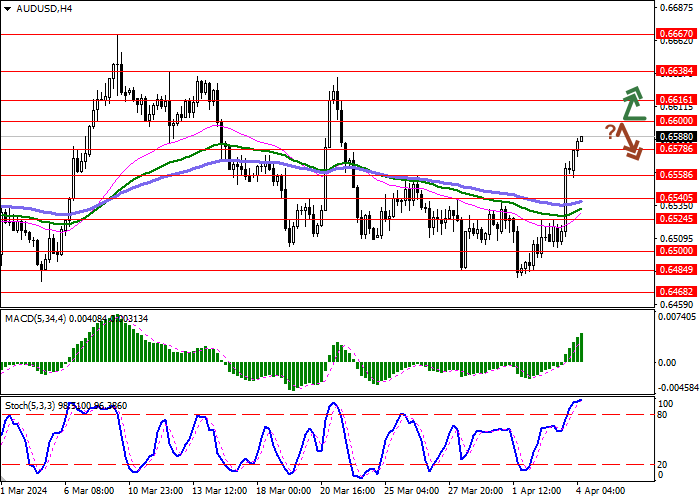

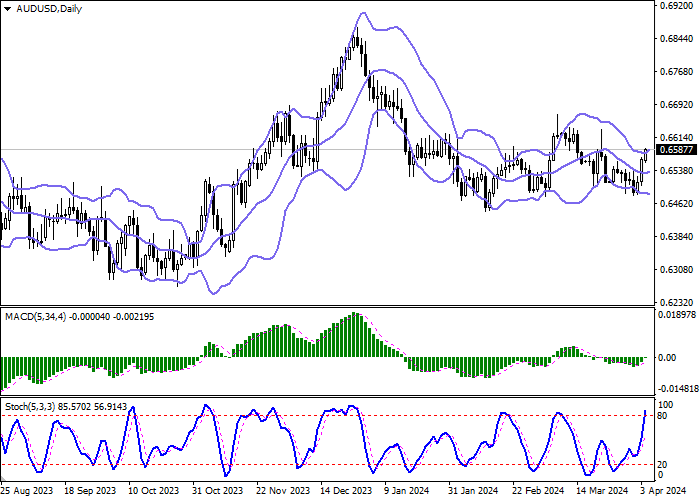

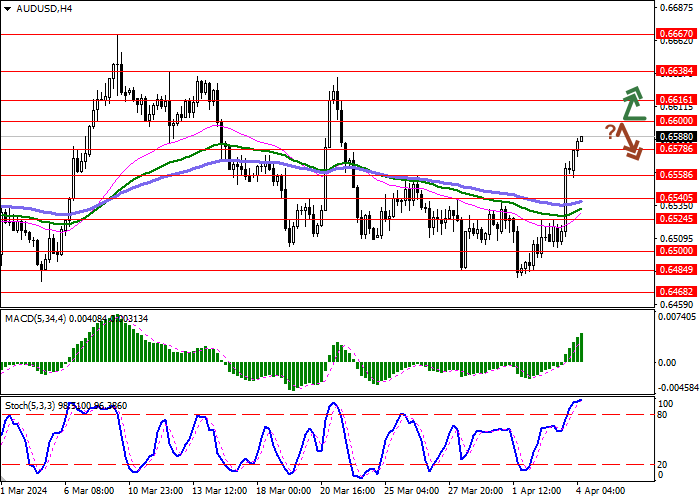

On the D1 chart Bollinger Bands are trying to reverse into the ascending plane. The price range is expanding from above but it fails to conform to the development of "bullish" sentiments at the moment. MACD grows, preserving a stable buy signal (located above the signal line). The indicator is also trying to consolidate above the zero level. Stochastic remains in an upward direction, but is currently rapidly approaching its highs, indicating the risks of the instrument being overbought in the ultra-short term.

Resistance levels: 0.6600, 0.6616, 0.6638, 0.6667.

Support levels:0.6578, 0.6558, 0.6540, 0.6524.

![AUD/USD: THE RBA WILL APPLY NEW SOLUTIONS TO ENSURE SUFFICIENT BANKING LIQUIDITY]()

Trading tips

Long positions can be opened after a breakout of 0.6600 with the target of 0.6638. Stop-loss — 0.6578. Implementation time: 1-2 days.

A rebound from 0.6600 as from resistance, followed by a breakdown of 0.6578 may become a signal for opening of new short positions with the target at 0.6540. Stop-loss — 0.6600.

Hot

No comment on record. Start new comment.