Current trend

The USD/CAD pair is trading within the ascending channel, currently holding at 1.3578: in the medium term, the US currency remains under pressure amid investors' expectation of an early easing of the monetary policy of the US Federal Reserve, which is increasingly confirmed both among economic statistics and official comments.

The February price index of personal consumption expenditures published on Friday fell from 2.9% to 2.8%, and the head of the regulator, Jerome Powell, noted that the slowdown in inflation was in line with officials' expectations. Yesterday, two members of the US Federal Reserve – Presidents of the Cleveland Federal Reserve Bank (FRB) Loretta Mester and the San Francisco FRB Mary Daly called for a three-fold reduction in rates during the year, despite the inflationary surge in January-February. All this strengthens the hopes of market participants for a correction of monetary policy in June, weakening the position of the US dollar against alternative assets. On Friday, investors expect the publication of March data on the US labor market, which is likely to confirm its further cooling: employment may slow down to 205.0 thousand, and the average hourly wage to 4.1%, acting as a driver of the depreciation of the USD/CAD pair.

Unlike the US Federal Reserve, representatives of the Bank of Canada are in no hurry to announce clear deadlines for lowering interest rates, despite the slowdown in inflation in February to 2.1% YoY, which provides the Canadian currency with some stability. Experts expect changes in the current monetary rate no earlier than the middle of the year.

Support and resistance

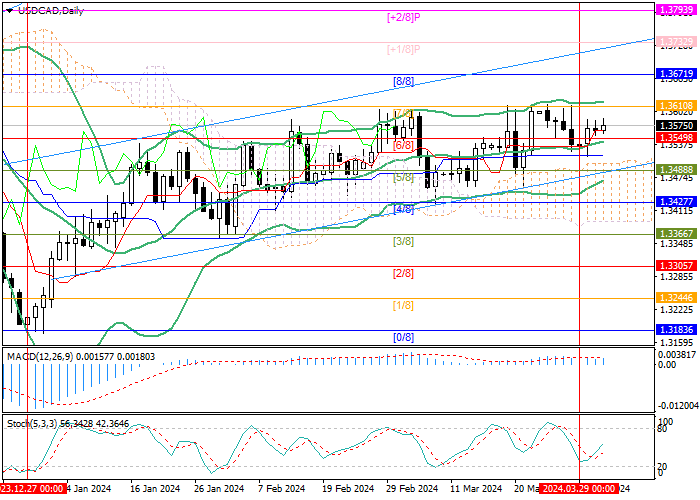

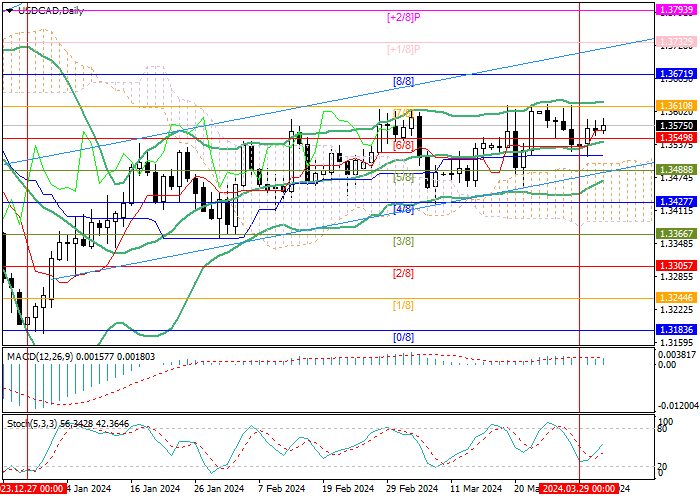

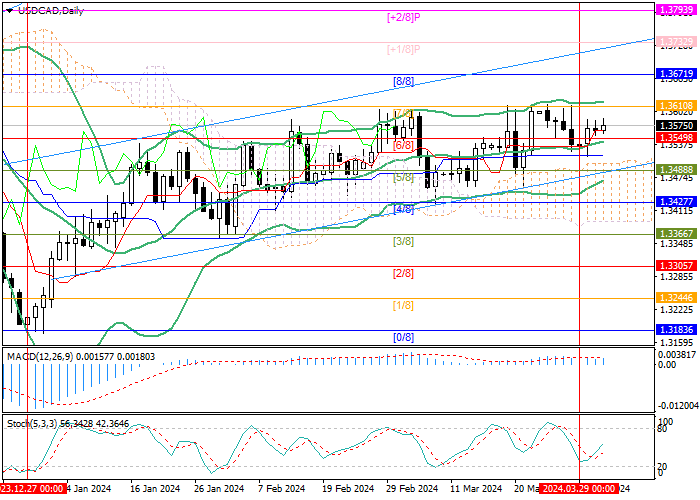

Technically, the instrument is close to the 1.3610 mark (Murrey level [7/8]), which it repeatedly unsuccessfully tested last month. Consolidating above it will allow quotes to develop upward dynamics towards the targets of 1.3671 (Murrey level [8/8]), 1.3732 (Murrey level [ 1/8]), 1.3793 (Murrey level [ 2/8]). The key for the "bears" is the level of 1.3488 (Murrey level [5/8]), the breakdown of which will lead to the exit of quotes from the ascending channel and the development of downward dynamics to the levels of 1.3366 (Murrey level [3/8]) and 1.3305 (Murrey level [2/8]).

Technical indicators confirm the probability of continued growth: Bollinger Bands and Stochastic are reversing up, MACD is stable in the positive zone.

Resistance levels: 1.3610, 1.3671, 1.3732, 1.3793.

Support levels: 1.3488, 1.3366, 1.3305.

Trading tips

Long positions can be opened above 1.3610 with targets of 1.3671, 1.3732, 1.3793 and stop-loss of 1.3565. Implementation period: 5–7 days.

Short positions should be opened below the 1.3488 mark with targets of 1.3366, 1.3305 and stop-loss of 1.3570.

Hot

No comment on record. Start new comment.