Current trend

CAC 40 index quotes remain around 8125.0 against the backdrop of mixed macroeconomic reports and local growth in the bond market. The Manufacturing PMI in France fell to 46.2 points in March from 47.1 points in the previous month, and the indicator in the eurozone fell to 46.1 points from 46.5 points, with the forecast of 45.7 points, confirming that the economy is under pressure from the European Central Bank's (ECB) long-term "hawkish" monetary policy stance.

Yesterday, auctions for the placement of short-term bonds of France took place, the rates for which were slightly lower than previous ones: three- and twelve-month bonds were placed at 3.815% and 3.413%, losing 3.844% and 3.436%, respectively, and the placement rate for six-month bills was 3.722%, exceeding 3.690% last week, indicating an unstable situation in the debt market. Global bonds are also higher, with 10-year bonds trading at 2.921% after 2.813% a week earlier, and 20-year bonds posting their highest yield since early December last year at 3.313%.

The growth leaders in the index are TotalEnergies SE ( 3.92%), Eurofins Scientific SE ( 1.56%), Renault SA ( 1.51%).

Among the leaders of the decline are Stellantis NV (-3.23%), Sanofi SA (-2.67%), Legrand SA (-2.65%), Dassault Systemes SE (-2.63%).

Support and resistance

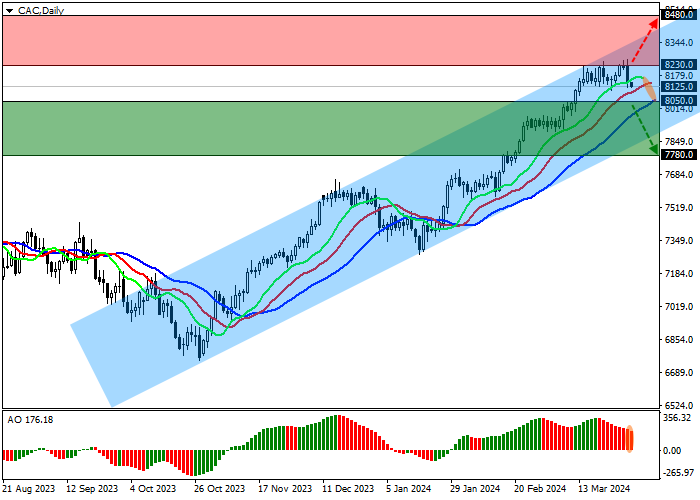

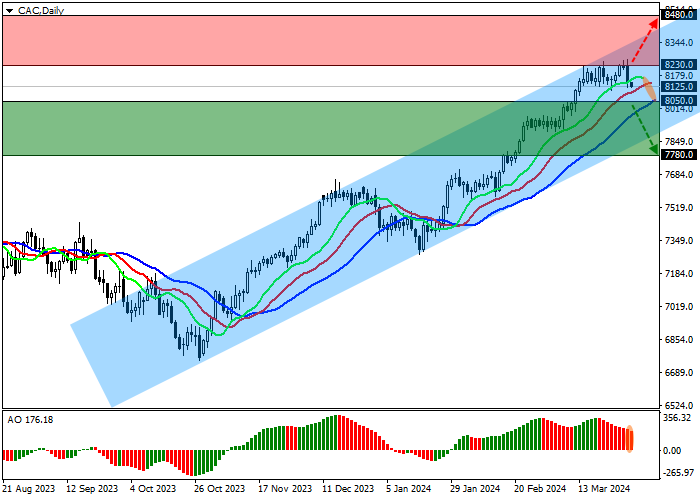

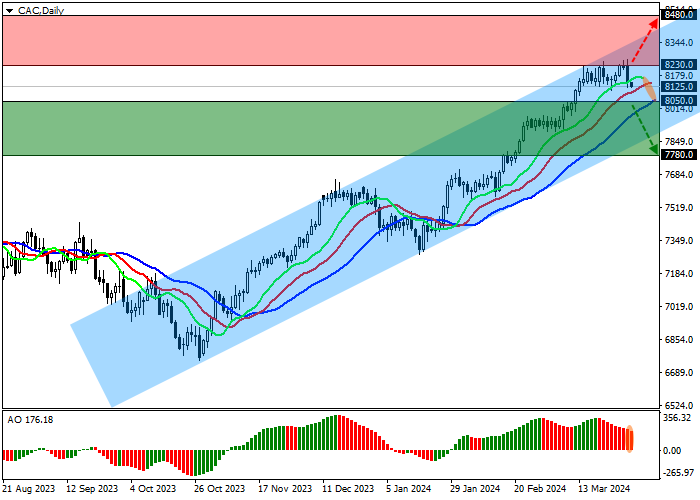

On the daily chart, quotes continue to grow, holding below the resistance line of the ascending channel 8300.0–7850.0.

Technical indicators keep a stable buy signal: fast EMAs on the Alligator indicator are above the signal line, narrowing the range as part of a local correction, and the AO histogram, remaining above the transition level, continues to form corrective bars.

Support levels: 8050.0, 7780.0.

Resistance levels: 8230.0, 8480.0.

Trading tips

If the asset reverses and declines and the price consolidates below 8050.0, short positions can be opened with the target at 7780.0. Stop-loss — 8150.0. Implementation time: 7 days and more.

If the asset continues growing, and the price consolidates above the local resistance at 8230.0, long positions with a target of 8480.0 and stop-loss of 8150.0 will be relevant.

Hot

No comment on record. Start new comment.