Current trend

Shares of Volkswagen AG, a German automobile corporation, are moving as part of an intensifying correction around 142.00.

Guangzhou Xiaopeng Motors Technology Co. Ltd. (XPeng Motors) and Volkswagen AG announced a collaboration on the development of Battery Electric Vehicles (BEVs), which will involve joint procurement of common vehicle parts and platform components, with Volkswagen AG’s established supply chain expected to play a critical role in increasing the efficiency of the partnership.

In addition, management assured that the recent Baltimore railroad bridge collapse will not affect the delivery time of spare parts and products, as additional logistics hubs are available.

The financial report will be published on April 30, and the central forecast of analysts suggests a decline in revenue from 87.18B euros to 77.74B euros and earnings per share (EPS) from 9.31 euros to 8.12 euros, which is still above the figures mid–2023 at 7.76 euros and 6.48 euros.

Support and resistance

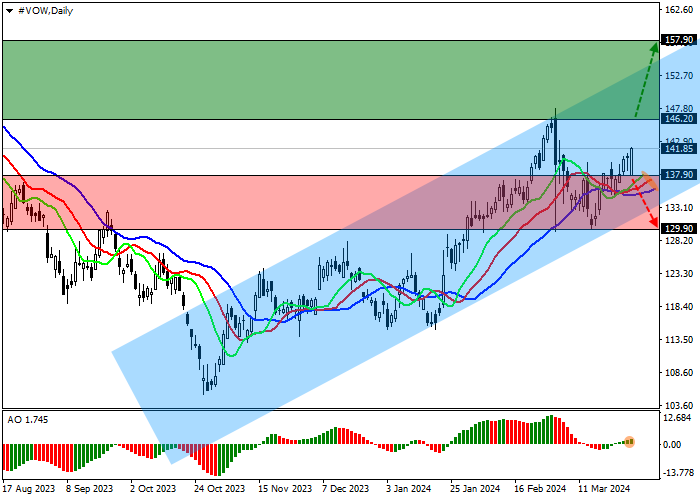

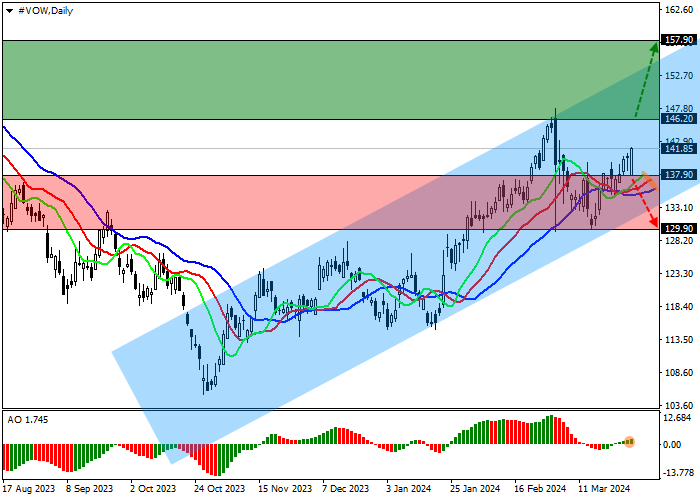

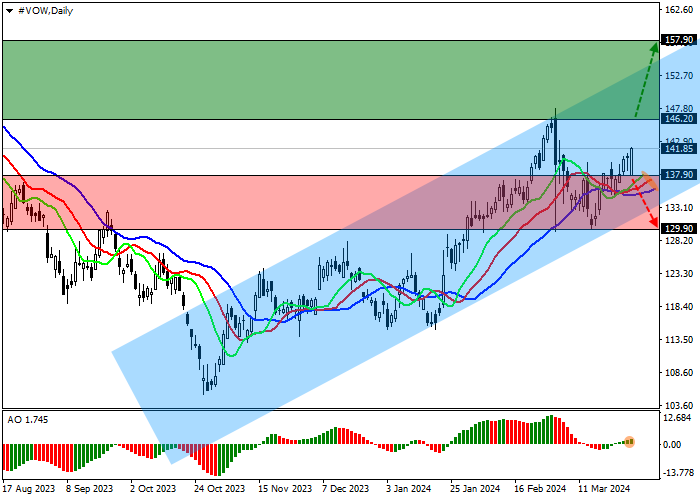

On the daily chart, the trading instrument is growing within the ascending channel of 152.00–130.00, heading towards the yearly high of 146.00.

Technical indicators strengthen the buy signal: fast EMAs of the Alligator indicator are above the signal line, moving away from it, and the AO histogram forms corrective bars in the buy zone.

Resistance levels: 146.20, 157.90.

Support levels: 137.90, 129.90.

Trading tips

Long positions may be opened after the price rises and consolidates above 146.20, with the target at 157.90 and stop loss 143.00. Implementation period: 7 days or more.

Short positions may be opened after the price declines and consolidates below 137.90, with the target at 129.90. Stop loss – 140.00.

Hot

No comment on record. Start new comment.