Current trend

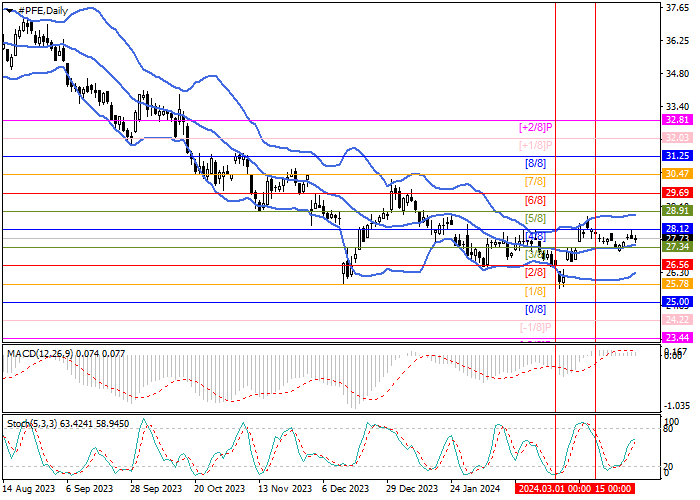

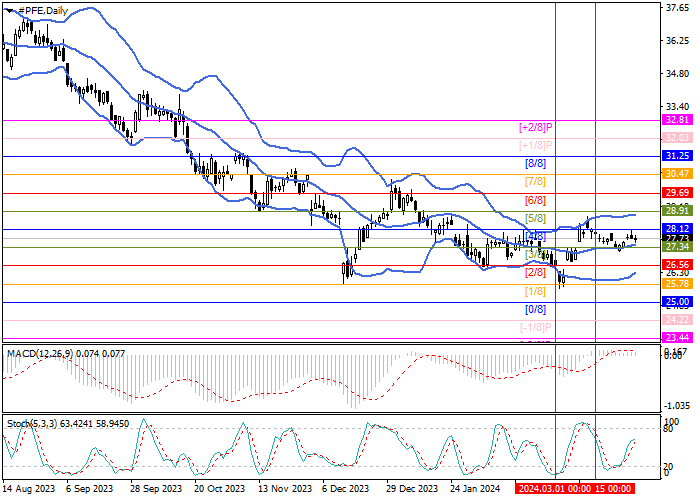

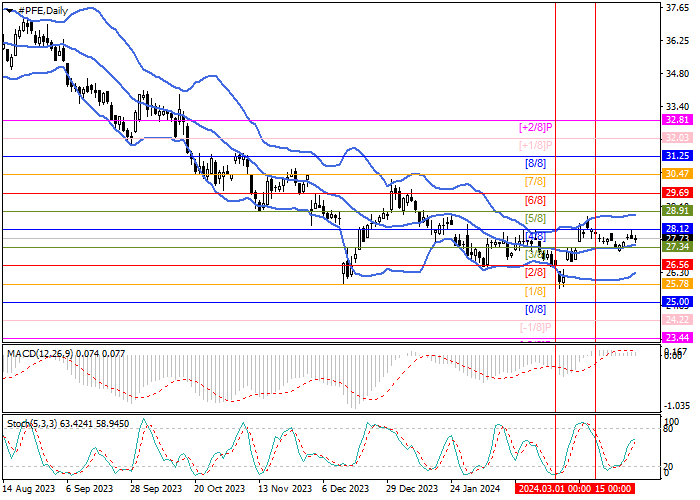

At the beginning of last month, shares of Pfizer Inc., the largest American pharmaceutical company, attempted an upward correction to a long–term downtrend: the price reversed around the 25.78 mark (Murrey level [1/8]), but then entered the lateral range of 28.12–27.34 (Murrey level [4/8]-[3/8]), where it's trading now.

The central mark of the Murrey trading range (28.12) remains strong enough, but if the price consolidates above it, the growth of the trading instrument will resume to the targets of 29.69 (Murrey level [6/8]) and 31.25 (Murrey level [8/8]). The key for the "bears" is the reversal mark of 26.56 (Murrey level [2/8]), the breakdown of which will allow quotes to resume their decline to the lower border of the trading range at 25.00 (Murrey level [0/8]) and further into the reversal zone to the target of 23.44 (Murrey level [-2/8]).

Technical indicators confirm the possibility of further growth: Bollinger Bands and Stochastic are reversing up, MACD is stable in the positive zone.

Support and resistance

Resistance levels: 28.12, 29.69, 31.25.

Support levels: 26.56, 25.00, 23.44.

Trading tips

Long positions can be opened above the 28.12 mark with targets of 29.69, 31.25 and stop-loss around 27.30. Implementation period: 5–7 days.

Short positions should be opened below the level of 26.56 with targets of 25.00, 23.44 and stop-loss around 27.60.

Hot

No comment on record. Start new comment.