Current trend

The quotes of the DJIA stock index are adjusted in the local trend at 39411.0 against the background of the situation on the bond market, as well as macroeconomic statistics.

Yesterday's business activity reports, despite their multidirectional nature, supported the US currency. The Manufacturing PMI in March fell to 51.9 points from 52.2 points, and the same indicator from the Institute of Supply Management (ISM) rose to 50.3 points from 47.8 points. In turn, the employment index in the Manufacturing sector rose to 47.4 points from 45.9 points, and the price index rose to 55.8 points from 52.5 points, for the first time since June 2022.

The bond market has been experiencing active growth for the two days, putting pressure on the stock index: 10-year securities are trading at a rate of 4.311%, exceeding the 4.213% recorded last week, the yield of 20-year bonds rose to 4.560% from 4.449%, and the rate on 30-year bonds is 4.454% after 4.342% earlier.

The growth leaders in the index are 3M Co. ( 6.02%), Microsoft Corp. ( 0.92%), Chevron Corp. ( 0.85%).

Among the leaders of the decline are Home Depot Inc. (-4.06%), Boeing Co. (-1.81%), Honeywell International Inc. (-1.58%).

Support and resistance

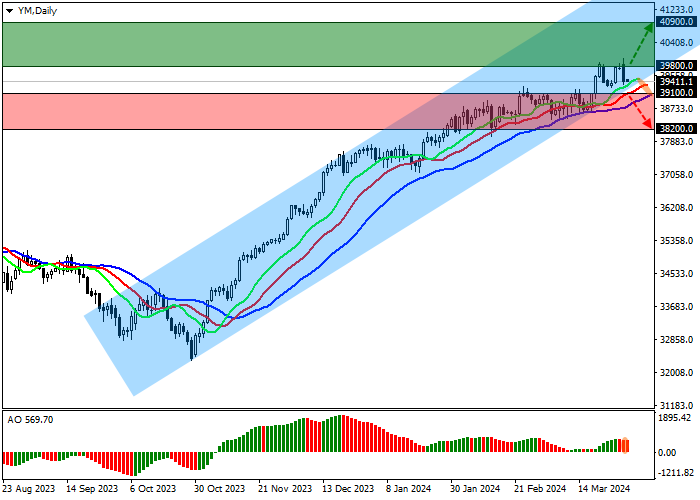

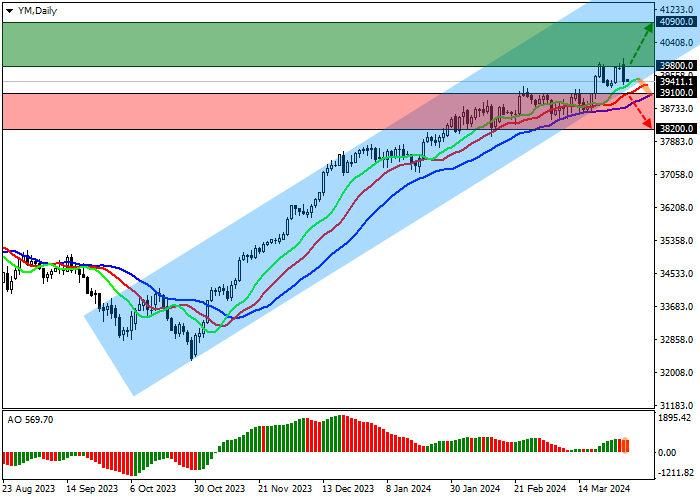

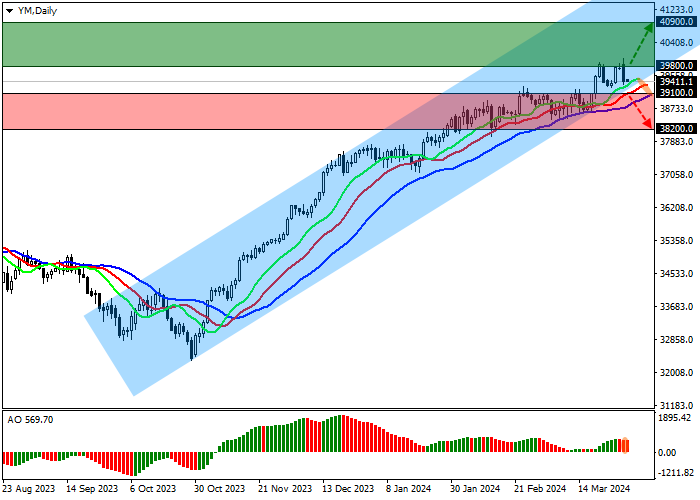

On the D1 chart, the index quotes continue their uptrend, staying within the channel of 40900.0–39100.0.

Technical indicators maintain a fairly stable buy signal: the range of fluctuations of the EMAs of the Alligator indicator remains wide, and the AO histogram forms new correction bars, holding above the transition level.

Support levels: 39100.0, 38200.0.

Resistance levels: 39800.0, 40900.0.

Trading tips

If the asset continues to grow, buy positions will be relevant, which can be opened after overcoming the resistance level of 39800.0 with the target of 40900.0 and stop-loss of 39400.0. Implementation time: 7 days and more.

In the event of a reversal and continued decline of the asset, as well as price consolidation below the support level of 39100.0, sell positions with the target of 38200.0 can be opened. Stop-loss – 39600.0.

Hot

No comment on record. Start new comment.