Current trend

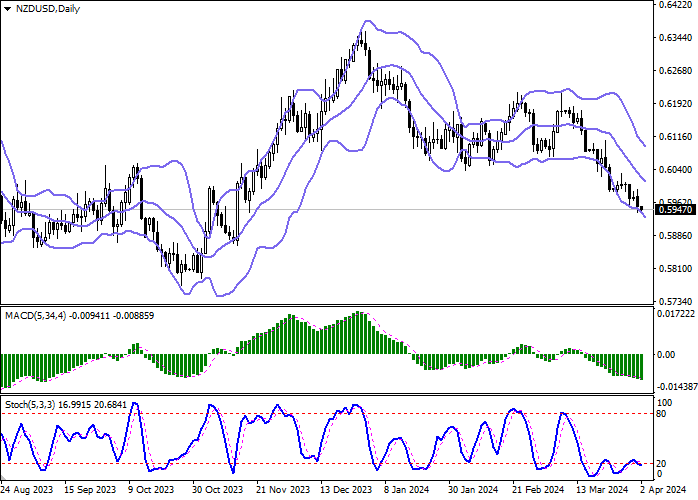

The NZD/USD pair shows a slight decline, developing a downward trend in the short and medium term, as well as updating local lows from November 17. The instrument is testing 0.5945 for a breakdown, while trading participants expect new drivers to emerge. Thus, the focus of investors' attention during the day will be the February statistics from the United States on the dynamics of Factory Orders: forecasts suggest that the figure will add 1.0% after a decline of 3.6% in the previous month. Also, during the day, there will be speeches by representatives of the US Federal Reserve, who can comment on the unexpectedly strong data on business activity, which reflected the growth of the Manufacturing PMI in March from 47.8 points to 50.3 points, while analysts expected 48.4 points.

Today, New Zealand will release statistics on its Dairy Price Index, which uses a weighted average percentage of price changes for nine products sold at the twice-monthly Global Dairy Trade auction. The previous figure fell by 2.8%, which put pressure on the position of the New Zealand currency.

Tomorrow, the focus of investors' attention will again be primarily on American statistics. During the day, a report from Automatic Data Processing (ADP) on Employment Change is expected to be published, as well as a speech by US Federal Reserve Chairman Jerome Powell. Employment Change is expected to increase by 148.0 thousand in March after an increase of 140.0 thousand a month earlier. On Friday, the market will receive data from the US Department of Labor: according to preliminary estimates, in March Unemployment Rate will remain at 3.9%, but Nonfarm Payrolls will slow down to 204.0 thousand, and Average Earnings might decrease to 4.1% on an annualized basis, increasing the likelihood that borrowing costs will begin to decline soon.

Support and resistance

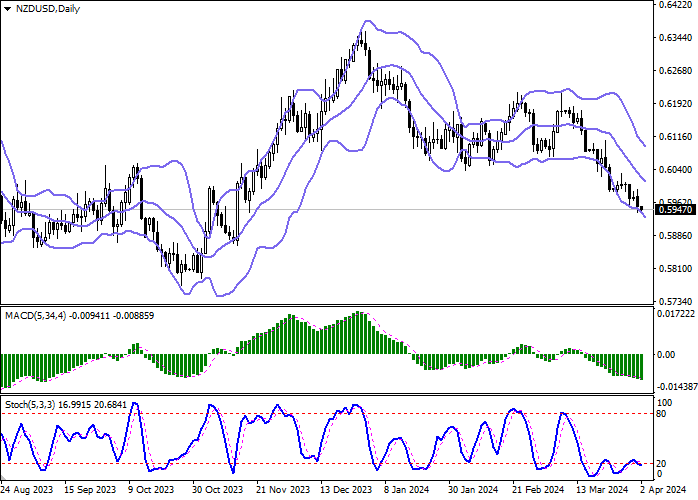

Bollinger Bands on the daily chart show a steady decline. The price range expands from below, making way for new local lows for the "bears". MACD is falling, keeping a relatively strong sell signal (the histogram is below the signal line). Stochastic has been demonstrating oscillatory dynamics for a long time, being located near its lows, signaling the risks of oversold New Zealand dollar in the ultra-short term. At the moment, one should wait for the signals from the indicator to be clarified.

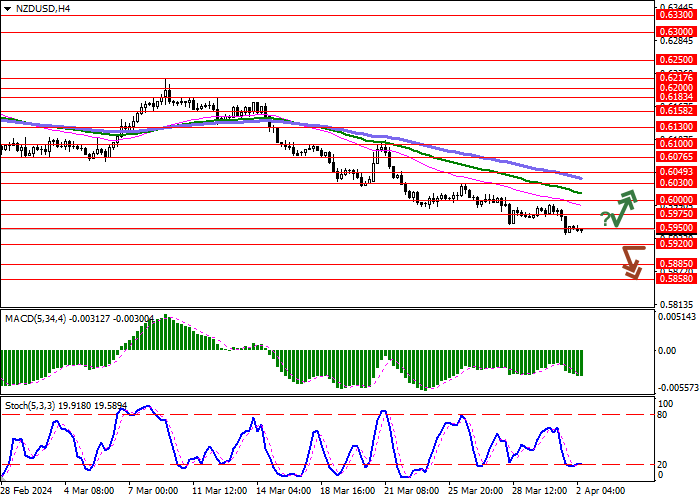

Resistance levels: 0.5975, 0.6000, 0.6030, 0.6049.

Support levels: 0.5950, 0.5920, 0.5885, 0.5858.

Trading tips

Short positions may be opened after a breakdown of 0.5920 with the target at 0.5858. Stop-loss — 0.5950. Implementation time: 2-3 days.

A rebound from 0.5950 as from support followed by a breakout of 0.5975 may become a signal for opening new long positions with the target at 0.6030. Stop-loss — 0.5950.

Hot

No comment on record. Start new comment.