Current trend

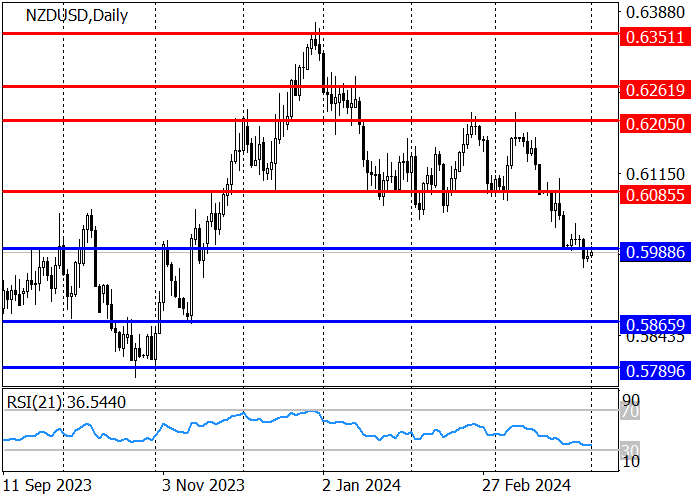

The NZD/USD pair is weakening after the publication of negative statistics from New Zealand, breaking the support level of 0.5988.

The consumer confidence index in March decreased from 94.5 points to 86.4 points, below the forecast of 97.0 points, and the business confidence indicator – from 34.7 points to 22.9 points compared to preliminary estimates of 34.0 points. Ongoing problems do not allow the national currency to begin an upward trend.

In turn, US Federal Reserve Chairman Jerome Powell said that the increase in inflation pressure in January-February did not change the general trend towards a slowdown in consumer price growth, and an early adjustment of monetary policy parameters remains highly likely. Data on the volume of gross domestic product (GDP) for the fourth quarter of 2023 confirmed the stability of the American economy: the indicator added 3.4% against preliminary estimates of 3.2%, allowing officials to maintain a wait-and-see attitude.

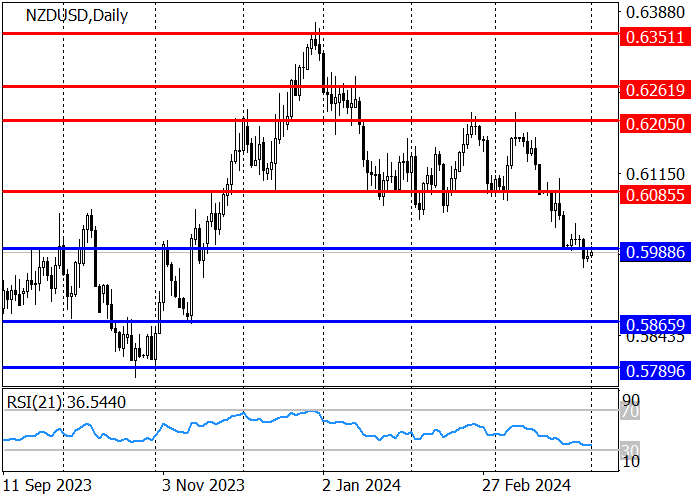

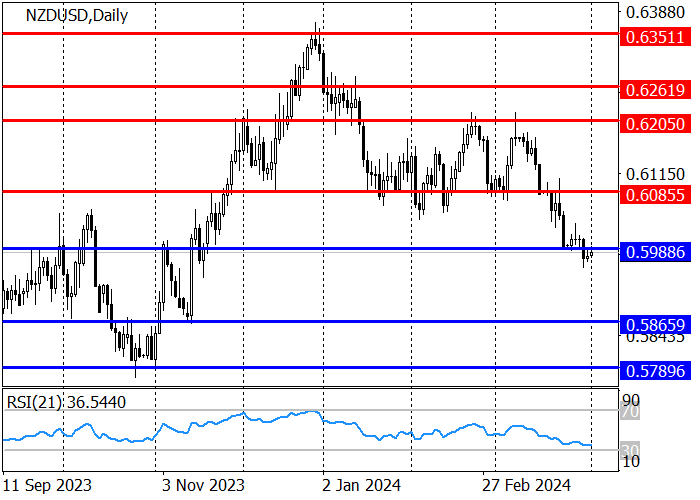

Last week, the NZD/USD pair broke the support level of 0.5988, and the sales target became 0.5865. In case of a return to 0.5988, a correction to the resistance level of 0.6085 is expected. The RSI indicator (21) is approaching the oversold zone but has not yet entered it, which allows us to consider both short and long positions.

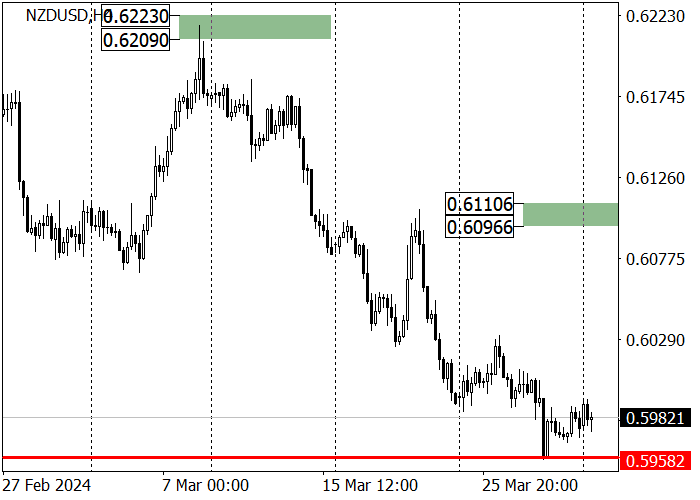

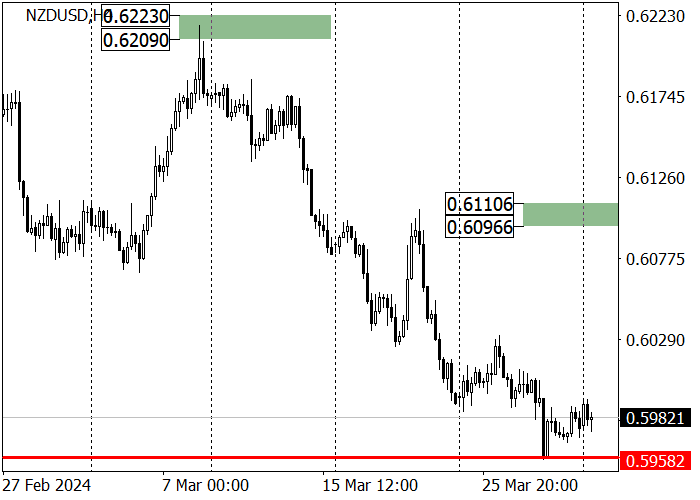

The medium-term trend is also downward: last week, the price was approaching zone 3 (0.5949–0.5935), and if it is reached, a correction to the key resistance area of 0.6110–0.6096 is possible, where short positions are relevant with the target at last week’s low of 0.5958.

Support and resistance

Resistance levels: 0.6085, 0.6205.

Support levels: 0.5988, 0.5865.

Trading tips

Long positions may be opened above 0.6008 with the target at 0.6085 and stop loss around 0.5978. Implementation time: 9–12 days.

Short positions may be opened below 0.5953 with the target at 0.5865 and stop loss around 0.5988.

Hot

No comment on record. Start new comment.