Current trend

The USD/JPY pair is trading below the key resistance level of 151.80. In anticipation of the start of interventions from the Bank of Japan to support the yen, downward dynamics are possible.

Last week, Japanese Prime Minister Fumio Kishida said that intervention in the market situation by the regulator was possible, and the government did not exclude any options to combat excessive fluctuations in the national currency without giving a specific chart for the start of these actions. Additional support for the yen is provided by the manufacturing PMI: in March, the index amounted to 48.2 points, confirming analysts’ forecasts and being better than 47.2 points earlier. In turn, the consumer price index in the Tokyo region increased from 2.5% to 2.6%, and inflation, excluding food and energy prices, fell from 3.1% to 2.9% over the same period. Retail sales volumes in February adjusted from 2.1% to 4.6%, significantly better than market expectations of 3.0%, and the figure added 1.5% MoM after growing by 0.2% earlier. However, the unemployment rate accelerated from 2.4% to 2.6%, reflecting the tight employment market.

The American dollar is supported by statements by US Federal Reserve Chairman Jerome Powell, who said that regulator officials needed more confidence to begin lowering the interest rate from the current value of 5.50%. He also noted that the department’s base scenario includes a reduction in consumer prices in 2024. The latest inflation rate was higher than the previous value of 3.1%, amounting to 3.2%. So, the US Fed is not yet in a hurry to move on to easing monetary policy.

Support and resistance

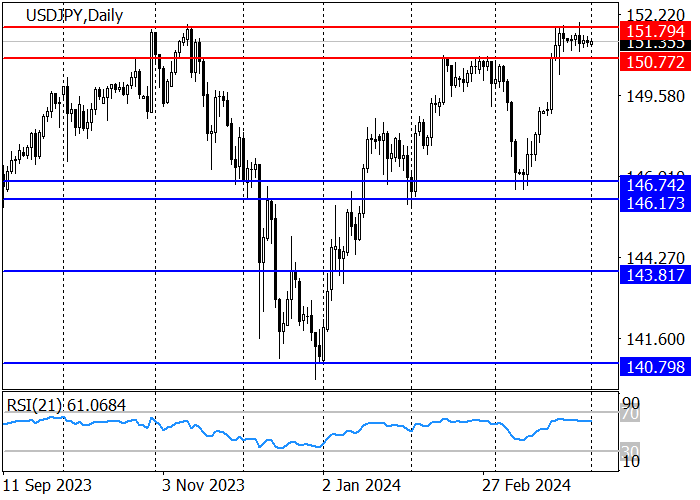

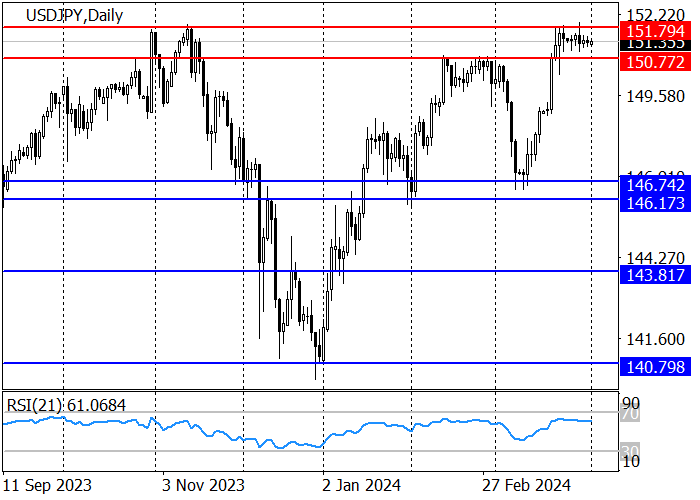

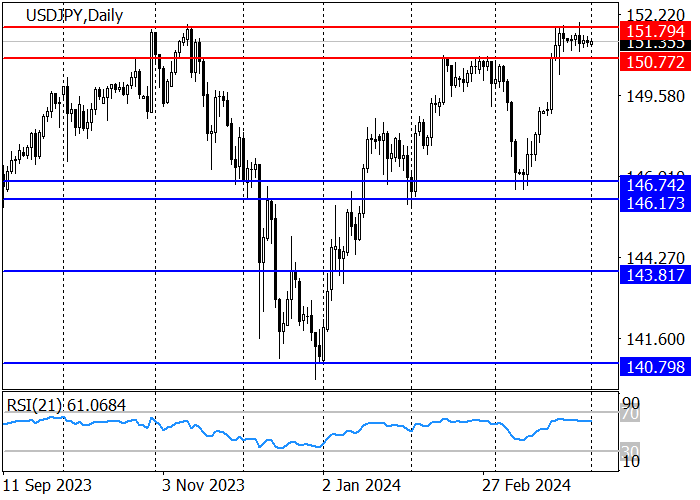

The long-term trend remains upward: the price is in the resistance area of 151.80–150.77, and if it leaves it downwards, a long-term correction to the area of 146.74–146.17 is expected, after holding which, long positions with the target at 151.80 and then 155.50 are relevant.

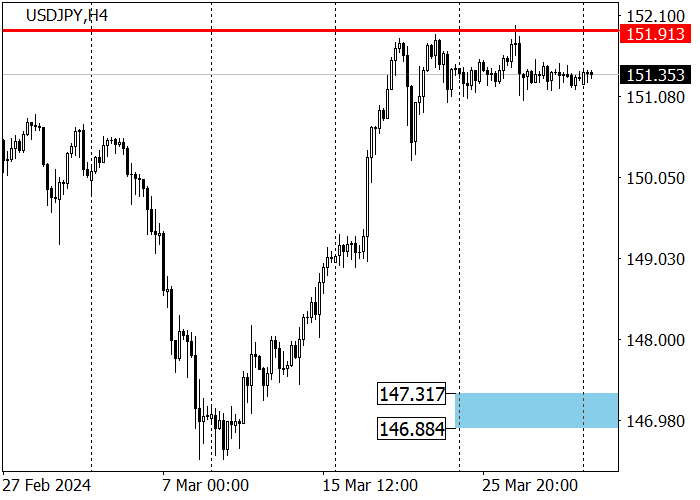

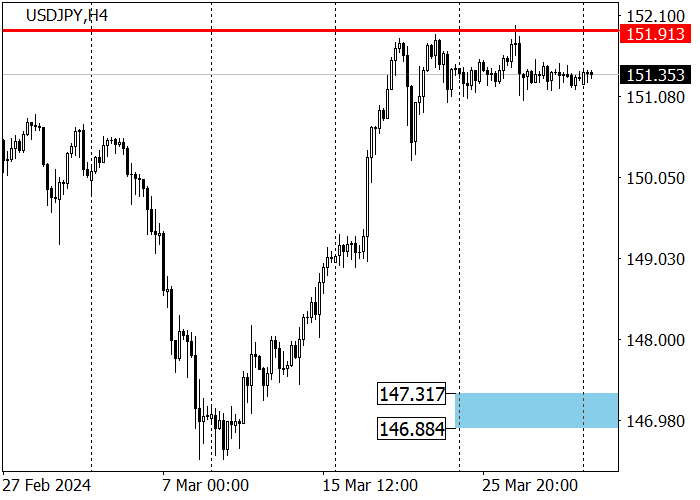

The medium-term trend is upward: after breaking through zone 2 (149.38–148.93), the quotes headed towards zone 3 (154.17–153.69), and in the event of a correction to the key support of the trend 147.31–146.88, long positions with the target at last week’s high 151.92 are relevant.

Resistance levels: 151.80, 155.50.

Support levels: 146.74, 146.17, 143.81.

Trading tips

Short positions may be opened from 151.80, with the target at 146.74 and stop loss 152.81. Implementation time: 9–12 days.

Long positions may be opened above 152.81, with the target at 155.50 and stop loss 151.81.

Hot

No comment on record. Start new comment.