Current trend

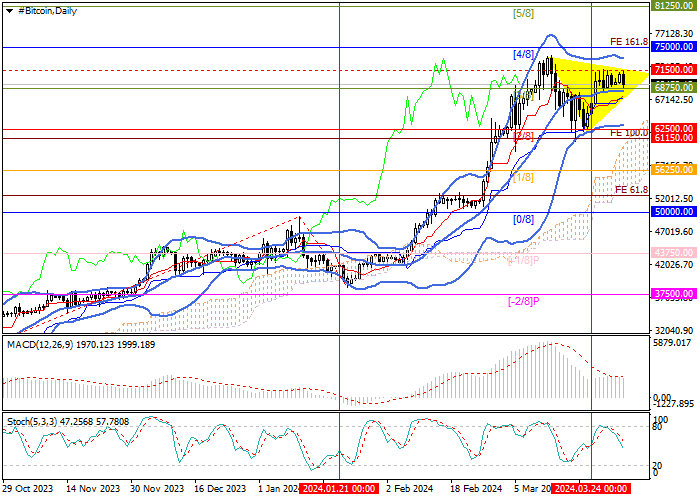

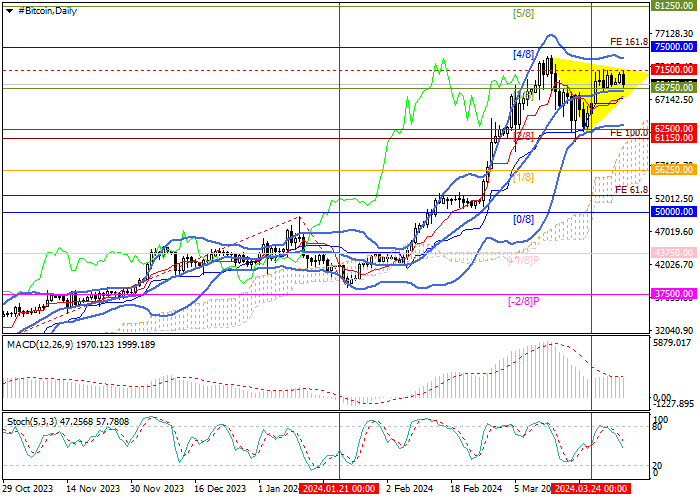

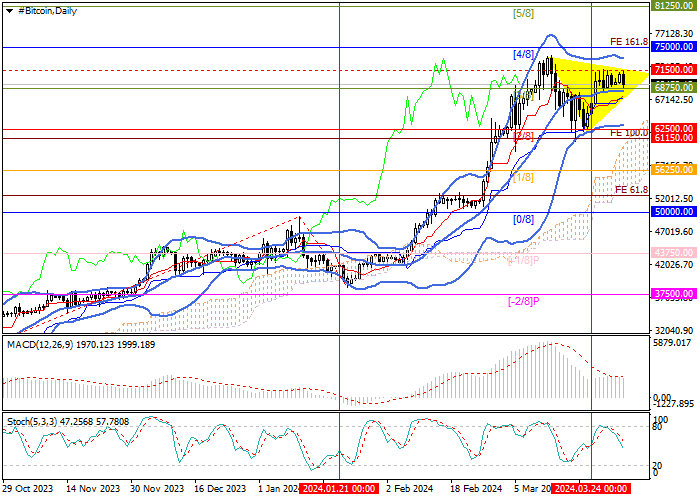

The BTC/USD pair has been trading in the main lateral range of 71500.00–68750.00 since last week and cannot leave it yet. The cryptocurrency market is in a state of uncertainty against the background of a number of opposite factors.

On the one hand, investors are expecting the halving of the Bitcoin network, which is due to take place in three weeks, and in anticipation of this event, they are holding BTC, withdrawing them from exchanges and creating a shortage of coins. According to Glassnode AG, last Friday alone, digital platforms lost more than 22.0 thousand BTC, which is the third biggest figure this year, and since the launch of the bitcoin ETF, the amount of outflow of the first world cryptocurrency has exceeded 10.0 billion dollars. We should also note that there are more and more signs of the beginning of the US Federal Reserve's interest rate cut cycle in June. The basic price index of personal consumption expenditures in February adjusted from 2.9% to 2.8% YoY and from 0.5% to 0.3% MoM. These data increase the likelihood of an early correction in monetary policy and further weakening of the US currency against alternative assets.

Nevertheless, despite the positive monetary factors for the cryptocurrency market, it has not been able to resume growth amid the actions of the American regulatory authorities. So, the U.S. Securities and Exchange Commission (SEC) demanded that a new fine of 2.0 billion dollars be imposed on Ripple based on an earlier ruling that sales of XRP to large investors violated the Securities Act. The regulator also achieved recognition of the Wallet application from the Coinbase crypto exchange as contributing to the distribution of unregistered assets among customers, which may cause a new trial against the management of the site. Finally, the U.S. Attorney's Office accused the KuCoin exchange of laundering 9.0 million dollars over the past eight years and demanded payment of fines and a ban on its further activities.

Generally, positive and negative factors are still balancing the cryptocurrency market, making it difficult to choose the direction of further price movement.

Support and resistance

The asset forms a "triangle" within the framework of a long-term uptrend, the exit from which may determine the further movement of quotes. If the level of 71500.00 is broken up, growth will be able to resume to 75000.00 (Murrey level [4/8], 161.8% Fibonacci extension), 81250.00 (Murrey level [5/8]). The key for the "bears" remains the 61150.00 mark (100.0% Fibonacci extension), if consolidated below which the decline may develop towards the targets of 56250.00 (Murrey level [1/8]) and 50000.00 (Murrey level [0/8]).

Technical indicators do not give a clear signal: Bollinger Bands are horizontal, MACD is stable in the positive zone, and the Stochastic has reversed down.

Resistance levels: 71500.00, 75000.00, 81250.00.

Support levels: 61150.00, 56250.00, 50000.00.

Trading tips

Long positions can be opened above 71500.00 with targets of 75000.00, 81250.00 and stop-loss of 69000.00. Implementation period: 5–7 days.

Short positions can be opened below the level of 61150.00 with targets of 56250.00, 50000.00 and stop-loss of 65600.00.

Hot

No comment on record. Start new comment.