Current trend

The Japanese stock index NI 225 is adjusted at 39950.0. The corporate reporting season starts at the end of the month, so traders focus their attention on macroeconomic reports and the situation in the bond market.

Today, data from Tankan was published in Japan, according to which the index of capital expenditures of large enterprises in all sectors in Q12024 added only 4.0%, significantly inferior to the 13.2% recorded in the previous period. In addition, the growth of the index for small enterprises slowed significantly, amounting to -3.6% after 8.3% earlier. The activity index of large producers adjusted from 8.0 points to 10.0 points, and the sentiment index of large producers — from 13.0 points to 11.0 points.

After the Bank of Japan raised the interest rate to 0.10%, the domestic bond market shows local growth: 10-year securities are held at a yield of 0.739%, which is higher than 0.709% shown a week earlier, the rate on 20-year bonds rose to 1.503% from 1.462%, and the yield on 30-year securities was 1.805%, significantly exceeding the 1,760% recorded last week.

The growth leaders in the index are Citizen Holdings Co., Ltd. ( 6.16%), Casio Computer Co., Ltd. ( 5.21%), Omron Corp. ( 4.40%), Rakuten Inc. ( 3.47%).

Among the leaders of decline are Resonac Holdings Corp. (-5.98%), Kawasaki Heavy Industries Ltd. (-6.02%), Dainippon Screen Mfg. Co. Ltd. (-5.66%).

Support and resistance

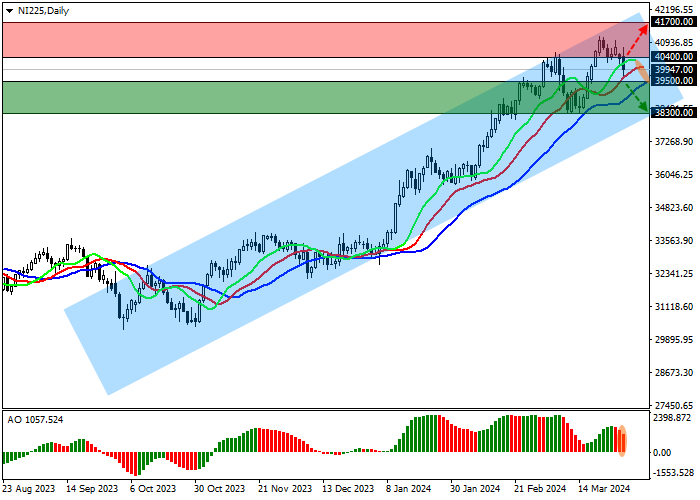

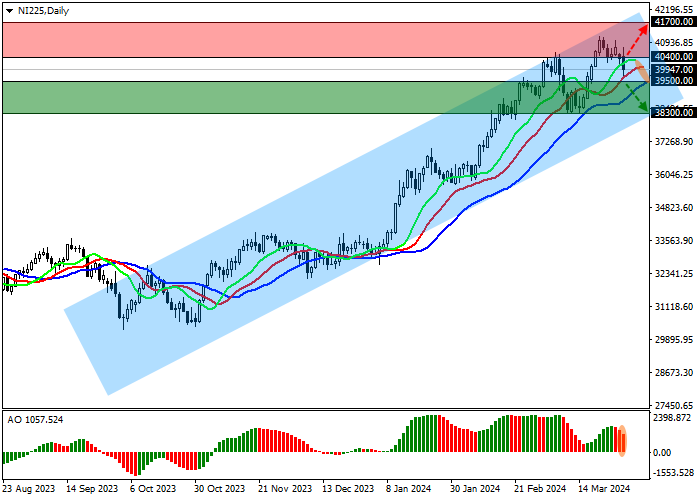

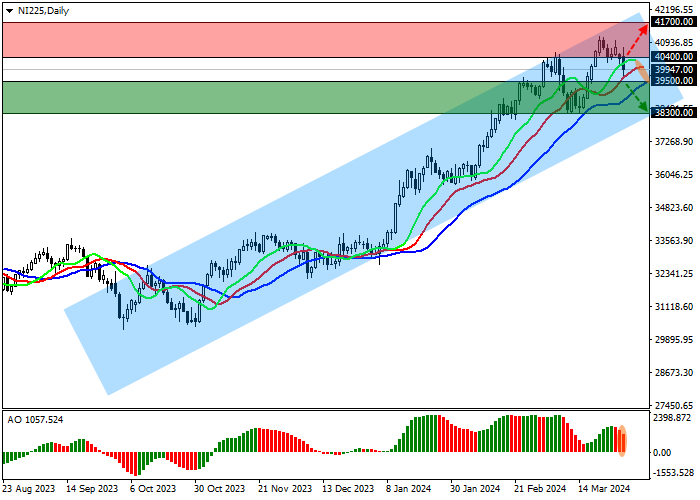

On the D1 chart, the price moves away from the resistance line of the ascending channel with dynamic borders of 41700.0–38200.0.

Technical indicators retain the buy signal, but narrow the range of fluctuations: the AO histogram forms new descending bars, and the fast EMAs on the Alligator indicator approaches the signal line, narrowing the range of fluctuations.

Support levels: 39500.0, 38300.0.

Resistance levels: 40400.0, 41700.0.

Trading tips

In the event of a reversal and continued decline of the asset, as well as price consolidation below the support level of 39500.0, sell positions with the target of 38300.0 can be opened. Stop-loss – 40000.0. Implementation time: 7 days and more.

In case of continued growth of the asset, as well as price consolidation above the resistance level of 40400.0, buy positions with the target of 41700.0 may be opened. Stop-loss – 40000.0.

Hot

No comment on record. Start new comment.