Current trend

The AUD/USD pair is showing faltering gains as it tries to recover from last week's mostly "bearish" trading dynamics, which resulted in updating of local lows from March 5. The instrument is testing the level of 0.6520, receiving support from macroeconomic statistics from China.

The Caixin Manufacturing PMI in March rose from 50.9 points to 51.1 points, with a forecast of 51.0 points. Last weekend, China also released business activity data from the China Federation of Logistics and Purchasing (CFLP): the Manufacturing PMI rose from 49.1 points to 50.8 points, which was higher than expected at 49.9 points, and the Services PMI - from 51.4 points to 53.0 points. After the Chinese government lifted tariffs on Australian coal, barley and wine, officials intend to push for similar barriers to be removed on beef and seafood exports. The likelihood of a positive resolution of these issues is quite high, as political and economic relations between China and Australia continue to improve. Beijing introduced a number of protective duties on Australian goods back in 2020, when official Canberra called for an investigation into the origins of the coronavirus, but the dialogue between the countries has now resumed.

Today, the US will also present statistics on business activity: forecasts suggest that the Manufacturing PMI from the Institute for Supply Management (ISM) will increase from 47.8 points to 48.4 points. Tomorrow, investors will evaluate data from Australia on business activity in the manufacturing sector from S&P, as well as updated inflation data from TD Securities. In addition, the minutes of the Reserve Bank of Australia's March monetary policy meeting will be published throughout the day.

Support and resistance

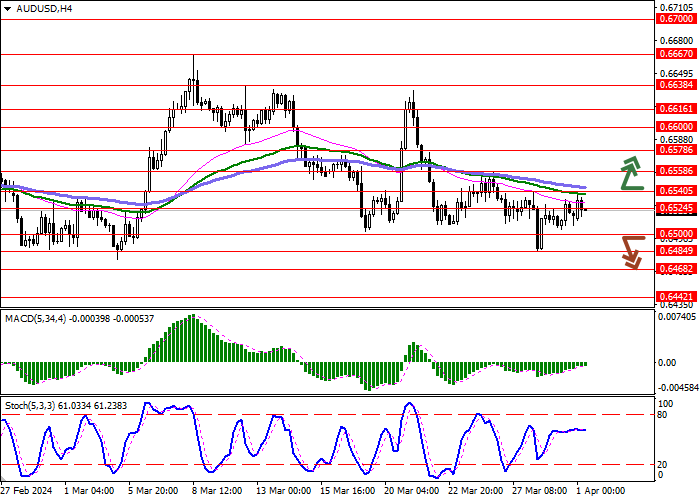

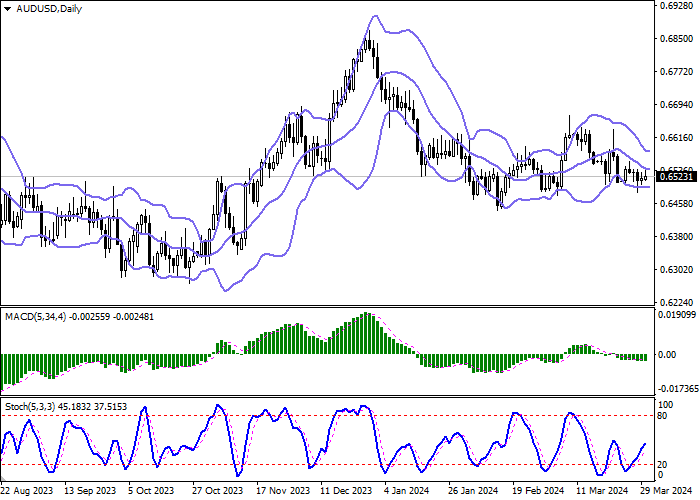

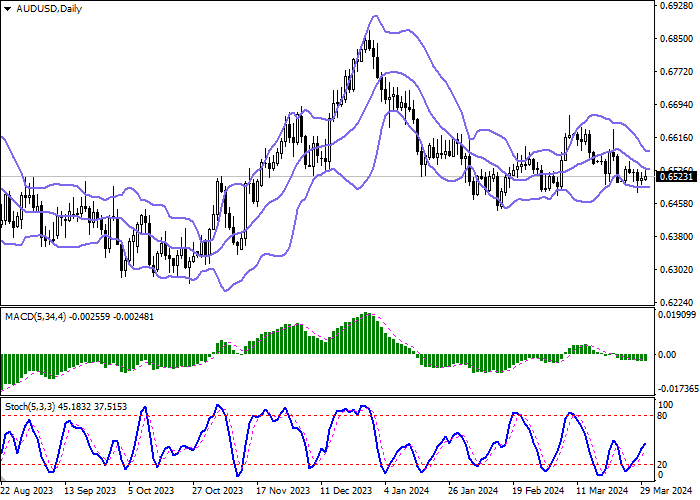

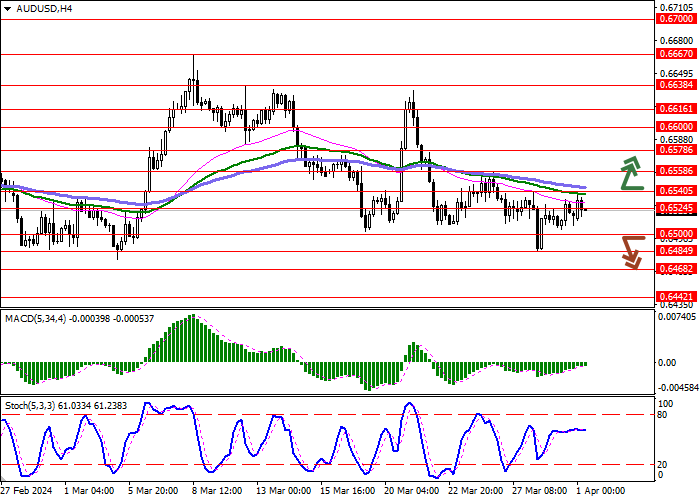

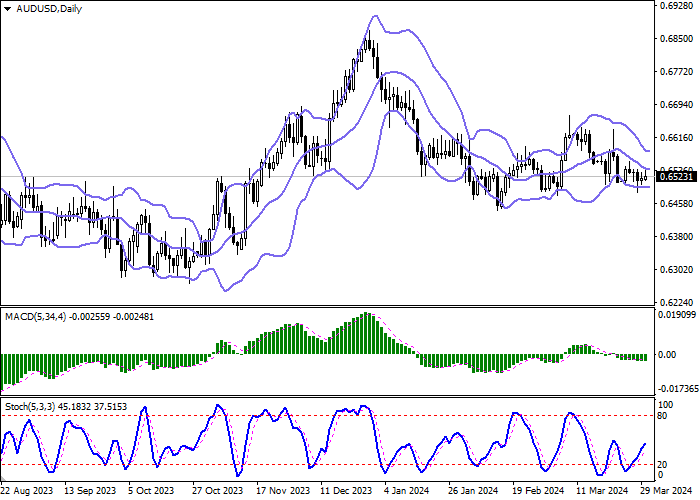

In the D1 chart, Bollinger Bands are reversing horizontally. The price range is almost constant, remaining rather spacious for the current level of activity in the market. MACD indicator tries to reverse to growth and to form a new buy signal (the histogram is about to consolidate above the signal line). Stochastic is showing more active growth and is currently located approximately in the center of its area, signaling sufficient potential for "bullish" dynamics in the ultra-short term.

Resistance levels: 0.6540, 0.6558, 0.6578, 0.6600.

Support levels: 0.6524, 0.6500, 0.6484, 0.6468.

Trading tips

Long positions can be opened after a breakout of 0.6540 with the target of 0.6578. Stop-loss — 0.6524. Implementation time: 2-3 days.

The return of a "bearish" trend with the breakdown of 0.6500 may become a signal for new short positions with the target at 0.6468. Stop-loss — 0.6520.

Hot

No comment on record. Start new comment.