Current trend

Shares of the Starbucks Corp. coffee company are trading in a corrective trend around 91.00.

Starbucks Corp. continues to restructure the personnel management system: for example, Michael Conway was appointed CEO of the North America region, and Brady Brewer took over as CEO of Starbucks International. At the moment, the position of creative leader of the brand remains vacant, and the company plans to determine a candidate before the publication of the financial report for Q2 2024 on April 25, where revenue is expected at 9.22 billion dollars, which is lower than 9.43 billion dollars shown in the previous period, and earnings per share (EPS) may amount to 0.816 dollars after 0.900 dollars.

Against the background of weak preliminary estimates by the company's management, Baird analysts adjusted the forecast for the shares: the target price was lowered from 106.0 dollars to 100.0 dollars per share, and the rating was maintained at the "neutral" level.

Support and resistance

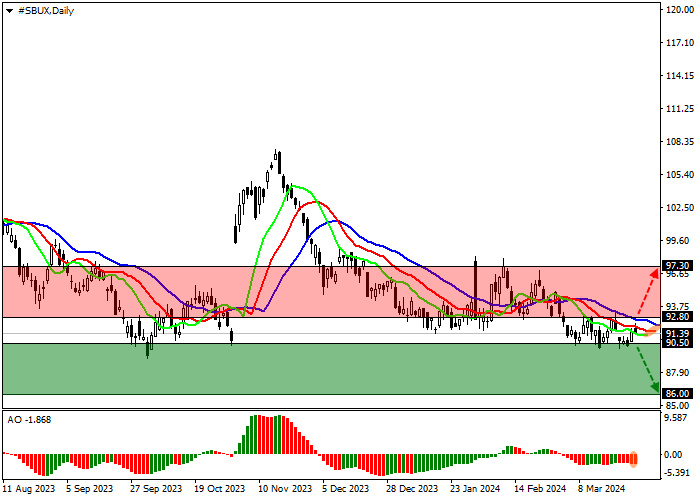

On the D1 chart, quotes are trading in a corrective trend, approaching last year's low at around 90.00.

Technical indicators hold a fairly stable sell signal: the range of EMAs fluctuations on the Alligator indicator expands in the direction of decline, and the AO histogram forms new descending bars, being in the sales zone.

Support levels: 90.50, 86.00.

Resistance levels: 92.80, 97.30.

Trading tips

If the asset continues to decline and the price consolidates below the local minimum at around 90.50, sell positions with the target of 86.00 can be opened. Stop-loss – 92.00. Implementation time: 7 days and more.

In the event of a reversal and growth of the asset, as well as consolidation above the resistance level of 92.80, buy positions with the target of 97.30 may be opened. Stop-loss – 91.00.

Hot

No comment on record. Start new comment.